Best Crypto to Buy Now – February 2026

TLDR

- Bitcoin trades around $65,000-$70,000 after falling 45% from October 2025 peak above $126,000

- Ethereum’s Pectra upgrade aims to push throughput toward 10,000+ TPS while trading at $2,000-$2,800

- Solana dropped from $294 all-time high to near $90 but maintains strong developer activity and on-chain metrics

- BNB stays resilient at $670-$860 with quarterly token burns and revenue from Binance ecosystem

- XRP trades around $1.35 with recent court victories and growing institutional partnerships in cross-border payments

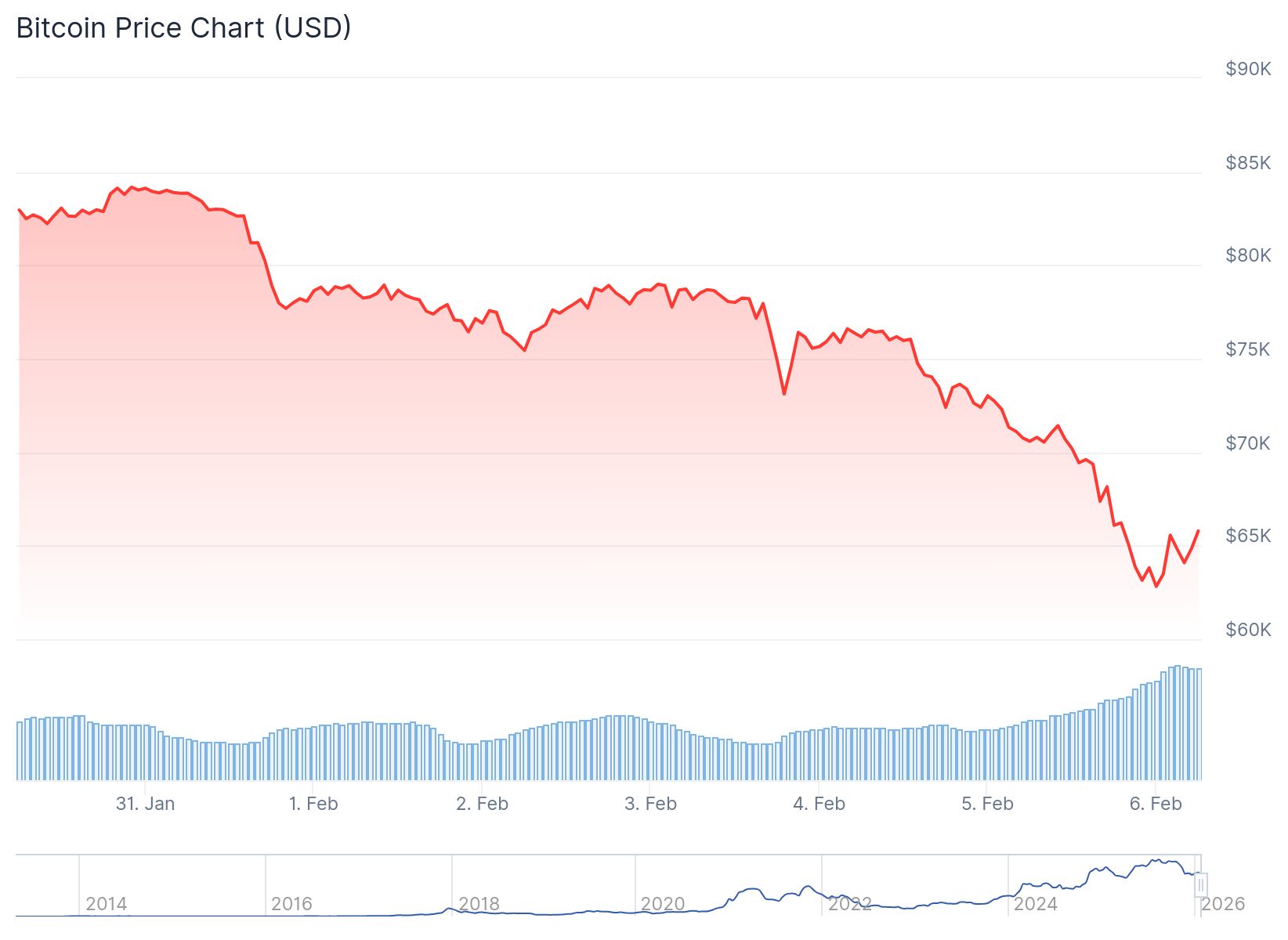

The cryptocurrency market has entered a harsh correction phase in February 2026. Bitcoin dropped from its October 2025 high above $126,000 to around $65,000-$70,000. The total crypto market cap lost nearly $2 trillion in value.

Altcoins suffered even steeper losses. Many tokens fell 20-30% in just one week. Retail investors are selling at a rapid pace while ETFs record outflows.

Despite the pain, history shows bear markets create buying opportunities. Projects with strong fundamentals tend to survive and grow in the next cycle. Five cryptocurrencies stand out during this downturn.

Bitcoin (BTC)

Bitcoin remains the largest cryptocurrency by market cap. The asset fell more than 45% from its cycle peak. Current prices hover between $60,000 and $70,000.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The Bitcoin network maintains its 21 million coin supply cap. This fixed supply attracts institutional investors seeking digital gold. Spot Bitcoin ETFs absorbed millions of coins since their launch.

Recent weeks saw ETF outflows as sentiment turned negative. Many analysts expect demand to return when market conditions improve. Network security remains unmatched in the crypto space.

Ethereum (ETH)

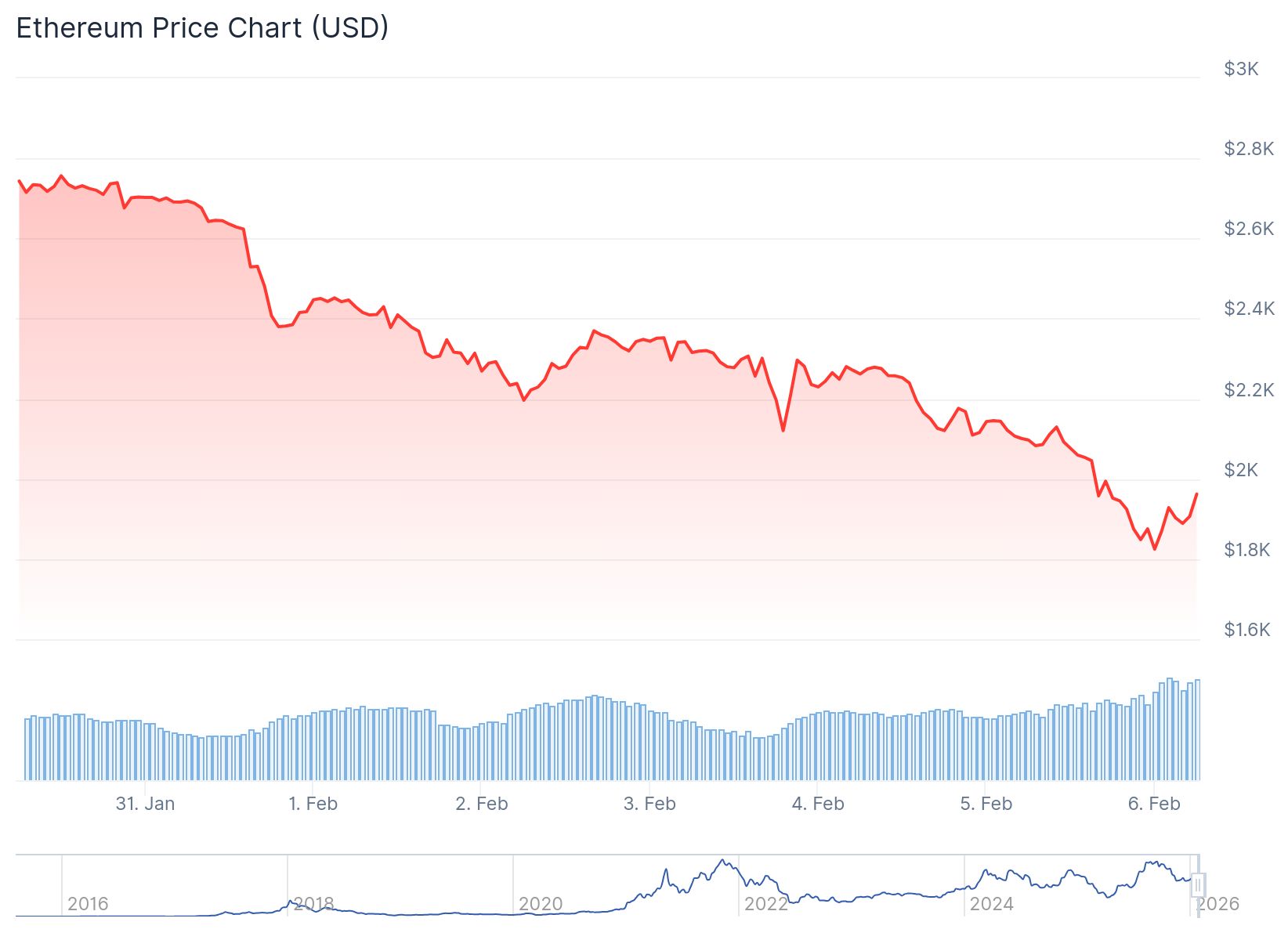

Ethereum trades between $1700 and $2,000 after weak price performance this cycle. The network’s fundamentals improved despite the price action. The upcoming Pectra upgrade will enhance staking and account abstraction features.

Ethereum (ETH) Price

Ethereum (ETH) Price

The upgrade could push network throughput toward 10,000 transactions per second. Layer-2 solutions will also benefit from efficiency improvements. DeFi protocols on Ethereum continue to dominate total value locked across the sector.

Institutional investors stake ETH through approved ETFs. Real-world asset tokenization projects choose Ethereum for their infrastructure. The network processes more transaction value than any competing blockchain.

Solana (SOL)

Solana fell from its all-time high of $294 to approximately $68. The network experienced outages in previous years that hurt its reputation. Recent leverage liquidations pushed prices down further.

The blockchain offers fast transaction speeds with fees under one cent. DeFi applications, memecoins, and consumer apps drive network activity. Developer engagement metrics remain strong across the ecosystem.

The Firedancer upgrade aims to fix reliability issues. On-chain activity shows consistent growth despite price declines. The network processes millions of transactions daily.

BNB

BNB trades in a range of $670 to $860 during the bear market. The token powers the BNB Chain ecosystem and Binance exchange. Quarterly token burns reduce the total supply over time.

Binance remains the world’s largest cryptocurrency exchange by volume. The exchange generates real revenue that supports BNB utility. The token shows resilience during market downturns compared to other large-cap assets.

BNB Chain hosts numerous decentralized applications and protocols. The network offers low fees and fast confirmation times. Use cases continue expanding across the Binance ecosystem.

XRP

XRP currently trades around $1.35, well below previous highs. Ripple achieved court victories in its legal battles over recent years. These wins brought more regulatory clarity to the token.

Ripple expanded partnerships with financial institutions for cross-border payments. The company launched a stablecoin initiative to compete in that market. XRP offers high liquidity and availability on major exchanges.

The token serves real-world payment use cases through RippleNet. Banks and payment providers test XRP for international money transfers. Potential U.S. regulatory clarity could change market perception of the asset.

Bitcoin and Ethereum provide the safest core holdings for crypto portfolios. Solana, BNB, and XRP each offer different strengths and risk profiles. The current market conditions create entry points for investors with long time horizons.

The post Best Crypto to Buy Now – February 2026 appeared first on CoinCentral.

You May Also Like

The Next Bitcoin Story Of 2025

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility