Michael Burry Warns Bitcoin Crash Could Hit Miners and BTC-Holding Firms

The post Michael Burry Warns Bitcoin Crash Could Hit Miners and BTC-Holding Firms appeared first on Coinpedia Fintech News

Michael Burry, the investor famous for predicting the 2008 financial crisis, has issued a strong warning about Bitcoin. He has warned that the ongoing Bitcoin crash could seriously damage crypto miners and companies that hold large amounts of Bitcoin.

He believes the Bitcoin price may further drop to $50K, leading to heavy losses and possible bankruptcies.

Bitcoin Fails as a Safe Haven Asset

In a recent Substack post, Michael Burry said that Bitcoin has failed to prove itself as a safe store of value like gold or silver. He described it as a purely speculative asset that moves mainly on market hype.

While precious metals have recently reached record highs, Bitcoin has continued to slide lower.

He said Bitcoin has not reacted positively to typical market drivers like dollar weakness or geopolitical tensions. Instead, it is moving closely with the stock market, especially the S&P 500.

Burry pointed out that Bitcoin’s correlation with the S&P 500 has reached around 0.50, showing that it is acting more like a tech stock than an independent asset.

Michael Burry Warns Bitcoin Price To Crash To $50K

Since October, Bitcoin has already dropped around 40% from its high of $126,000, and Burry believes the worst may still be ahead.

However, Bitcoin recently fell below $73,000, its lowest level in over a year, due to weaker demand and lower liquidity.

He further criticized Bitcoin exchange-traded funds ETFs, which have seen some of their biggest outflows in recent months. He believes ETFs have increased speculation and made price swings even sharper.

Therefore, he believes that Bitcoin could further slide toward $50,000, which could seriously hurt miners and companies tied to crypto.

Bitcoin Holding Company & Miners May Face Heavy Risks

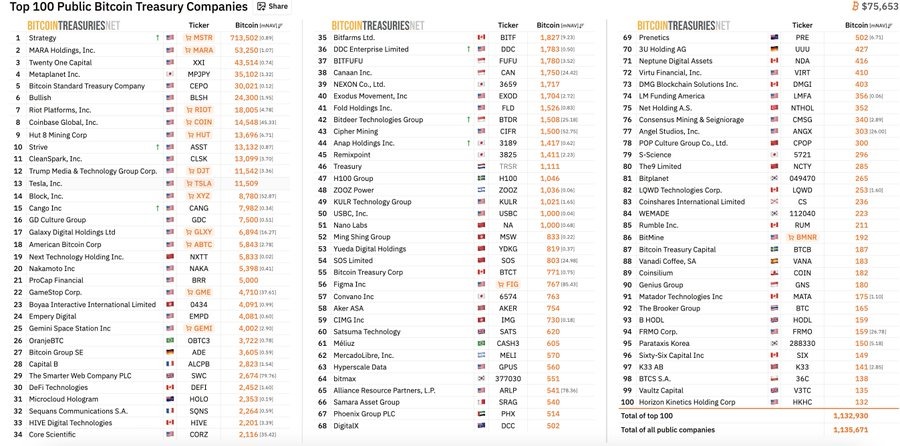

Burry is even more worried about large companies that hold Bitcoin on their balance sheets. He warned that firms like Strategy Inc., one of the biggest corporate Bitcoin holders, face serious risks.

If Bitcoin falls another 10%, the company could face billions of dollars in losses and struggle to raise new funds.

He also warned that continued price drops could push many Bitcoin mining firms toward bankruptcy. Since miners depend on high Bitcoin prices to stay profitable, a deeper crash could destroy their business models.

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

Sonic Holders Accumulate Millions as Price Tests Key Levels