Bitcoin Tops $120,000 Amid US Government Shutdown, Echoing Hoskinson’s Forecast

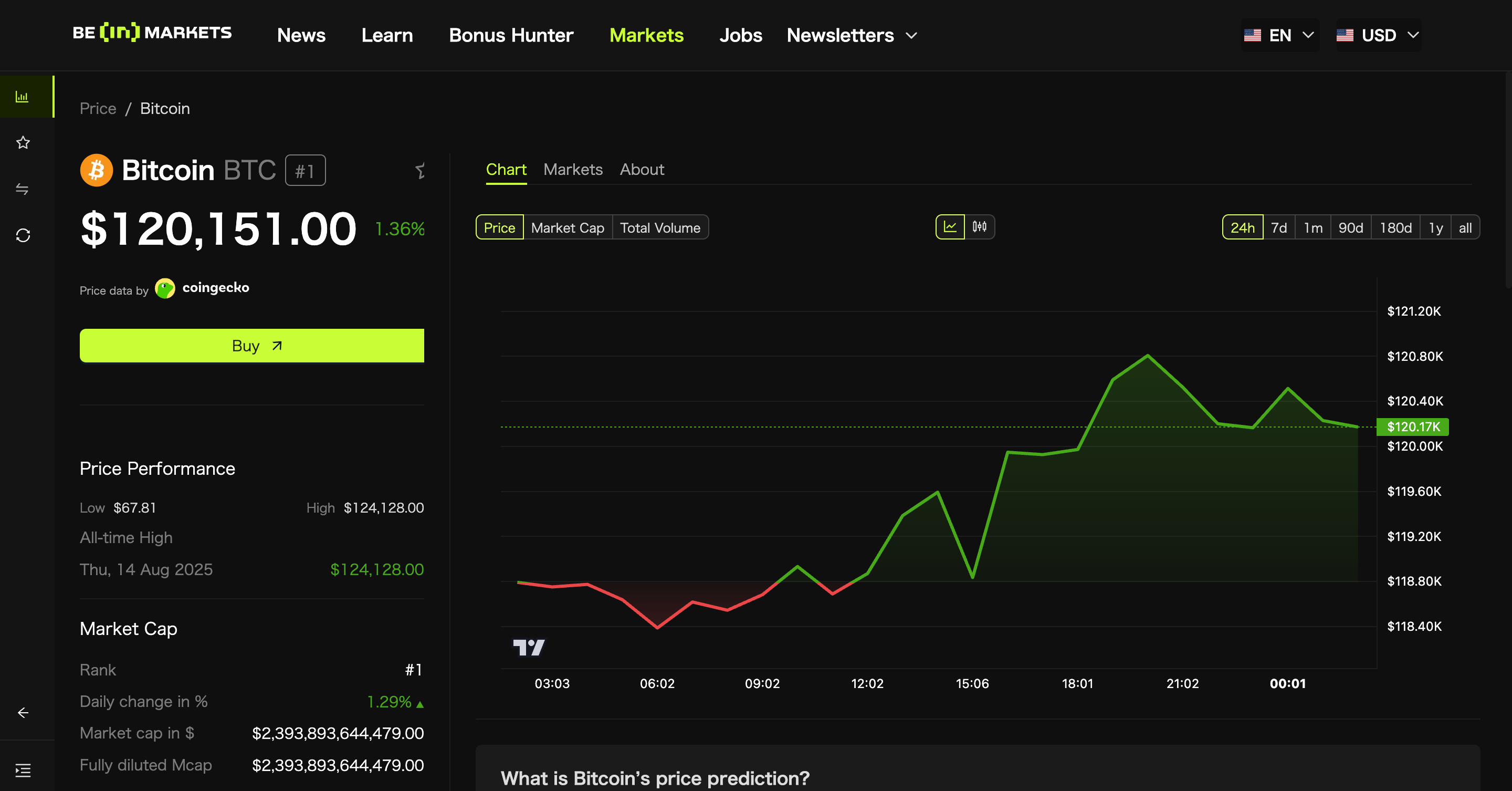

Bitcoin surged past $120,000 on October 3 following the US federal government’s partial shutdown earlier this week. Investors sought safety in digital assets and gold, highlighting Bitcoin’s position as an alternative store of value when traditional systems falter.

Just one day earlier, Cardano founder Charles Hoskinson predicted Bitcoin could reach $250,000 by mid-2026, citing geopolitical disruption as a catalyst.

Government Shutdown Sparks Market Turbulence

The shutdown began on October 1 after the Senate rejected a stopgap funding bill by a 55-45 vote, falling short of the 60 votes required. Without appropriations, federal agencies lost access to funding, placing roughly 150,000 government employees at risk of furlough.

Market reactions were immediate. Futures tied to the S&P 500 dropped sharply in early trading hours, while gold rose 1.1% to $3,913.70 per ounce.

Bitcoin jumped more than 2% overnight, reaching $116,400 before breaking through the $120,000 threshold the following day.

Deutsche Bank strategist Jim Reid warned in a client note that the absence of official data releases, such as employment and inflation reports, left policymakers and investors in “complete blindness.”

Bitcoin price chart Source: BeinCrypto

Bitcoin price chart Source: BeinCrypto

Analysts see the shutdown as a direct contributor to market volatility.

Matt Mena, a strategist at 21Shares, argued that delayed economic data may prompt the Federal Reserve to cut interest rates by 25 basis points in October, with another reduction likely in December. Lower real yields and a weaker dollar, he noted, historically provide favorable conditions for Bitcoin.

The Bitcoin price action follows a recent Bloomberg interview in which Charles Hoskinson said he sees Bitcoin at around $250,000 by the middle of next year.

Bitcoin’s Appeal in Geopolitical Fragmentation

Hoskinson has repeatedly argued that geopolitical fragmentation strengthens the case for cryptocurrencies. Speaking to Bloomberg from TOKEN2049, Hoskinson noted the US government had publicly flagged Cardano and added, “They tweeted about it. It’s going to the reserve,” a reference to earlier announcements about a proposed US crypto strategic reserve.

With tensions between the US, Russia, and China complicating cross-border commerce, reliance on conventional banking systems becomes more politically constrained. Digital assets like Bitcoin, he suggested, offer a global settlement layer free from such restrictions.

Amberdata’s derivatives director Greg Magadini described the shutdown as a “catalyst” that could either accelerate Bitcoin’s ascent or trigger sharp declines, depending on whether investors view it as a hedge against the dollar or as a risk asset.

For now, the reaction is clear: Bitcoin rose nearly 4% within 24 hours, while Ethereum, XRP, Solana, and Dogecoin gained between 4% and 7%. The CoinDesk 20 Index climbed 5% to 4,217 points.

The crisis also reflects Hoskinson’s earlier prediction that increased corporate involvement could solidify crypto’s credibility. Tech giants such as Apple and Microsoft have signaled growing interest, while Visa, Mastercard, and Stripe advance stablecoin integrations.

This convergence between traditional finance and crypto is blurring industry lines, lending Bitcoin additional legitimacy during times of instability.

Economic Risks and Policy Implications

Economists warn that the longer the shutdown lasts, the more severe the consequences for US growth. Oxford Economics’ Ryan Sweet estimated that GDP could decline by 0.1 to 0.2 percentage points for each week of closure. A full-quarter disruption could reduce growth by as much as 2.4 percentage points.

This potential contraction increases the likelihood of further monetary easing, creating conditions that may accelerate capital flows into digital assets. As traditional indicators remain unavailable, market participants face heightened uncertainty.

Hoskinson’s broader thesis, that crypto could dominate global finance within three to five years, appears increasingly relevant.

The US shutdown demonstrates how political dysfunction and economic uncertainty can undermine faith in traditional systems, while decentralized assets gain traction as alternatives. For investors, the episode underscores Bitcoin’s evolving role as both a hedge and a barometer of systemic fragility.

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

Botanix launches stBTC to deliver Bitcoin-native yield