Bitcoin (BTC) Price Prediction: Bitcoin Targets $126K Breakout Amid Fed Rate Cut Concerns

Despite short-term uncertainty, market participants are positioning for both potential pullbacks and a sustained upward move, with technical patterns and macroeconomic indicators pointing to a possible historic rally.

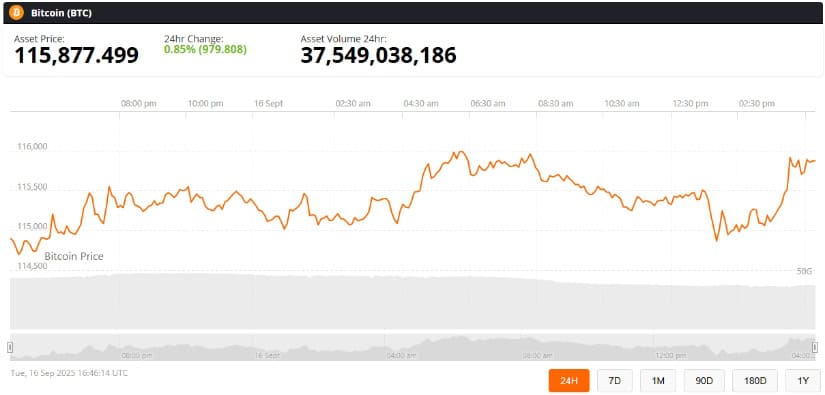

Bitcoin Price Today Holds Key Support Levels

After bouncing from the $111,000 zone, Bitcoin has found a firm footing around $115,877, testing resistance between $116,000 and $118,000. The daily chart shows the 0.618 Fibonacci retracement level at $115,429 acting as a critical support.

Bitcoin (BTC) was trading at around $115,877, up 0.85% in the last 24 hours at press time. Source: Bitcoin Price via Brave New Coin

Additionally, the 20-day and 50-day EMAs at $113,645 and $113,478 provide further stability. Breaking above $116,000 could set the stage for a push toward $123,600, while failure to clear this resistance may lead to a short-term pullback.

Fed Rate Cut May Trigger Short-Term Sell-Off

The Federal Reserve is expected to cut rates due to 3.1% inflation and 4.3% unemployment, adding liquidity to the financial system. This move could cause Bitcoin to dip temporarily to $104,000, or potentially toward $92,000 where a CME futures gap has yet to be filled.

Bitcoin may dip ahead of the Fed rate cut before rebounding, as analysts warn of short-term volatility. Source: @TedPillows via X

Historical patterns show that rate cuts often trigger brief sell-offs before recovery. Bitcoin’s volatility, which can spike 3–4 times higher than equities during policy changes, reinforces the risk of short-term price swings ahead of the Fed decision.

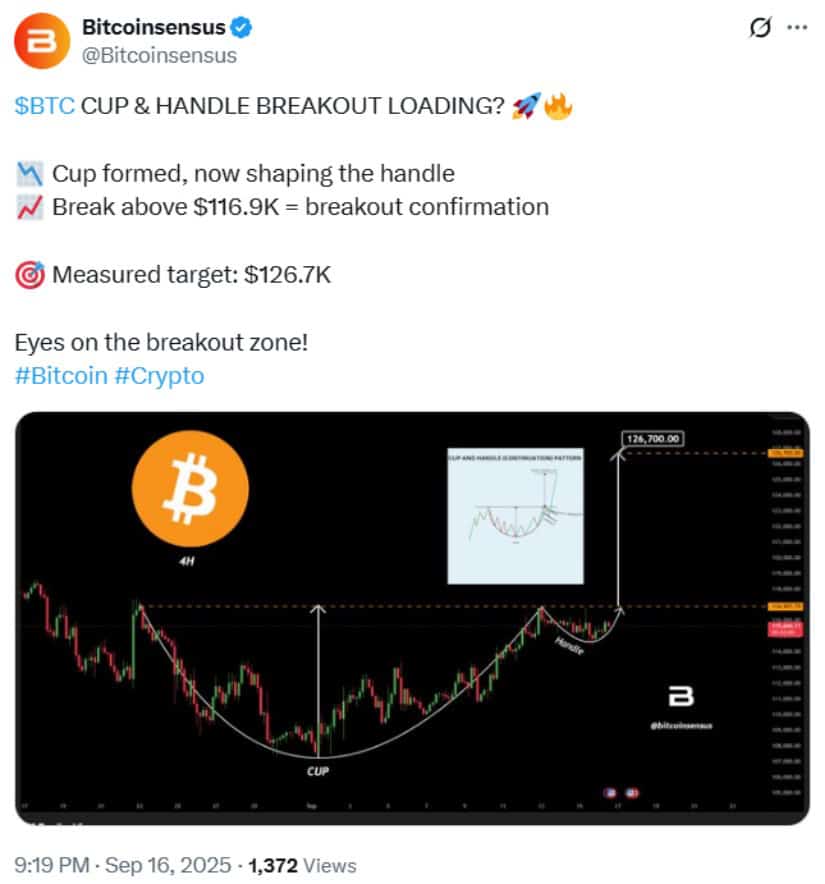

Technical Patterns Suggest Potential Breakout

Short-term charts show a cup and handle pattern forming on the 4-hour timeframe, with a U-shaped recovery from $105,000 to $116,900 followed by a small pullback. A breakout above $116,900 could send Bitcoin toward $126,700, following the pattern’s historical performance.

BTC cup & handle nears breakout—surge above $116.9K could target $126.7K! Source: @Bitcoinsensus via X

While such patterns have generally low failure rates in bull markets, frequent formations near all-time highs may produce false breakouts. Traders should be cautious and wait for confirmation before entering large positions.

Immediate Support and Resistance Levels

Immediate support sits at $113,500, reinforced by the 20-day and 50-day EMAs. If this level breaks, Bitcoin could test $111,100 and the 200-day EMA at $105,349, reflecting the scenarios for potential short-term pullbacks.

Bitcoin’s next move hinges on the Fed rate cut, with potential dips before a push toward a $126K breakout if support holds. Source: Morad762025 on TradingView

Key resistance levels include $116,000, $118,000, $120,000, and $123,600, which could determine whether Bitcoin continues its upward trend. Surpassing these points may pave the way for a $126,000 breakout in the medium term.

Looking Ahead: Bitcoin’s Next Move

Bitcoin’s near-term direction will depend heavily on the market’s reaction to the Fed rate cut. As long as BTC remains above $113,500, medium-term momentum is expected to stay constructive.

Traders should prepare for possible dips toward $104,000–$111,000 before a sustained rally. If resistance levels are overcome and support holds, a historic $126K breakout remains within reach.

You May Also Like

Exclusive interview with Sherry, the founding engineer of Aptos: Meta Blockchain "OG"'s technical journey to build a "global trading engine"

The U.S. House of Representatives intends to merge the CLARITY and GENIUS bills and strive to pass them before August