From 100,000 to 75,000: The cyclical truth behind the deep correction and the signal of bull market restart

Author: BITCOIN MAGAZINE PRO

Compiled by: Tim, PANews

Bitcoin did not have the explosive start many expected in early 2025. After peaking above $100,000, the price fell sharply, leaving investors and analysts questioning where in the halving cycle Bitcoin is currently? In this article, we will penetrate the market noise and analyze a series of key on-chain indicators and macroeconomic signals to determine whether the Bitcoin bull market is still sustainable, or is it about to face a deeper correction?

Healthy correction or the end of the bull market?

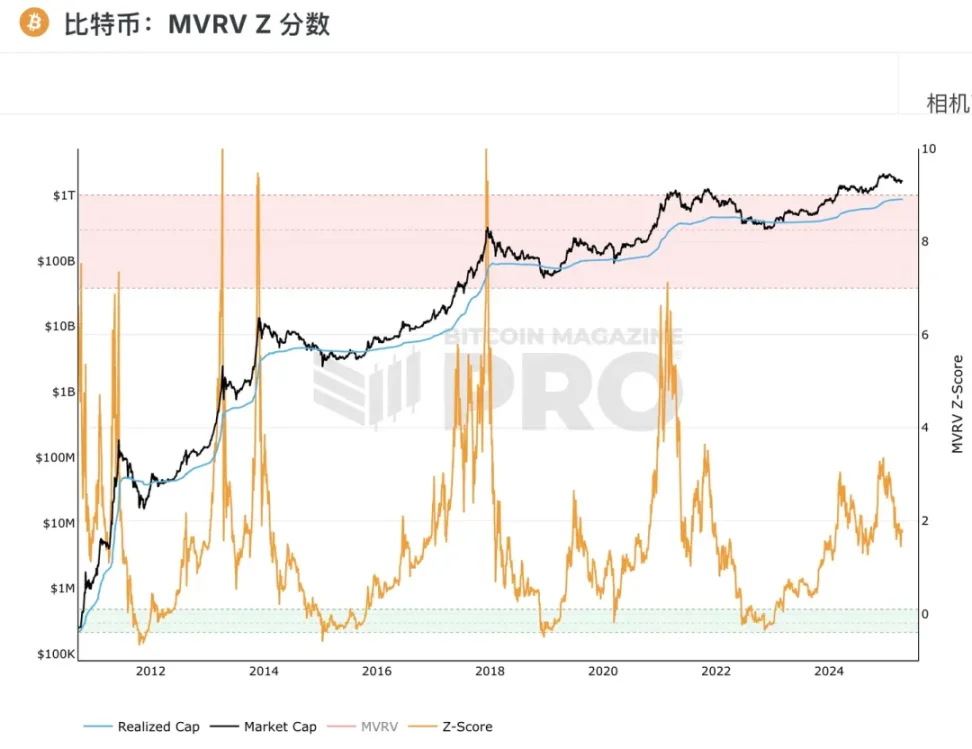

An ideal entry point is the MVRV-Z indicator. This long-standing valuation indicator measures the status of assets by comparing the market value of cryptocurrencies to their realized value. When the value fell from a peak of 3.36 to around 1.43, the price of Bitcoin fell from a high of nearly $100,000 to a staged low of $75,000. Intuitively, such a 30% price correction is indeed quite drastic.

Figure 1: Recently, the MVRV Z-Score has rebounded from the 2025 low of 1.43

Historically, the current MVRV-Z level has tended to mark local bottoms rather than tops. Similar pullbacks have occurred in past cycles, such as 2017 and 2021, before BTC prices resumed their upward trend. In short, while this decline has shaken investor confidence, it is essentially consistent with historical corrections in bull cycles.

Follow the smart money

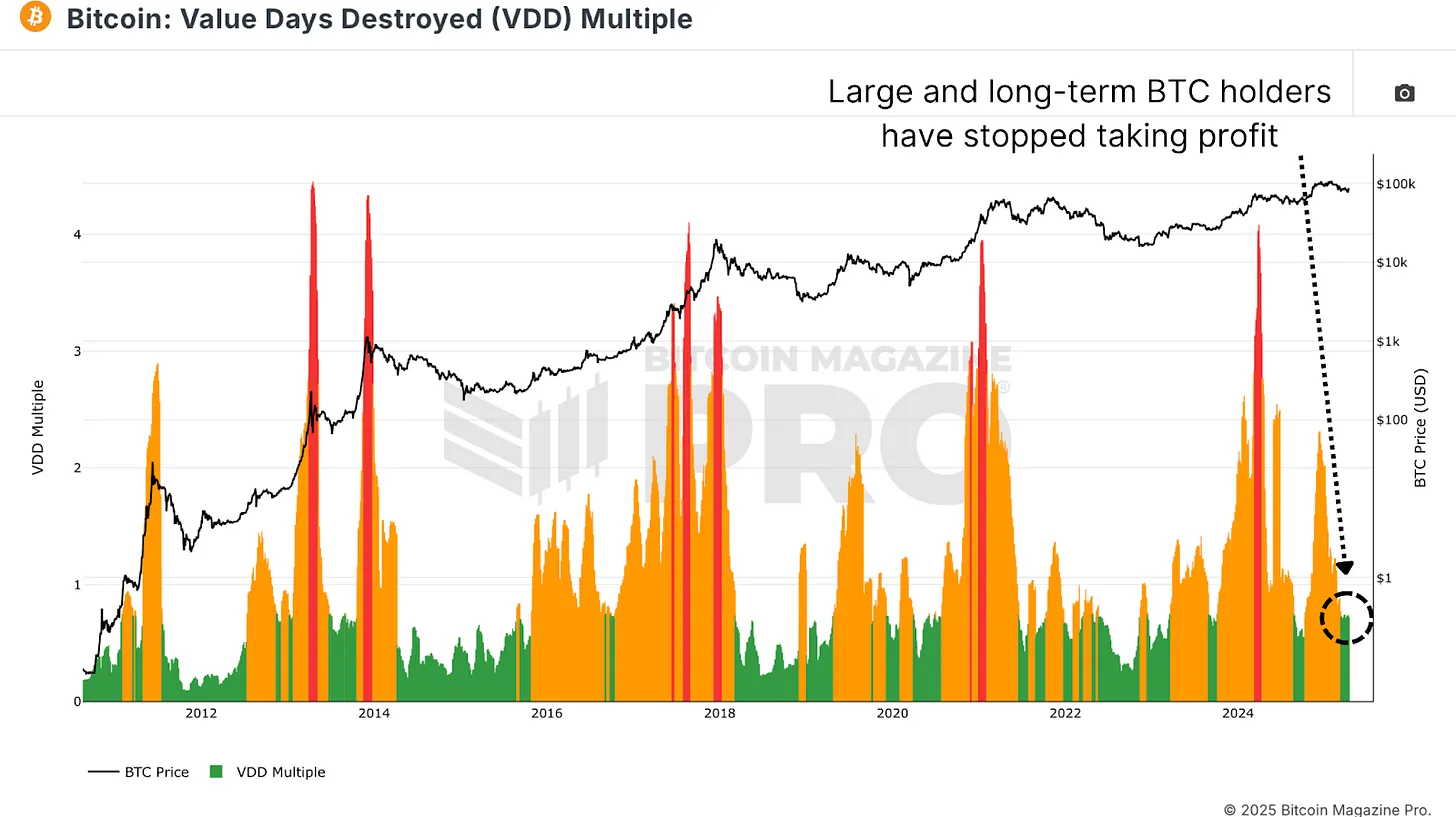

Another key indicator is the Value Days Destroyed (VDD) multiple. This metric measures the speed of on-chain transfers by weighting the time Bitcoin is held before being traded. When the multiple soars, it usually means that experienced holders are taking profits; if it remains low for a long time, it may indicate that the market is in an accumulation phase.

Currently, the indicator is deep in the "green zone", with levels similar to the late bear market or early recovery stages. As BTC prices have reversed sharply from above $100,000, we may be witnessing the end of the profit-taking wave, while some long-term accumulation behavior has become more apparent, indicating that participants are positioning themselves for future price increases.

Figure 2: Current VDD multiples suggest long-term holders are in an accumulation phase

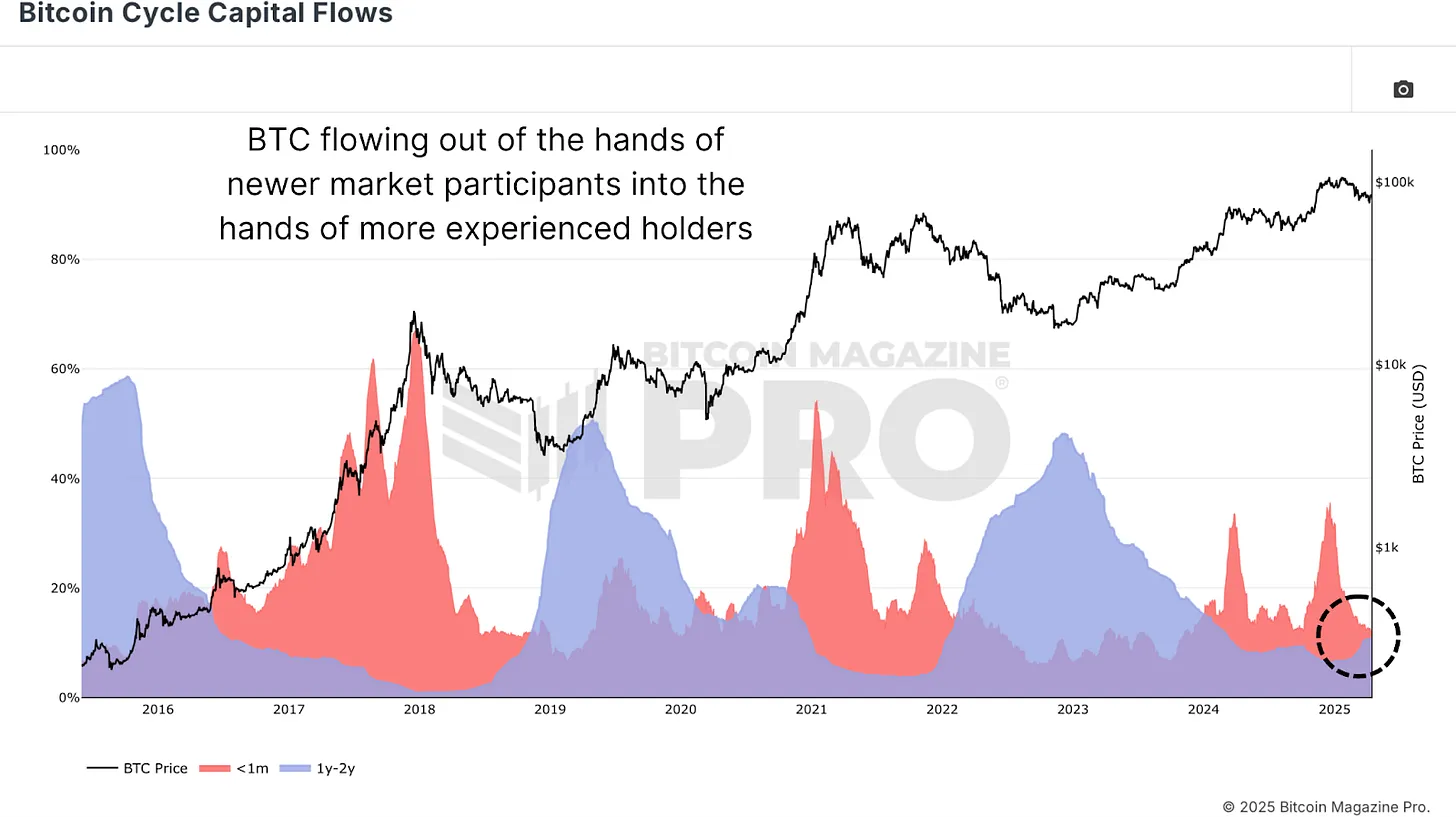

One of the most insightful on-chain indicators is the Bitcoin Cycle Capital Flow Chart, which breaks down realized capital by coin age, isolating different groups such as new entrants (holding time < 1 month) and medium-term holders (1-2 years) to observe the capital migration path. The red band (new entrants) rose sharply near the historical high of $106,000, indicating that a large amount of panic buying driven by FOMO sentiment occurred at the top of the market at that time. Since then, the activity of this group has cooled significantly, falling back to a level consistent with the early to mid-stage bull market.

On the contrary, the group that has held tokens for 1-2 years (usually accumulators with macro insights) has resumed the trend of increasing holdings. This inverse correlation reveals the core logic of market operation: when long-term holders accumulate chips at the bottom, new investors are often experiencing panic selling or choosing to leave. This pattern of capital flow, which increases and decreases, is highly consistent with the "accumulation-distribution" law presented in the complete bull market cycle from 2020 to 2021, reproducing the typical characteristics of the historical cycle.

Figure 3: Bitcoin Cycle Capital Flow Chart Shows BTC Flowing Back to More Experienced Holders

What stage are we at now?

From a macro perspective, we divide the Bitcoin market cycle into three key stages:

- Bear market stage: deep correction (70-90%)

- Recovery phase: Recovering historical highs

- Bull market growth stage: Parabolic rise after breaking through the previous high

The bear markets in 2015 and 2018 lasted about 13-14 months, respectively. Our most recent bear market cycle also lasted 14 months. The market recovery phase in historical cycles generally takes 23 to 26 months, and we are currently within this typical recovery time window.

Figure 4: Using historical cycle trends to predict potential bull market peaks

However, the performance of this bull phase is somewhat abnormal. Bitcoin did not immediately surge after breaking through the historical high, but instead experienced a pullback. This may mean that the market is building a higher low before entering a steeper upward channel in the exponential growth phase. If we use the average length of the 9-month and 11-month exponential phases in the past cycles as a reference, assuming that the bull market can continue, we expect the potential top of this cycle to appear around September 2025.

Macro risks

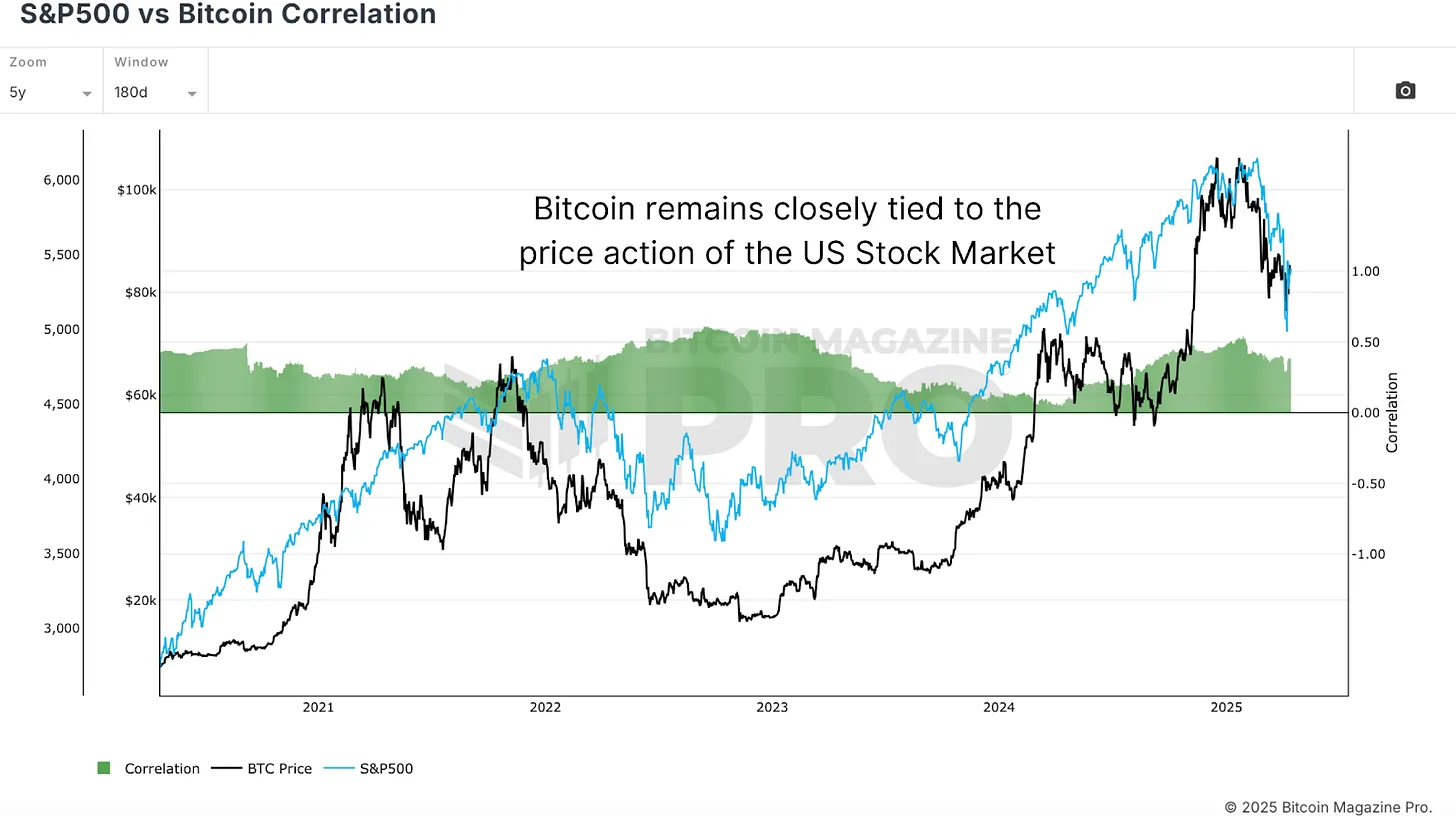

Despite the encouraging on-chain data, macro headwinds remain. Analysis of the S&P 500 and Bitcoin correlation charts shows that Bitcoin remains highly correlated with the U.S. stock market. Continued weakness in traditional markets could impact Bitcoin’s ability to rebound in the short term as concerns grow over a potential global recession.

Figure 5: Bitcoin Correlation with US Stocks

in conclusion

As we have seen in our analysis, key on-chain indicators such as MVRV Z-score, Value Days Destroyed, and Bitcoin Cycle Funds Flows indicate that the market is showing healthy cyclical trends and showing signs of continued accumulation by long-term holders. However, there are still significant macroeconomic uncertainties in the market, and these are key risks that need to be closely monitored.

This cycle is slower and more volatile than previous ones, but it has not broken the historical structural pattern. Bitcoin seems to be ready to rise again, and if there is no further deterioration in traditional markets, it may reach a new peak in the third quarter or early fourth quarter.

You May Also Like

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”

Trump Owns $870 Million Bitcoin Amid Crypto Market Meltdown