Daily Market Update: Bitcoin Struggles as Gold Hits Records and Tech Earnings Drive Stock Market

TLDR

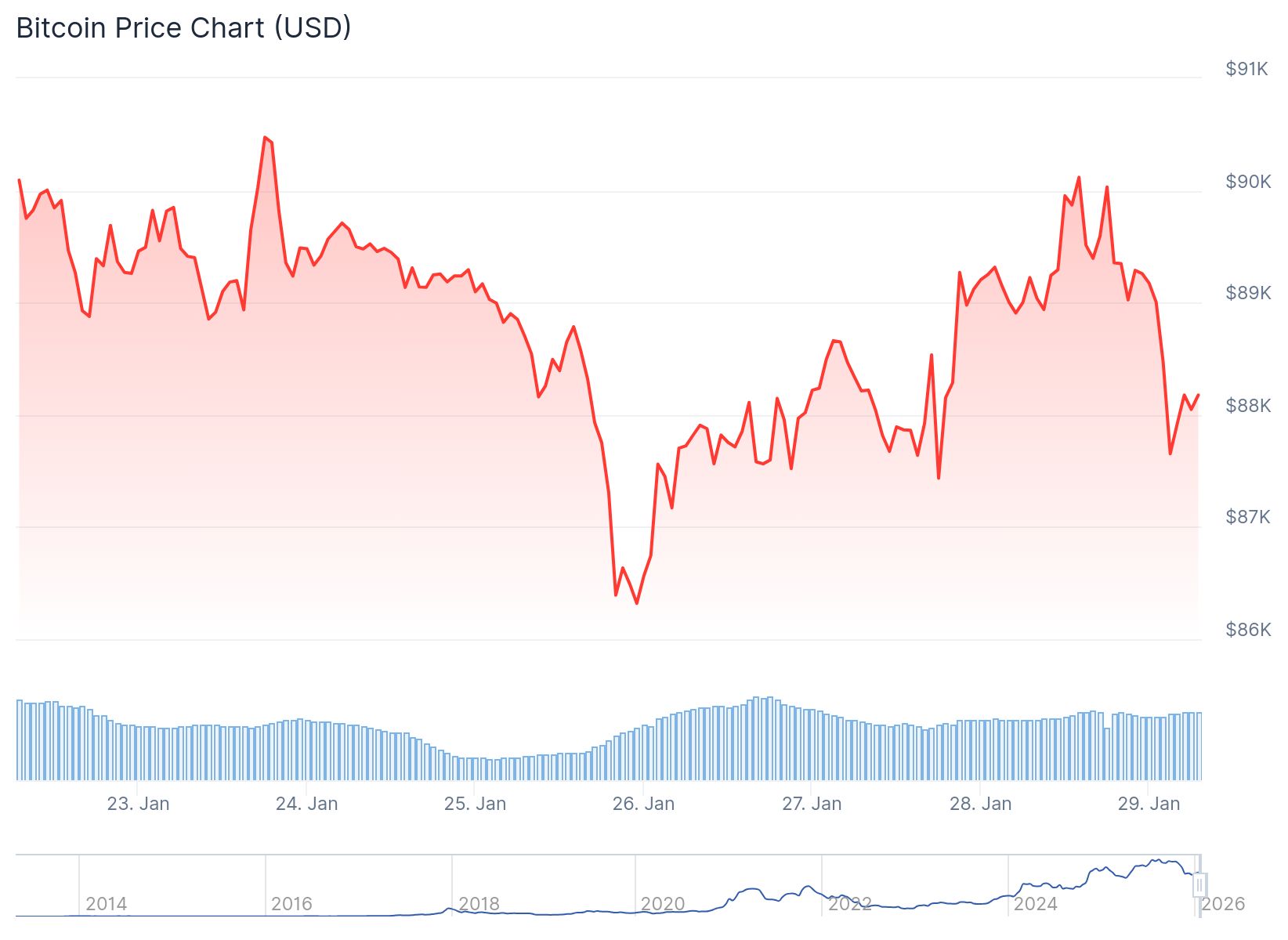

- Bitcoin traded around $88,000 after the Federal Reserve held interest rates steady, remaining roughly 30% below its October peak

- Gold hit record levels above $5,500 per ounce while silver and copper also rallied, drawing attention away from crypto markets

- The U.S. dollar posted its largest one-day gain since November after Treasury Secretary Scott Bessent reaffirmed support for a strong-dollar policy

- Bitcoin continues to behave like a high-beta risk asset rather than a macro hedge, failing to match gold’s performance despite similar narratives

- Stock futures rose Thursday morning led by tech, with Meta surging 10% on earnings while Microsoft fell 5% on cloud growth concerns

Bitcoin remained under pressure Thursday as commodity markets and tech earnings dominated investor attention. The leading cryptocurrency traded near $88,000 after briefly crossing $89,000 earlier in the session. Other major tokens posted mixed results, with ether hovering around $2,950 while solana, XRP and dogecoin declined between 2% and 4%.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The crypto market’s weakness comes as gold continues its historic rally. The precious metal held near record highs after topping $5,500 per ounce earlier this week. Silver and copper also maintained elevated levels following recent sharp gains.

The strength in commodities has been fueled by geopolitical risk and demand for traditional stores of value. This shift has pulled focus away from digital assets. Bitcoin, often positioned as a hedge against currency debasement, has failed to keep pace with gold’s surge.

The cryptocurrency is trading roughly 30% below its October peak. This decline comes even as metals and global equities trade near record levels. Analysts say bitcoin continues to act more like a high-beta risk asset than a macro hedge.

The Federal Reserve’s decision to hold interest rates unchanged on Wednesday added to the cautious market tone. Policymakers maintained their stance after three rate cuts late last year. Chair Jerome Powell indicated the central bank wants clearer evidence of cooling inflation before making further moves.

The dollar index posted its biggest one-day gain since November on Wednesday. Treasury Secretary Scott Bessent’s comments supporting a strong-dollar policy drove the move. The rebound in the dollar came after days of volatility tied to fiscal concerns and political pressure on the central bank.

Crypto Lags Behind Traditional Assets

Alex Kuptsikevich, chief market analyst at FxPro, noted the disconnect between bitcoin and other assets. He pointed out that bitcoin rose over 50% when the dollar weakened 8% from April to June last year. The recent 4% drop in the dollar index over two weeks coincided with a 30% jump in silver and 15% gain in gold.

Bitcoin has struggled to break above key resistance near $89,000. This level is reinforced by the 50-day moving average. The cryptocurrency’s position relative to this technical indicator suggests a bearish market structure.

Kuptsikevich said bitcoin has managed to defend support near $85,000 due to a relatively favorable external environment. However, fluctuations about one-third below recent highs point to continued weakness. The pattern shows crypto lagging during the metals rally and failing to respond to earlier dollar weakness.

Stock Market Responds to Tech Earnings

Stock futures climbed Thursday morning as investors processed megacap earnings results. Nasdaq 100 futures rose 0.4% while S&P 500 futures added 0.3%. Dow Jones Industrial Average futures traded roughly flat.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Meta shares surged as much as 10% in extended trading after beating revenue expectations. The company said its AI investments would push spending to as much as $135 billion this year. Tesla gained around 2% after quarterly results topped Wall Street forecasts.

Microsoft shares fell over 5% as investors reacted to slower cloud growth. The company also reported higher-than-expected capital spending and finance lease costs. Investors await Apple’s quarterly earnings report after Thursday’s closing bell.

Futures markets continue to price in two quarter-point rate cuts by the end of 2026. This outlook persists despite the Fed’s steady policy stance. Upcoming data releases including weekly jobless claims and durable goods orders will provide further economic clues.

The post Daily Market Update: Bitcoin Struggles as Gold Hits Records and Tech Earnings Drive Stock Market appeared first on CoinCentral.

You May Also Like

Trend Research has liquidated its ETH holdings and currently has only 0.165 coins remaining.

Changan Launches 2026 Global Testing Season with SDA Intelligence Update and Sodium-Ion Battery Strategy