LayerZero Price (ZRO) Skyrockets 75%: Why Investors Should Watch for a Cool-Off

The post LayerZero Price (ZRO) Skyrockets 75%: Why Investors Should Watch for a Cool-Off appeared first on Coinpedia Fintech News

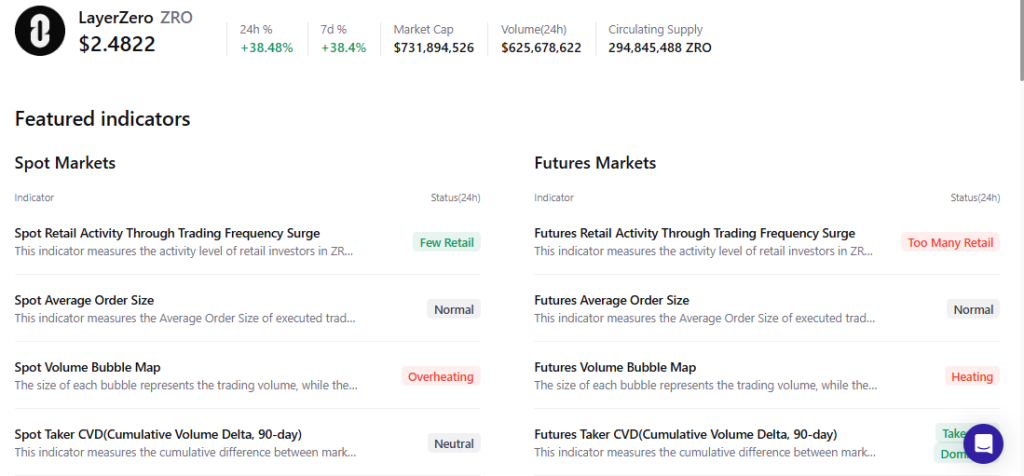

The LayerZero price doesn’t usually move quietly. This time, it detonated. A 38% intraday spike and over 75% in seven days. And suddenly, ZRO is the token everyone’s pretending they were watching all along.

What lit the match? Institutional gravity. An announcement confirming a Ark Invest CEO Cathie Wood’s advisory board addition hit the tape, reinforcing a clear narrative: finance is shifting on-chain, and LayerZero intends to be part of that infrastructure layer. Add to that a strategic investment from Tether tied to interoperability tech used by USDt0, and the story writes itself, as this shows credibility, capital, and long-term positioning.

But let’s be real. The market doesn’t move on vision alone. It moves on positioning.

LayerZero Price Surged WIth Institutional Boost

The news cycle delivered exactly what speculative markets crave for. Institutional attention, Reduced perceived project risk, Signals of long-term relevance and most importantly the fresh capital that’s looking for exposure.

That cocktail pushed the LayerZero price sharply higher and flipped sentiment fast. On the LayerZero price chart, the vertical structure is hard to ignore. ZRO/USD didn’t grind up. It sprinted.

And whenever a chart starts sprinting, traders start sweating.

Big Resistance Lies Ahead In ZRO/USD

Here’s the technical friction point. On the daily timeframe, ZRO/USD is facing resistance in the $2.45–$2.50 range. That’s the immediate ceiling. Price pushing beyond it won’t be easy, and the current hesitation suggests the rally may be running hot.

Now, the nearest round number support sits near $2.00, where possibly other major players are having eye at. If momentum cools and since overheated metrics suggest it might then that’s the level traders are quietly circling.

The broader LayerZero price prediction now hinges on one simple condition: a sustained daily close above $2.45–$2.50. Without that confirmation, upside targets near $2.90 and even $3.30 remain conditional, not promised.

Why A Dip is Likely, Because of Overheating OnChain Signals

And here’s the uncomfortable part. CryptoQuant metrics flag the asset as overheated. Futures retail activity over the past 24 hours has surged, suggesting too many late entrants are piling in at once. Historically, when retail crowds futures positioning, larger players tend to reassess risk.

Volume bubble maps across both futures and spot markets echo that heating pattern. Translation? The move may be extended in the short term.

Now, could the LayerZero crypto rally ignore these warning signs and continue higher? Absolutely. Markets love squeezing doubters. But confirmation matters.

So what’s next in LayerZero price?

If buyers defend $2.00 and build structure, the narrative holds. If price reclaims and closes firmly above the resistance band, momentum traders will chase toward higher targets.

Until then, the LayerZero price sits at a crossroads charged with institutional narrative fuel, but flashing technical exhaustion lights at the same time.

You May Also Like

The Channel Factories We’ve Been Waiting For

Ethereum unveils roadmap focusing on scaling, interoperability, and security at Japan Dev Conference