Bitcoin Hyper Presale Breaks $18M While Bitcoin Core v30 Upgrade Divides the Community

Bitcoin is due a major upgrade. Scheduled for release this October, Bitcoin Core v30 will remove the long-standing 80-byte limit on OP_RETURN. Basically, it’s the part of a Bitcoin transaction that allows you to embed arbitrary data directly onto the blockchain.

By enabling more data to be stored on-chain, Bitcoin will unlock a range of new capabilities, spanning scaling solutions (such as rollups and zk-proofs), smart(er) contracts, and cutting-edge dApps.And that’s not the only boost Bitcoin is getting. Once the Layer-2 (L2) scaling solution Bitcoin Hyper goes live in late 2025, it’ll propel the network’s speed, reduce costs, and increase efficiency.

When taking this into account, it’s no wonder that the network’s native token, $HYPER, has already scooped up $18M on presale. Who knows, it might even be the next 1000x crypto.

Bitcoin Core v30 Sparks Debates Over Spam & Steep Fees

Built by a global community of developers working together and relying on miners and node operators, Bitcoin Core is the leading software that powers the Bitcoin network.

But since the v30 upgrade announcement, there has been a divide between the Bitcoin community: one side wants Bitcoin to remain a ‘money only’ network focused on transactions. Others are excited about it evolving into a more versatile base layer for broader innovation.Not helping matters, Bitcoin Core developer, Luke Dashjir, has gone so far as to say that ‘Bitcoin is dead if people adopt Core 30.’

He argues that removing the OP_RETURN limit risks turning the blockchain into a dumping ground for spam and child sexual abuse material (CSAM).

Nevertheless, Blockstream CEO Adam Back defends the upgrade. On X, he explains how, since the release of its version 0.1, Bitcoin has leveraged the same censorship-resistant network model.

According to him, it makes it thicker to control spam but is essential for decentralization.

Interestingly, blockchain expert VTECH notes that removing the 80-byte limit would ‘allow the free market to decide on fees for block space storage based on demand.’

In turn, they believe that would automatically adjust as more users store data on-chain. But it’s not all doom and gloom, as it could help discourage spam and junk content.

Still, there are solutions under development to help make Bitcoin’s network fees faster and cheaper. One such example? Bitcoin Hyper, with its DeFi-ready Layer-2 (L2) project.

Hyper L2 to Uplift Bitcoin With Solana-Level Speeds

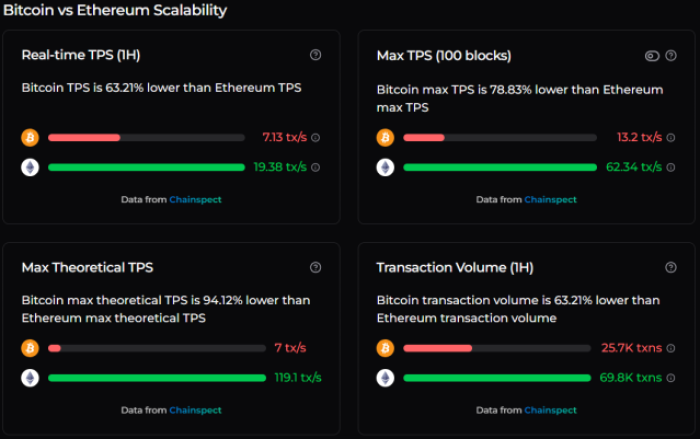

Right now, Bitcoin can only process around 7 transactions per second (TPS), which is a sizable 63.21% lower than Ethereum’s 19.38 tps.

Bitcoin’s maximum TPS is also just 13.2 transactions per second, a hefty 78.83% lower than Ethereum.

Due to its slow design, Bitcoin is not immune to steep fees during periods of peak demand. Take November, for instance, when fees went above $8 per transaction.

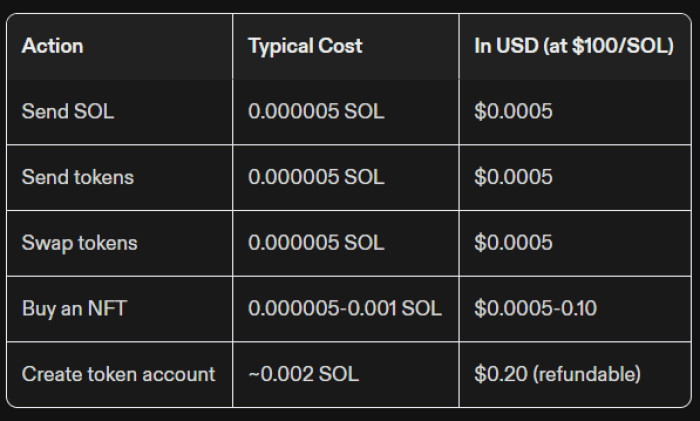

Although they’ve since declined to just $0.62 (a decrease of over 90%), Bitcoin’s fees are still significantly more expensive than on networks like Solana, where fees rarely go beyond $0.05.

This is where Bitcoin Hyper sets itself apart. Built on the Solana Virtual Machine (SVM), it’s designed to deliver Solana-level speed and scalability to Bitcoin. In turn, it’ll enable thousands of transactions per second for significantly less cost.

The L2 will also leverage a Canonical Bridge for faster and cheaper transactions, as you’ll be able to transfer $BTC into the Hyper ecosystem easily.

And that’s just touching the surface. The bridge will unlock tons of new use cases, ideal for if you want to explore DeFi, dApps, and the next crypto to explode across launchpads and marketplaces.

$HYPER Powers Bitcoin Hyper’s Evolution

The project’s native token, $HYPER, makes all this possible. One reason being that it sets aside 30% of its total token supply for development funding, meaning a near third of the presale raise goes directly into building the L2.

Another 25% goes towards the ecosystem’s treasury, with more set aside for community rewards and the token’s listings in Q4 2025.

Holding the token unlocks additional value, including governance rights and lower gas fees on the L2. (Check out our Bitcoin Hyper guide for more information.)

Once you buy $HYPER (still available on presale for just $0.012975), you can also stake it at a 65% APY.

But don’t wait around: that rate will go down when more investors catch on. The token is also likely to spike 24x after listing and increased adoption in late 2025, as per our Bitcoin Hyper price prediction.

Joining the presale isn’t just about supporting the network’s growth and enjoying its benefits.It’s also a chance to be part of an $18M+ raise that shows no signs of slowing down. Whale buyers have put in as much as $161.3K, $100.6K, and $74.9K, after all.

Visit the Bitcoin Hyper presale today.

Disclaimer: This isn’t financial advice. Always do your own research and never invest more than you’d be sad to lose, as crypto is a volatile market.

Authored by Leah Waters, Bitcoinist – https://bitcoinist.com/bitcoin-hyper-breaks-18m-amid-bitcoin-upgrade-news

You May Also Like

BNB Chain Integrates Chainlink to Bring US Government Economic Data Onchain

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon