ETH ETFs Back with Inflows after 3 Days amid Dip Buys and Transfer Count Surge

Ether ETH $2 254 24h volatility: 1.0% Market cap: $272.12 B Vol. 24h: $45.05 B continued to trade flat near $2,200 over the past 24 hours as it sees ETF inflows and large holder activity.

SoSoValue data shows that Ethereum spot ETFs recorded $14.06 million in net inflows on Feb. 3 after recent outflows. This comes despite net withdrawals from Bitcoin funds and suggests selective demand for Ether.

Moreover, on chain data suggests renewed dip buying from large holders. Lookonchain reported that three wallets, dormant for roughly four years and likely linked to the same entity, spent about $13.1 million to acquire 5,970 ETH at $2,195.

Despite these inflows, ETH has struggled to break out of its $2,400 resistance zone for any meaning rally.

Ethereum Transfer Spike Raises Concerns

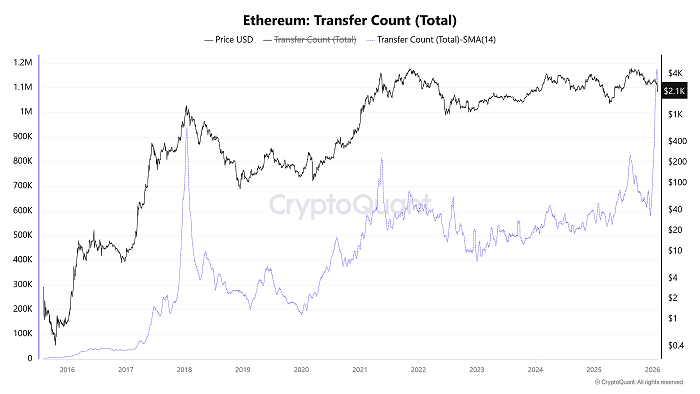

Ethereum’s total transfer count, smoothed by a 14 day simple moving average, climbed to 1.17 million on Jan. 29, CryptoQuant data shows.

Ethereum has seen this level of network activity only twice before in its history. In January 2018, a similar surge came during the cycle top before a prolonged ETH price drop. In May 2021, it again coincided with a sharp market selloff.

Ethereum transfer count | Source: CryptoQuant

Analysts note that such spikes tend to appear during periods of heavy trading activity near local price extremes. This pattern suggests high risk, as funds may be moving to exchanges for selling or repositioning.

Holders See High Unrealized Losses

Ether’s recent slide has increased unrealized losses among large holders. Some institutional players have already started reducing exposure as BitMine’s paper losses are nearing $7 billion.

Trend Research and Garrett Jin have continued selling ETH to repay loans and limit liquidation risk. Over the past three days, they deposited a combined 316,185 ETH, worth about $738 million, into Binance.

As bearish signals emerge, Ether’s short side activity has also increased. A smart trader, who recently earned about $7.2 million from short positions, opened new 20x shorts on 21,838 ETH valued near $49.3 million.

nextThe post ETH ETFs Back with Inflows after 3 Days amid Dip Buys and Transfer Count Surge appeared first on Coinspeaker.

You May Also Like

Valour launches bitcoin staking ETP on London Stock Exchange

USDT Transfer Stuns Market: $238 Million Whale Movement to Bitfinex Reveals Critical Patterns