JPMorgan Files Service Mark to Expand Digital Asset and Blockchain Services

JPMorgan Chase has filed a service mark for “JPMD,” signaling an aggressive push into blockchain, digital assets, and decentralized finance infrastructure at institutional scale.

JPMorgan Files Service Mark for JPMD in Strategic Blockchain and Digital Asset Expansion Plan

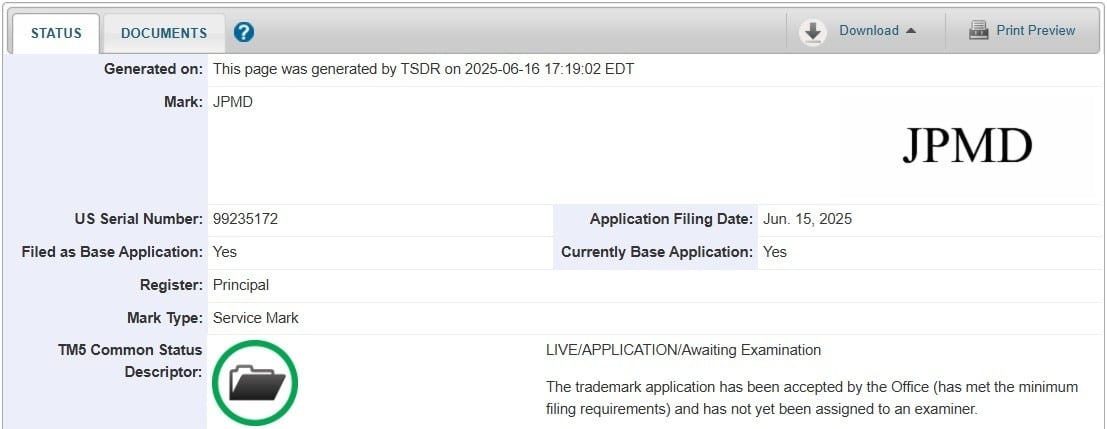

JPMorgan Chase Bank submitted a service mark application on June 15 for the mark “JPMD,” signaling a major expansion of its presence in blockchain-based financial services. Filed with the U.S. Patent and Trademark Office (USPTO), the application has been accepted for review and is currently awaiting assignment to an examining attorney. The mark, listed on the principal register, is claimed in standard characters without any design elements, and the filing qualifies as a live application.

The bank intends to use “JPMD” in connection with a wide range of digital asset and blockchain-enabled services. The application outlines key services covered by the mark:

JPMorgan’s service mark filing for JPMD. Source: USPTO

JPMorgan’s service mark filing for JPMD. Source: USPTO

Additional areas include the issuance and redemption of digital currency, electronic transmission and exchange of digital tokens, financial securities exchange services, and brokerage via distributed ledger technology. Other covered services span online real-time trading, electronic funds transfers, and clearing and reconciling financial transactions through blockchain systems.

The application further describes plans for offering a financial futures exchange, financial custody services, and fraud data sharing using distributed ledger infrastructure. These services aim to support digital asset trading, currency conversion, payment processing, and financial information sharing through decentralized technologies. The scope also includes managing stored value accounts and enabling secure online transactions. JPMorgan’s filing indicates a strategic effort to develop a distinct brand identity under the “JPMD” name as it deepens its involvement in digital finance. The use of a service mark, rather than a trademark, reflects the intangible nature of the services being offered.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

The Next Bitcoin Story Of 2025