Best Crypto Presale $HYPER Hits Highs as Whale Buys Total $329K in a Day

But precisely the qualities that make Bitcoin so secure are also holding it back. It’s like a vintage car; good and reliable, but it can’t keep up with high-speed, flexible networks like Solana or Ethereum. Or rather, it couldn’t without Bitcoin Hyper ($HYPER).

The problem lies in the Bitcoin network’s ability to process transactions, which is notoriously slow, handling only around seven transactions per second. This low throughput leads to a frustrating user experience during busy periods, transactions can get stuck in a backlog, and fees can skyrocket, sometimes costing more than what you’re trying to buy.

Adding insult to injury, Bitcoin’s limited scripting language means it can’t support the kind of innovation other blockchains can offer. It’s a closed system, not an open one like Ethereum, so developers can’t build decentralized apps (dApps), DeFi protocols, NFTs, DAOs, and more on it.

This has created a ‘utility gap’ where Bitcoin is a great store of value but a poor platform for dApps, smart contracts, and other cutting-edge Web3 projects. Developers and entrepreneurs have flocked to more agile networks, leaving Bitcoin behind in the race for innovation.

The Bitcoin Hyper Solution: Unlocking a New Era

Enter Bitcoin Hyper ($HYPER), a project that doesn’t just aim to improve Bitcoin, but to fundamentally transform its role in the digital economy. It’s a Layer-2 that’s a strategic fusion of Bitcoin’s security with the blistering speed of the Solana Virtual Machine (SVM).

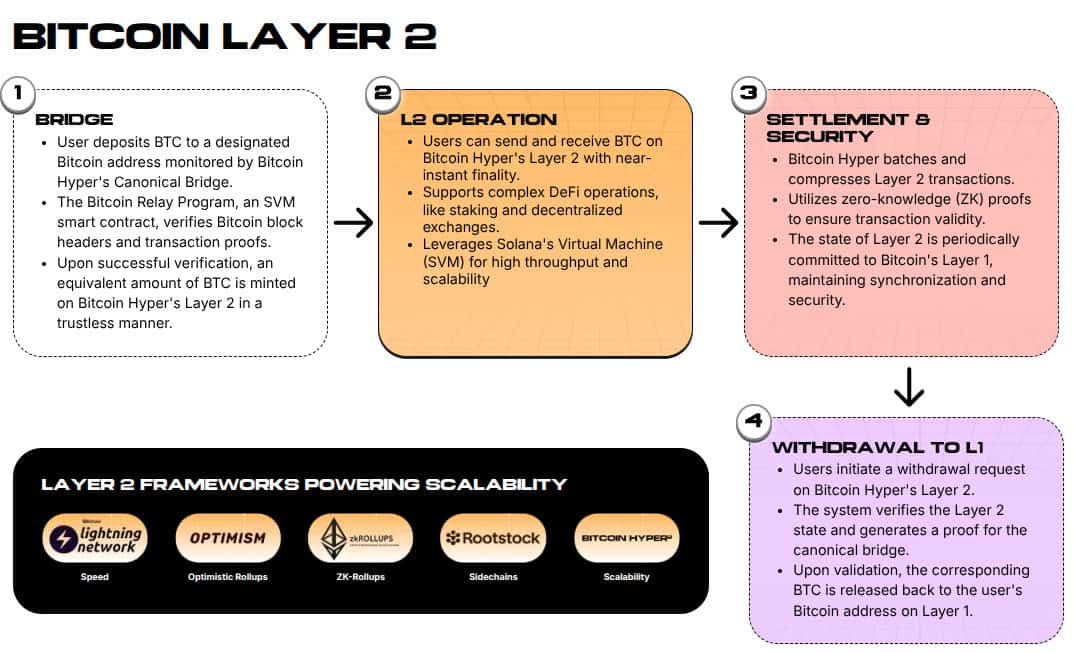

The concept is elegantly simple: a trustless ‘Canonical Bridge’ allows users to move their native Bitcoin onto the Hyper network. This creates a wrapped version of Bitcoin that can move at unprecedented speeds, enabling instant, low-cost transactions.

Using the SVM is a game-changer. It allows Bitcoin Hyper to support a vast ecosystem of applications that were previously impossible on the main Bitcoin network.

The Hyper network essentially acts as a high-speed express lane. Periodically, all activity is batched and settled back onto the secure Bitcoin blockchain. This ensures that Bitcoin Hyper inherits the unassailable security of its parent chain, creating a virtuous cycle of utility and trust.

Redefining Bitcoin’s Place in the Digital Universe

Bitcoin’s market dominance is undisputed, but past success is no guarantee of future relevance. Bitcoin Hyper’s mission is not just to maintain Bitcoin’s position but to elevate it to new heights.

By providing a scalable, programmable platform, it addresses the very limitations that have hindered Bitcoin’s adoption.

Whales Pile into the $HYPER Presale

The excitement surrounding Bitcoin Hyper ($HYPER) isn’t merely theoretical; it’s reflected in the numbers. The presale has raised over $19M, with high-profile whale buys demonstrating strong institutional and larger-scale investor interest.

We’ve seen whale buys of $113.8K, $109.9K, and $105.4K, totaling $329K in one day alone. These aren’t speculative small bets; they’re calculated moves by large players who see a real opportunity.

The $HYPER token is the lifeblood of the network, serving as both a transaction fee and a governance mechanism. This utility-first approach provides a strong foundation for long-term value.

For investors, the appeal lies in getting in on a project that addresses a fundamental market need and has a clear path to value creation. The 61% staking rewards help too.

With experts predicting a potential end-of-year high of $0.20, buying now could yield a return of up to 1437%.

The future of $HYPER relies on its ability to effectively connect Bitcoin with the Web3 world. The confidence of early investors suggests that it may just succeed.

You May Also Like

Here’s Why Mantle (MNT) Price Is Pumping Today

Cashing In On University Patents Means Giving Up On Our Innovation Future