Bitcoin Hyper’s $20.4M Presale Soars at the Prospect of a US-Europe Bitcoin Reserve Race

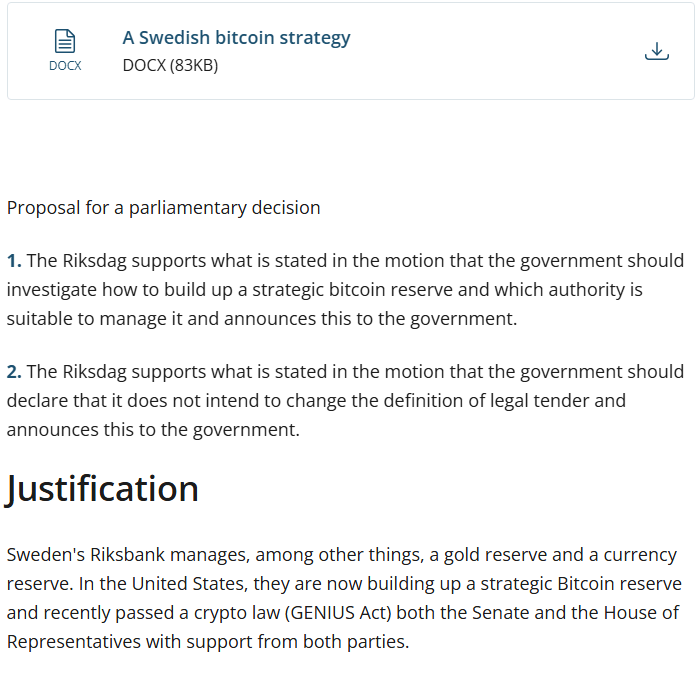

Taking President Donald Trump’s Strategic Bitcoin Reserve as an example, Sweden took a step in the same direction, after opposition MPs Dennis Dioukarev and David Perez submitted a motion for the creation of a Strategic Bitcoin Reserve.

The official Act specifically mentions the US’ Bitcoin Reserve and the passing of the GENIUS Act as among the main drivers behind the motion.

Source: Swedish Parliament

Source: Swedish Parliament

Other arguments invoke Bitcoin’s reliable liquidity, inflationary protection, portfolio diversification, and the need for innovation.

Bitcoin Hyper ($HYPER) is also poised to contribute to that once its Layer-2 rolls out, supporting faster and cheaper on-chain transactions for a more performant and scalable Bitcoin.

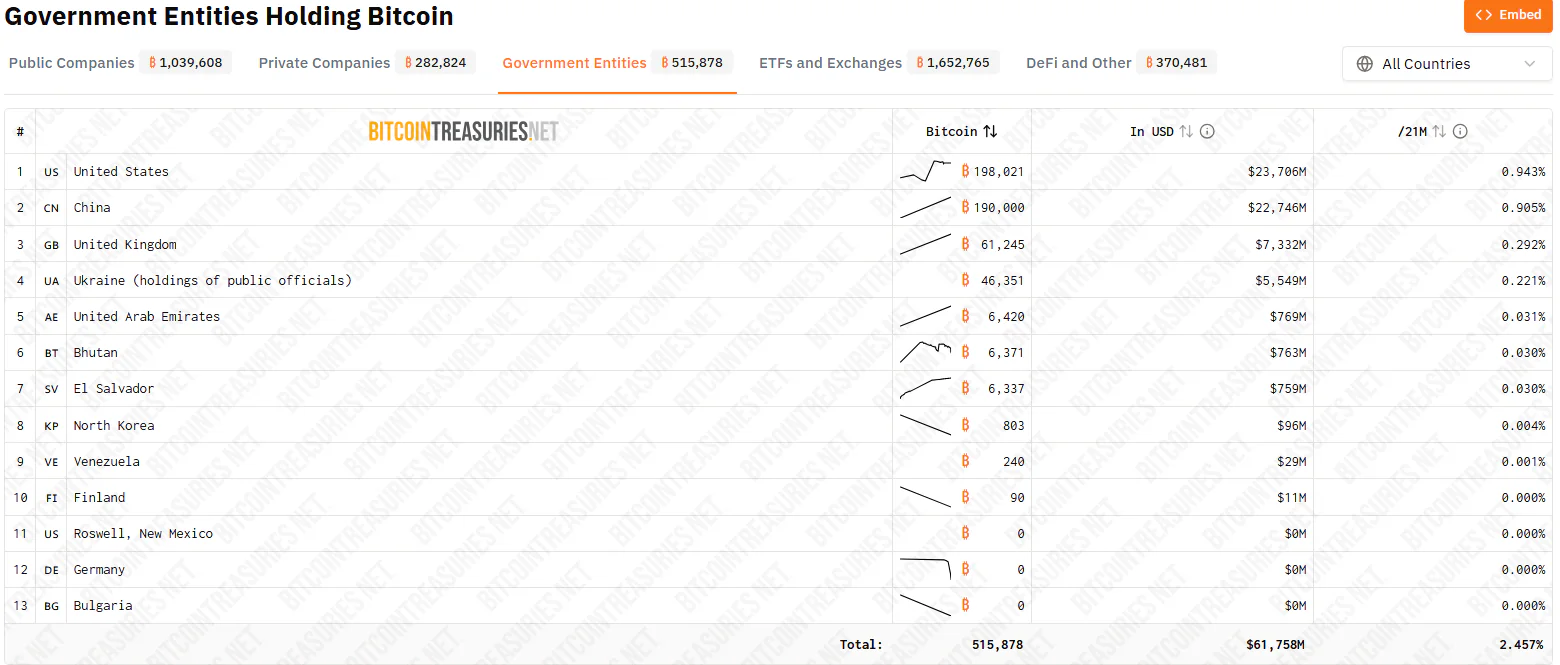

More Countries Eye Bitcoin Amid Growing Adoption

Sweden isn’t the only nation exhibiting a Bitcoin-favorable attitude. El Salvador was the first country to make Bitcoin legal tender, although it backtracked in February of this year, halting Bitcoin purchases following pressure from the IMF.

The Central American country is now splitting its Bitcoin reserve between multiple addresses for improved security. El Salvador currently holds 6,388 $BTC in its treasury, purchased at the average price of $42,000 and currently worth around $769M.

Pakistan also has skin in the game after recently starting to push its crypto strategy.

The country experienced its first pushback in July, after the IMF rejected its proposal for subsidised electricity tariffs for crypto mining. The argument was that the nation’s already-stretched power sector wouldn’t be able to support the new throughput.

Despite the setback, Pakistan remains on track, as it considers Bitcoin a critical tool for financial decentralization and innovation.

The public sector is even more stacked, with 184 companies worldwide holding 1,039,608 $BTC.

The trend is undeniable and puts Bitcoin in direct competition with gold, thanks to shared characteristics, such as high liquidity and limited supply, and correlation to traditional assets.

A Deutsche Bank Research study compares gold and Bitcoin across a variety of metrics, including 30-day volatility – it showed Bitcoin becoming more stable over time.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

What does this all mean? It means that Bitcoin is rapidly gaining ground in the fight for financial supremacy, and October may be where it all begins. Bitcoin broke above $121K yesterday and it’s now consolidating around the $120K mark in preparation for the coming bull cycle.

Bitcoin Hyper ($HYPER) raises similar interest thanks to its $20.4M presale and growing investor participation.

How Bitcoin Hyper Will Turn the Bitcoin Network Faster, Cheaper, and More Performant

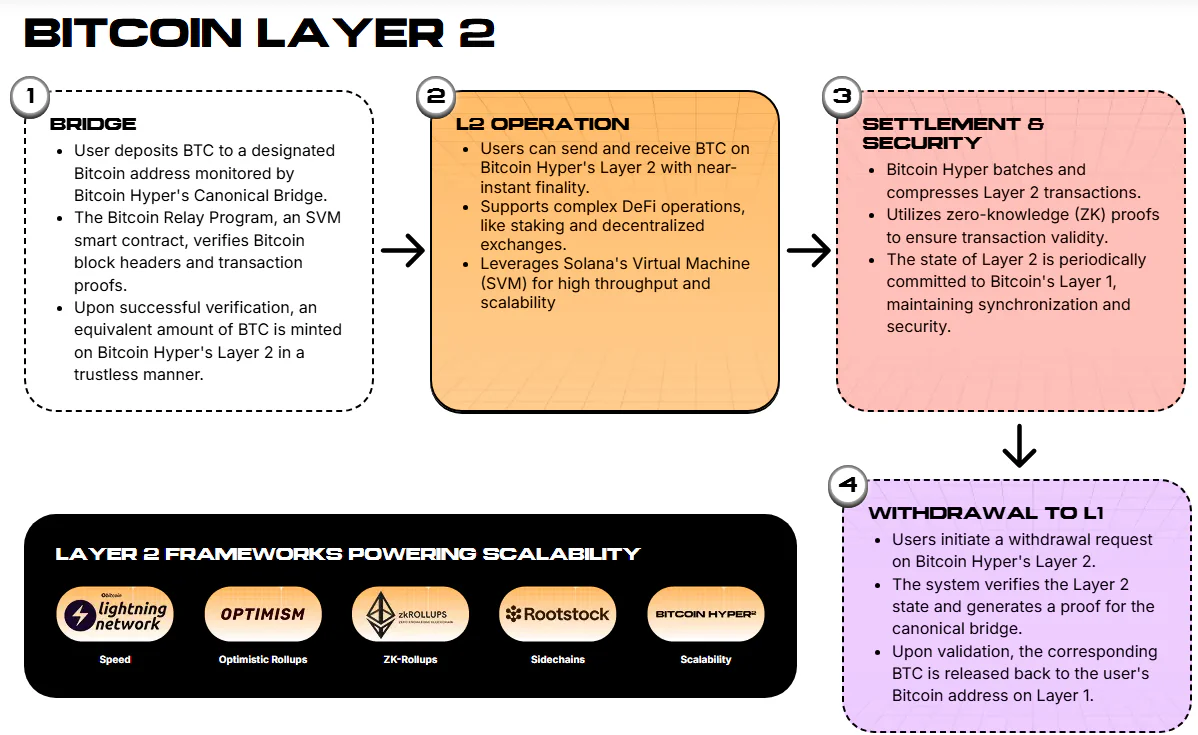

Bitcoin Hyper ($HYPER) plans to introduce a $BTC Layer-2 that promises faster and cheaper on-chain transactions for the Bitcoin network.

Hyper’s solution to Bitcoin’s performance limitation of seven transactions per second (compared to Solana’s 65K) involves the use of two primary tools: the Solana Virtual Machine (SVM) and the Canonical Bridge.

The Canonical Bridge, on the other hand, will deal with transaction optimization and execution time. Once the Bitcoin Relay Program confirms incoming transactions, the Canonical Bridge will mint your Bitcoin onto the Hyper Layer-2.

Those wrapped Bitcoins will be available for use within the Hyper layer, until you choose to withdraw it back to Bitcoin’s native Layer-1.

With these tools, Bitcoin Hyper will fulfill several core goals:

- Improve scalability to allow for multiple transactions at once

- Remove the fee-based priority system, which prioritizes some transactions over others based on the size of their fees

- Cut transaction confirmation times from hours to seconds

- Lower transaction costs

Investors Flock To The Hyper Presale

The Bitcoin Hyper presale is proving to be a phenomenal success, having raised $20.4M+ in just the few months since its release. In fact, this week alone has seen a significant whale activity to the tune of $940K, helped along by a $196.6K purchase less than a day ago.

Buying early could prove extremely rewarding long-term, provided Bitcoin Hyper sees successful implementation and experiences mainstream adoption.

Bear in mind, though, that those staking rewards are dynamic and guaranteed to drop as more investors join the staking pool. So be sure to get in now before they dip again. As for the $HYPER price, it goes up in stages, with the next increase due in just over one day. The clock is ticking.

Ready to join one of the best presales of the year? Buy your Bitcoin Hyper tokens from the official website today.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Bitcoin Hyper’s $20.4M Presale Soars at the Prospect of a US-Europe Bitcoin Reserve Race appeared first on Coindoo.

You May Also Like

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be

EUR/CHF slides as Euro struggles post-inflation data