A New Way to Design Universal Basic Income in Token Economies

Table of Links

Abstract and I. Motivation

II. Local Currencies

III. Unique Pop Ceremonies

IV. Monetary Policy

V. Purchasing-Power Adjusted Transaction Fees

VI. Architecture

VII. Trusted Execution Environment Security

VIII. Encointer Association

IX. Known Limitations

X. Conclusion and References

IV. MONETARY POLICY

Unlike Bitcoin, Encointer local currencies don’t have a hard-capped supply. The more people are joining the ecosystem, the more money is issued. Every PoP-ceremony participant will receive one reward per attended ceremony as an unconditional basic income (UBI).

\ To analyze the macroeconomics of such a basic income scheme let’s look at the steady state of a stationary economy with a fixed population and no economic growth.

\ If we’d just issue a fixed reward after every ceremony, constant absolute nominal inflation would result. The real value of one (constant) reward would decrease over time and our UBI would become meaningless. If we want our UBI to maintain meaningful value, we can either introduce increasing rewards which may be negatively perceived as hyperinflation.

\

\ Or we introduce a demurrage fee [6], constantly ”burning” money. Demurrage has been tested with local currencies [24], [25] and the cryptocurrency Freicoin [26]. Encointer will employ demurrage as a nominally deflationary measure to compensate for the inflation due to ceremonies. This way, a parametrizable percentage of the money supply will be frequently redistributed in egalitarian fashion. The demurrage fee can thus be understood as a tax to the ”decentralized state” that performs the redistribution of wealth.

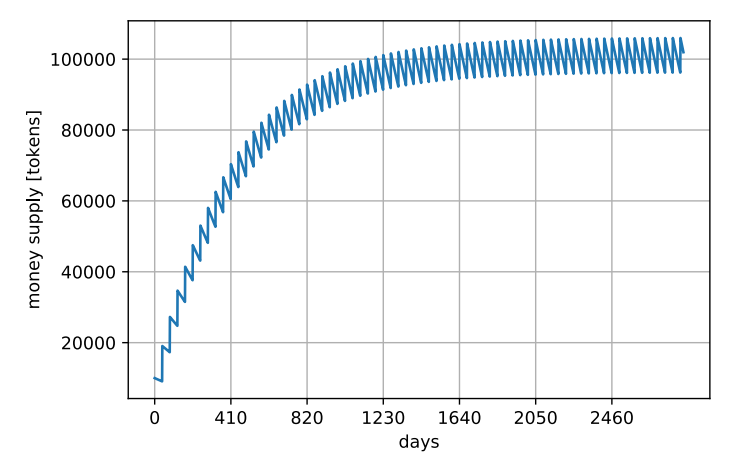

\ Fig 2 shows our example economy reaching an equilibrium state. For an example demurrage of 7% per month, the money supply saturates at around 100’000 tokens. Such a demurrage causes a deliberate incentive to spend as quickly as possible instead of saving. A high money velocity can be expected. For simplicity, we assume a money velocity of one per ceremony (the sum of money changing hands between two subsequent ceremonies equals the total money supply). With a stable money supply around 100’000 tokens the total of our ceremony rewards (10’000 tokens) will maintain a constant real value of 10% of all the spending during one period. That ratio will decrease with decreasing rates of demurrage.

\ Real economies are not stationary and it is not obvious, what a good amount of UBI would be. Encointer therefore allows local currencies to choose their parameters freely by means of on-chain governance.

\ One must expect that people with idle currency will try to avoid demurrage and buy assets better suited to store value, thereby reducing the real value of the Encointer currency. A nation state can enforce a legal tender and force citizens to pay taxes in national currency. An Encointer communitiy on the other hand could promote the use of its currency by social pressure.

\ Another way of applying this technology would be to use Encointer tokens as trusted vouchers for cash transfer schemes in fiat currency, run by a state or by NGOs. In this case demurrage should be disabled and replaced by verifiably burning tokens upon exanging them for fiat.

\

V. PURCHASING-POWER ADJUSTED TRANSACTION FEES

Bitcoin transactions pay a fee to the miner including the transaction in his block. Because Bitcoin has a hard cap on block size, a market develops for fees and miners choose the best-paying transactions to fill a block. This global fee market restricts adoption in developing countries where many people have very little purchasing power in global perspective. While IOTA [20] and Nano [21] have zero transaction fees they must use a small PoW as a measure against spam transactions. Even though small, PoW limits the possibilities to use mobile or IoT devices to send transactions.

\ Because Encointer currencies are local with an independent valuation, fees can be charged according to purchasing power within each community, as a percentage of the UBI which everybody can get. These fees in local currency are charged by the TEE sidechain validators who maintain the community shard.

\

:::info Author:

(1) Alain Brenzikofer (alain@encointer.org).

:::

:::info This paper is available on arxiv under CC BY-NC-SA 4.0 DEED license.

:::

\

You May Also Like

Here’s Why Mantle (MNT) Price Is Pumping Today

Cashing In On University Patents Means Giving Up On Our Innovation Future