Parataxis to go public and form a $640m Bitcoin treasury through SPAC merger

Parataxis Holdings is merging with SilverBox Corp IV in a special purpose acquisition that includes the formation of a NYSE-traded Bitcoin treasury company worth $640 million.

- Parataxis and SilverBox Corp IV are merging to form a Bitcoin Treasury targeting U.S. and South Korea markets.

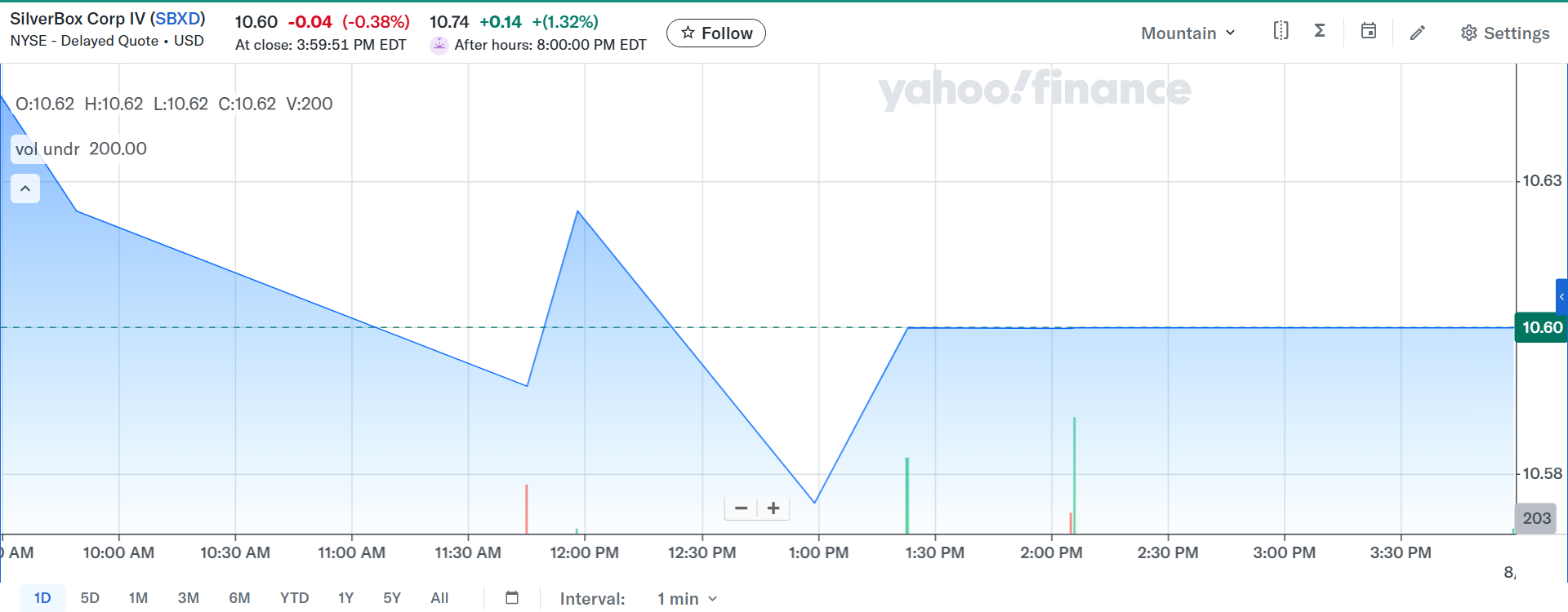

- News of the merger boosted the stock price of SilverBox by 1.32% in the past day.

In a recent press release, the two companies announced that the deal could “provide up to $640 million of gross proceeds” to fund a Bitcoin (BTC) treasury strategy listed on the New York Stock Exchange. As much as $31 million worth of equity in the deal will be used to immediately purchase Bitcoin.

The firm also explained that the merger will include a share purchase agreement that would permit the issuance of up to $400 million in equity line of credit.

News of the merger managed to boost the share price of SilverBox Corp, raising it by 1.32% in after-market sales. According to Yahoo Finance, the share price for SBXD now sits at $10.74 on August 7. Compared to how the share was performing in the past month, its a sharp contrast to the 3.37% dip it experienced since early July.

The acquisition of SilverBox Corp IV through a SPAC agreement will enable Parataxis to list publicly on the NYSE under the ticker symbol PRTX, gaining access to the U.S. market.

In turn, it also allows SilverBox to access the South Korean market as the digital investment firm has just recently started operating under a new name and focusing their operations on establishing a BTC reserve in Korea.

Parataxis plans to build a Bitcoin treasury in South Korea

According to the press release, the merger of the two companies will ultimately result in a BTC treasury company that will specifically target the U.S. and South Korean markets. Back in June 2025, Parataxis purchased South Korean biotechnology company Bridge Biotherapeutics Inc., renaming it into Parataxis Korea with the purpose of creating the country’s first Bitcoin treasury platform.

So far, not many South Korean companies have been interested in following the Metaplanet and Strategy blueprint. However, digital assets have been gaining traction in the region due to recent support from the current president, Lee Jae-myung. After Lee won the presidential election, he vowed to allow legalize spot Bitcoin ETFs this year.

Is there debt carried over in the deal?

According to a Form 10-K filing made to the Securities Exchange Commission dated December 2024, SilverBox Corp IV does not have any outstanding debts carried over to the SPAC.

However, as of June 2024, the company did report $109,000 in current debt and capital lease obligations, all attributable to the unpaid sponsor promissory note. It was later confirmed that this debt was repaid by the first quarter of 2025, as no current debts or capital lease obligations were listed on the company’s balance sheet.

As for Parataxis, there is no indication that the company holds any long-term debt, bank loans, or public bond obligations listed in press releases or summaries. The only indication of debt is the Equity Line of Credit mentioned in the press release worth $400 million.

Though, it is worth noting that an ELOC is not a traditional debt. It functions as a credit facility, giving Parataxis the flexibility to issue equity as needed to fund operations and expand BTC holdings.

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more