BTC, ETH, XRP, SOL, and ADA: SEC Approves First Multi-Crypto ETP, Highlighting Pepeto as a Top Investment

SPONSORED POST*

SEC Approves First Multi-Crypto ETP in the United States

The U.S. Securities and Exchange Commission has authorized the Many Digital Large Cap Fund, marking it as the first multi-asset crypto exchange-traded product that includes Bitcoin, Ethereum, XRP, Solana, and Cardano. This approval leverages the new “generic listing standards,” designed to reduce the time it takes for crypto products to list on major exchanges like Nasdaq, NYSE Arca, and Cboe BZX.

This milestone signals an industry shift toward broader regulated access for altcoins and helps investors identify the best crypto assets to focus on for the 2025 bull run. Amid this evolving environment, Pepeto stands out as a leading investment opportunity, with real utility and the capacity to benefit from wider mainstream acceptance and regulatory approval.

What This Means For Early And Smart Movers

As regulatory frameworks expand highlighted by the inclusion of multiple major cryptocurrencies in a single fund the opportunities for innovative projects to break through are opening rapidly. Getting in early on presales now allows investors to ride the same momentum fueling the growth of multi-asset crypto ETFs. Projects that focus on building solid infrastructure, offering rewarding staking, and earning community trust are set to benefit the most.

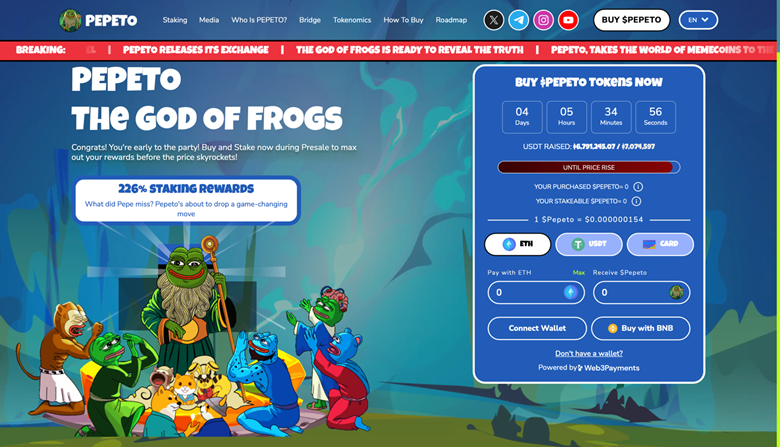

Pepeto, priced at $0.000000155 per token with a supply model inspired by meme culture, featuring a 420 trillion cap like PEPE has a rare window of opportunity. Early entry at this low cost, combined with its connection to the Pepe story and the potential for significant growth as ETF interest broadens, makes now an ideal time to participate. This is a chance to back a project poised for substantial upside amid the evolving crypto landscape.

Where Opportunity Lies: Best Crypto To Buy In 2025

Pepeto is more than a meme token; it’s being built with clear purpose. As the presale approaches its final stages, a demo exchange prepares to launch and the project has already raised over $6.8M, momentum is accelerating. As funds like GDLC open regulated pathways for crypto exposure, tokens with real utility, active communities, and working products are likely to draw increased attention. If history repeats, those who buy before listings and public hype often capture the largest gains. This is a rare window to stake, hold, and potentially ride the next meme-infrastructure wave many investors now cite Pepeto as the best crypto to buy in 2025 based on its mix of story and substance.

Thousands have already joined the presale, and the recent exchange demo pushed interest across major platforms. With more than $6.8M secured, Pepeto is proving it’s not just a short-term trend but a magnet for serious crypto capital. Historical patterns show investors who position themselves just ahead of public listings tend to realize the biggest upside. With the ETF cycle gaining steam, Pepeto could be one of the last meme-native tokens still available at true entry-level prices.

Missed Shiba And Pepe? Pepeto Could Be Your Final 100× Presale Opportunity

Look back at crypto’s biggest winners and you’ll see a pattern: the wealth wasn’t made by buying Bitcoin at $30K or Ethereum at $2K. The real fortunes came from early presale bets on tokens like Shiba Inu, Dogecoin, and Pepe long before they hit mainstream awareness. Today’s top 10 coins have already had their breakout moments.

Pepeto sits in that same pre-breakout spot at $0.000000155: low entry, big upside, and momentum already building. Ground-floor access like this is rare this might be one of those once-in-a-cycle chances you don’t want to miss.

Steps To Secure Early Exposure To Pepeto

In speculative markets timing matters. Pepeto (PEPETO) sits at the intersection of buzz, utility, and access as its presale advances. Visit https://pepeto.io to participate early. With a zero-fee PepetoSwap exchange, cross-chain tools, and growing brand momentum, the project lines up with strong upside potential.

Secure your presale allocation before the next price stage. The momentum is real, and staying active in the community supports long-term positioning. Accepted payment methods include USDT, ETH, BNB, credit card, and wallet integrations via MetaMask or Trust Wallet.

About Pepeto Socials

For more information about Pepeto, users can visit the official website https://pepeto.io

X : https://x.com/Pepetocoin

Youtube channel : https://www.youtube.com/@Pepetocoin

Telegram channel : https://t.me/pepeto_channel

Instagram : https://www.instagram.com/pepetocoin/

Tiktok : https://www.tiktok.com/@pepetocoin?_t=8rCR2O27v5s&_r=1

Disclaimer:

The Pepeto presale is live. To participate, use the official website: https://pepeto.io. As the listing approaches, some unauthorized platforms may attempt to use the Pepeto name to mislead investors. Verification of sources is advised.

*This article was paid for. Cryptonomist did not write the article or test the platform.

You May Also Like

All Eyes On Solana: $15-B Stablecoin Supply, ETF Demand Drive Next Leg Up

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing