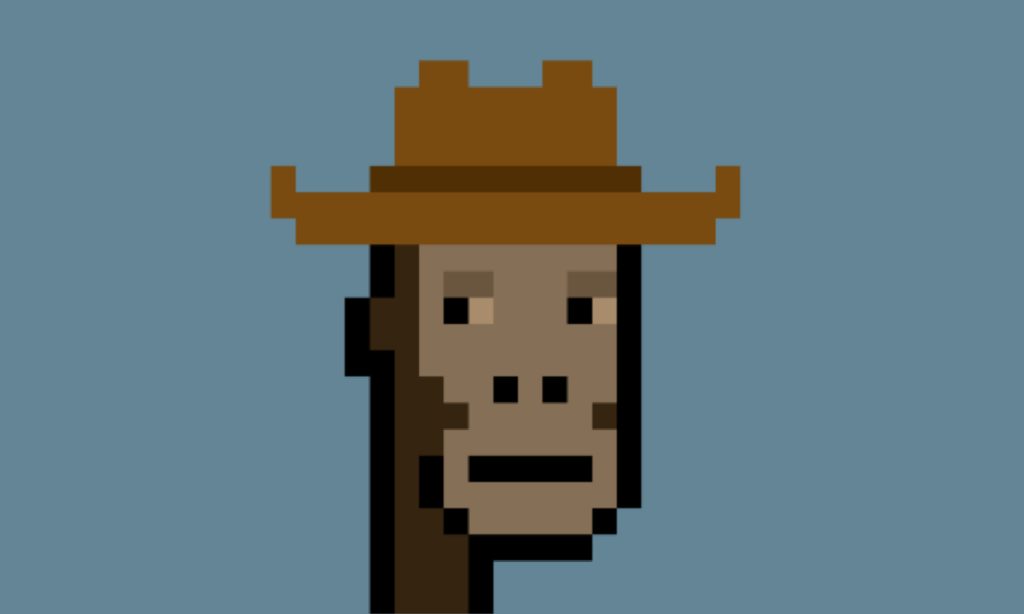

GameSquare CryptoPunk NFT Bet: $5.15M Cowboy Ape Deal Brings Leshner Onboard

GameSquare Holdings, Inc. (Nasdaq: GAME), a media and tech firm focused on Web3, has made a bold move into the world of digital collectibles with a new purchase.

In a press release shared with CryptoNews, the firm said it has purchased a rare “Cowboy Ape” CryptoPunk non-fungible token (NFT) from Robert Leshner, founder of Compound and CEO of Superstate.

In exchange, GameSquare issued $5.15 million in preferred stock convertible into approximately 3.4 million shares at $1.50 per share.

The acquisition marks GameSquare’s first direct NFT investment and is in line with its strategy to build a blockchain-native brand and generate treasury yield through digital assets.

CEO Justin Kenna described the Punk as a “grail” investment and emphasized the company’s growing interest in on-chain finance. Alongside the transaction, Leshner has joined GameSquare as a shareholder, bringing his experience in decentralized finance to the table.

What Is a CryptoPunk?

CryptoPunks are among the earliest NFT collections created on the Ethereum blockchain. Launched in 2017 by software developers Larva Labs, the series includes 10,000 pixelated characters with varying traits. Of these, only 24 are “Ape” Punks—making them among the rarest.

The Cowboy Ape (#5577), now part of GameSquare’s treasury, is widely regarded as a standout in the collection. Collectors often view CryptoPunks as digital artifacts that reflect early internet history and the rise of online identity.

Building Yield Through NFTs and ETH

GameSquare’s NFT purchase is part of its treasury strategy, which seeks to generate 6%–10% returns annually by using stablecoins and other digital assets.

The Cowboy Ape will be used in community activations, marketing campaigns, and potential licensing deals, blending culture with capital allocation.

GameSquare said it has partnered with 1OF1 AG, led by Web3 investor Ryan Zurrer, to manage the NFT yield program. The firm will also hold the asset and oversee yield generation efforts.

GameSquare said it recently purchased $10 million worth of Ethereum—about 2,742.75 ETH at an average price of $3,646. This adds to a growing ETH position now valued at approximately 12,913.49 ETH. The company has invested a total of $45 million in ETH under its $250 million crypto treasury authorization.

NFT Market Cap Jumps 21% to $6.3B Overnight

The NFT market roared to life on Monday, jumping more than 20% in a single day, with total market cap rising from $5.1 billion to $6.3 billion. After months of stagnation, renewed interest in Ethereum-based collections appears to be driving the sudden revival.

A major catalyst came in the form of a high-profile CryptoPunk sweep. According to on-chain data from Lookonchain, a newly created wallet, 0x1bb3, spent 2,082 ETH, or about $5.87 million, to purchase 45 CryptoPunk NFTs within hours. The transaction lit up OpenSea, where the wallet now holds assets valued at over 1,700 ETH, or roughly $6.5 million.

$GAME Price Action

As of 12:00 p.m. EDT on July 24, shares of GameSquare Holdings Inc. (Nasdaq: GAME) traded at $1.32, marking a 3.94% increase on the day.

The stock opened at $1.33, reached a high of $1.44, and dipped to a low of $1.26 during early trading. This intraday movement follows the company’s announcement of the CryptoPunk #5577 acquisition and the onboarding of Leshner as a shareholder, news that appears to have sparked renewed investor interest.

GameSquare currently holds a market capitalization of approximately $125.2 million, with a 52-week trading range between $0.50 and $2.87.

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Vlna BitcoinFi boomu sa začína s HYPER