Bitcoin and Ethereum ETFs Lose $1.7 Billion as Institutions Retreat

Spot Bitcoin and Ethereum exchange-traded funds (ETFs) in the United States reversed course sharply last week, shedding more than $1.7 billion.

This shift came amid Bitcoin and Ethereum price volatility during the past week as both assets shed more than 8% during the reporting period.

Bitcoin and Ethereum ETFs Bleed Cash Amid Market Volatility

According to data from SoSoValue, spot Bitcoin ETFs recorded $903 million in net withdrawals. The outflows ended a month-long streak of inflows that had reflected growing institutional confidence.

That sentiment shifted as macroeconomic uncertainty deepened, prompting many institutional investors to trim exposure and adopt a defensive stance.

Ethereum products mirrored the downturn but endured even heavier losses.

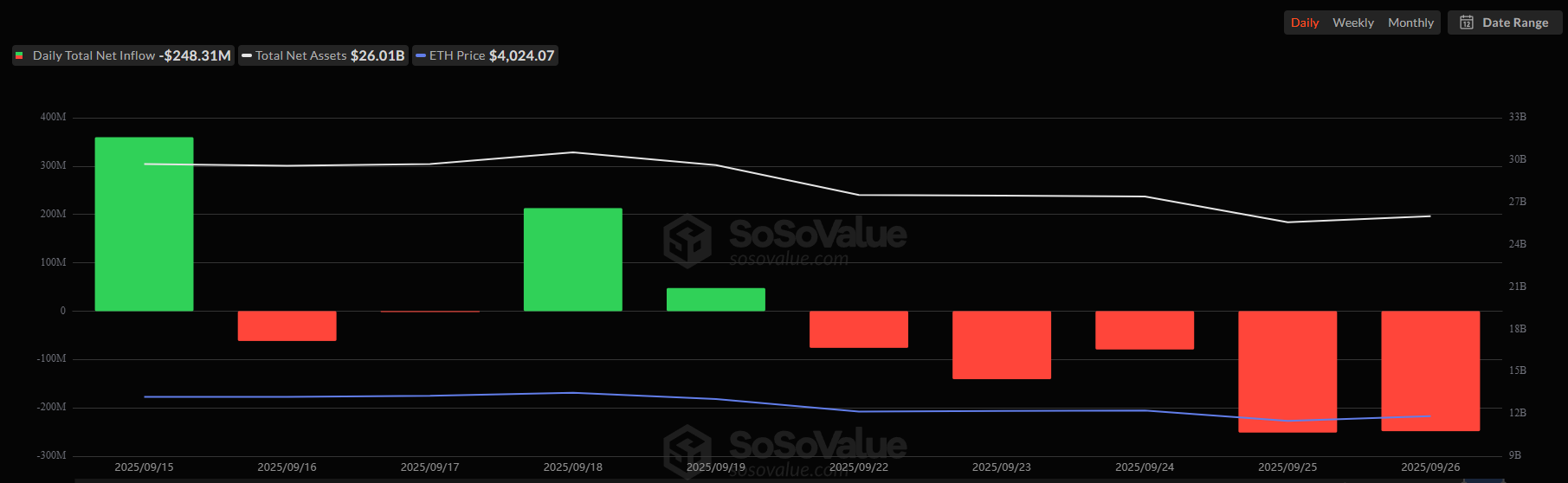

Ethereum ETFs Net Daily Inflow This Week. Source: SoSoValue

Ethereum ETFs Net Daily Inflow This Week. Source: SoSoValue

Data from SoSoValue shows that the nine US-listed spot Ethereum ETFs saw redemptions, amounting to $796 million in outflows. This is their largest weekly withdrawal since launching earlier this year.

The synchronized retreat across both assets reflects a broader cooling in crypto ETF demand.

Institutional allocators once viewed these vehicles as a convenient entry point into digital assets. They are now reassessing their strategies in light of growing macro headwinds.

Over the past week, persistent inflation concerns, slowing global growth, and heightened uncertainty around US monetary policy have reduced appetite for volatile assets. In this environment, digital assets—long categorized as high risk—were among the first to be pared from portfolios.

Meanwhile, institutional strategies have also grown more defensive, especially as investors are increasingly being exposed to losses.

CryptoQuant data shows that Bitcoin treasury firms raising capital through PIPE deals are under pressure, as share prices trend toward discounted issuance levels.

At the same time, investor attention is rotating toward newly launched ETFs tied to alternative tokens like Solana and XRP.

These vehicles have drawn capital away from Bitcoin and Ethereum funds, introducing fresh competition and encouraging experimentation with underrepresented assets.

The redirection of inflows suggests that while risk sentiment has cooled, appetite for diversification within crypto remains active — just more selective and opportunistic than before.

You May Also Like

Argentina And Brazil Both Drop In Official FIFA World Ranking

CEO of U.S. Global Investor Says ‘Underinvestment Theme’ Opportunity Presenting Itself in Gold and Silver Markets