Avalanche Positions Itself as a Hub for Stable Assets and Yield Markets

- Avalanche is redefining the Decentralized Finance (DeFi) industry with Ethena, Pendle, and PayPal USD (PYUSD0) integrations.

- Avalanche’s DeFi Total Value Locked (TVL) has more than doubled from the previous quarter to $2.1 billion as of September.

Avalanche (AVAX) is expected to transform its Decentralized Finance (DeFi) sector into a more structured financial infrastructure as it integrates Ethena, Pendle, and PayPal USD (PYUSD0).

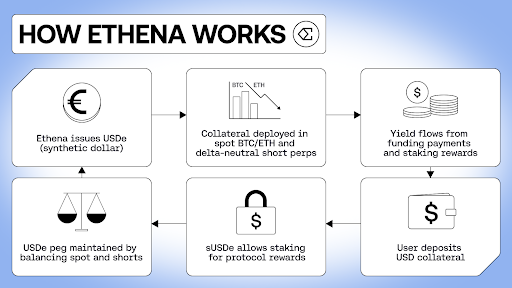

According to a post detailing these integrations, Avalanche explained that Ethena works by issuing synthetic dollar (USDe). The post explains that collaterals are deployed in spot BTC/ETH and delta-neutral short perps. Basically, yields are reported to flow from funding payments and staking rewards.

Source: Avalanche

Source: Avalanche

Avalanche’s Latest Integrations

In the press release, two stable assets were reported to be introduced to Avalanche by Ethena. These are USDe and sUSDe.

According to the post, sUSDe is a staked variant in charge of distributing protocol revenues from staking rewards and reserve yields. USDe also operates as a synthetic dollar pegged to $1. Its role is to reduce the exposure to crypto volatility.

Avalanche has also hinted that its DeFi foundation could be significantly strengthened since the sUSDe is already launched on Uniswap, LFJ, Pharaoh Exchange, and Blackhole. Apart from that, it has been integrated into different protocols, including Euler Finance, Silo, and Folks Finance.

Pendle, on the other hand, is expected to introduce a structured yield into the Avalanche ecosystem. Fascinatingly, this would be done with the “first cross-chain Principal Tokens (PTs).”

As mentioned in our earlier publication, PayPal USD is now live on Avalanche. Already, it is available across more than 140 blockchains via LayerZero’s distribution network. The stablecoin keeps expanding as it recently added Arbitrum support, according to our recent coverage. Unlike the other stablecoins, PayPal USD is reported to have a low fee, sub-second finality, and deterministic settlement.

Avalanche is expected to benefit greatly from this, as the stablecoin transaction volume has been projected to reach $250 billion per day. At the time of writing, Avalanche’s DeFi Total Value Locked (TVL) was booming as it more than doubled to $2.1 billion. The team is also working on further expansion. As noted in our recent blog post, there has been a partnership with Woori Bank to Pilot Korea’s KRW1 Stablecoin.

At the time of writing, the native token of Avalanche, AVAX, was also trading at $28 after surging by 2.8% in the last 24 hours and declining by 13% in the last seven days.

As detailed in our earlier discussion, Avalanche is equally rubbing shoulders with the top competitors in the Real World Assets (RWA) ecosystem, moving beyond theory to active development.

]]>You May Also Like

PEPE ($PEPE) Leads Top MEME Projects by Social Activity

How Solana Intends to Become an Even Stronger Competitor in the Blockchain Space