Blockstream, Michael Saylor Named in Newly Unsealed Epstein Files – What’s the Real Story?

Unsealed records by the U.S. Department of Justice related to Jeffrey Epstein now contain mentions of Blockstream executives and a different email that talks about a charity contribution made by MicroStrategy co-founder Michael Saylor.

The files, which have been published as part of a wider transparency project, have sparked public reaction regarding the names mentioned within them.

The latest batch includes emails, travel records, and correspondence involving a wide range of figures in finance, politics, academia, and technology.

The DOJ has stressed that the appearance of a person’s name in the documents does not, on its own, indicate wrongdoing.

Epstein Files Surface Emails Linked to Blockstream’s 2014 Fundraise

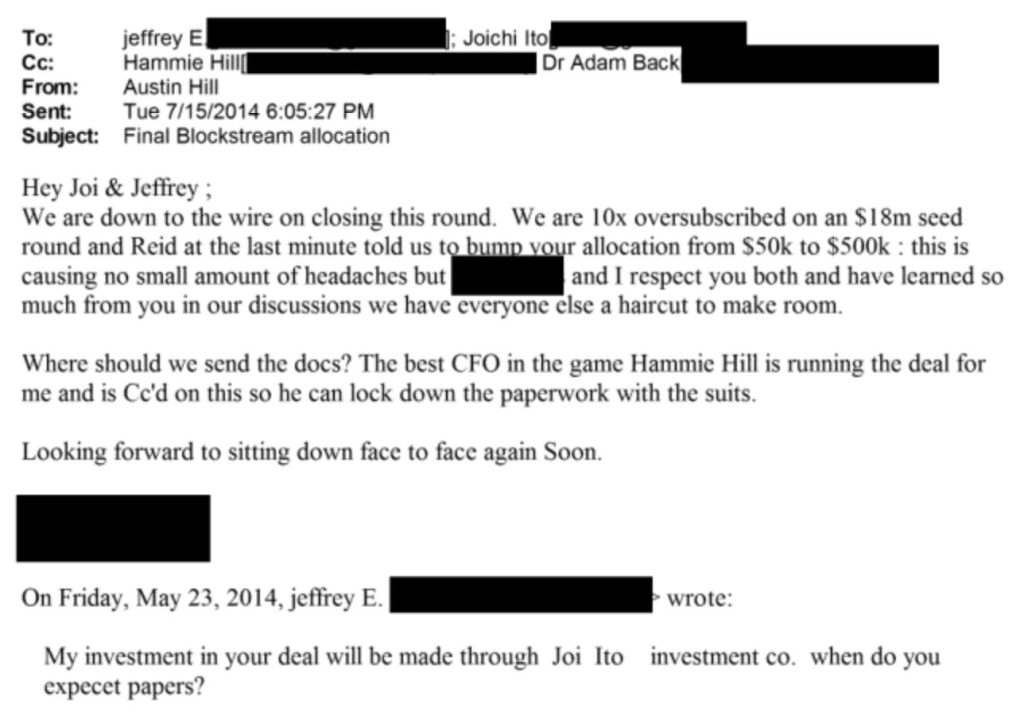

Among the newly surfaced records is a July 2014 email exchange in which Blockstream co-founder Austin Hill discussed the company’s oversubscribed $18 million seed round with Epstein and Ito.

Source: US DOJ

Source: US DOJ

In the message, Hill wrote that the round was “10x oversubscribed” and suggested increasing an allocation from $50,000 to $500,000. Adam Back was included in the email thread.

On X, Back claimed that in 2014, Blockstream participated in a seed-round investor roadshow coffee at which Joi Ito, then the director of the MIT Media Lab, was introduced to the company.

Through that connection, Blockstream later met Epstein, who was described at the time as a limited partner in an investment fund associated with Ito.

Co-founder and CEO of Blockstream, Adam Back, responded to the documents, admitting that his company has no continuing or material relationship with Epstein.

That fund went on to take a minority stake in Blockstream, but Back said it later divested its shares due to potential conflicts of interest and other concerns.

Files Show Saylor Mentioned in Pre-Bitcoin Charity Correspondence

Michael Saylor’s name appears in a different context within the files.

An email dated May 8, 2010, sent by Hollywood publicist Peggy Siegal, detailed arrangements for the Robin Hood Foundation’s annual gala and related Cannes social events.

The message noted that Michael Saylor donated $25,000 to a charity initiative, which granted him access to attend the events and potentially meet members of an exclusive social circle.

However, Siegal characterized Saylor as socially awkward, describing him as difficult to engage with and lacking awareness of basic social norms.

The message predates Saylor’s later prominence as one of Bitcoin’s most vocal corporate advocates and does not mention cryptocurrency.

Saylor only began acquiring Bitcoin for MicroStrategy in 2020, years after the correspondence cited in the Epstein materials.

Other unsealed documents reference travel arrangements involving Hill and Back, including bookings connected to St. Thomas, an island near Epstein’s private property.

The documents have also emphasized Epstein’s broader interest in cryptocurrency during Bitcoin’s formative years.

Email communications reveal him discussing with one of the biggest tech investors, Peter Thiel, how to define Bitcoin and whether it was more of a store of value, a currency, or a technological architecture.

Individual correspondence suggests that Epstein kept a close eye on the debates in the crypto ecosystem and shared his views on rival blockchain projects.

In 2016, he also offered suggestions connected with digital currencies in the Middle East, such as a Sharia-compliant type based on the technology of Bitcoin.

Other Prominent Figures, Social and Email Links to Epstein Records

Other notable names mentioned throughout the documents are former director of MIT Media Lab Joi Ito, PayPal co-founder Peter Thiel, and Kevin Warsh, who was recently appointed by President Donald Trump to the role of Federal Reserve chair.

The Epstein files were unsealed following earlier court orders in 2024 that released names from a separate civil case involving Epstein’s associate Ghislaine Maxwell.

While more than 150 previously anonymized names have now entered the public record, others remain redacted, particularly where victims’ identities or ongoing investigations are involved.

Epstein died in 2019 while awaiting trial on federal charges, including sex trafficking of minors and conspiracy to commit sex trafficking of minors.

You May Also Like

SBI VC Trade Adds Litecoin to Japanese Lending Program

Work Dogs TGE Is Running — Is WD About to Drop in Q2 After March 30?