Cloudflare CEO Announces NET Dollar Stablecoin for AI Agent Micropayments

Cloudflare CEO Matthew Prince announced the launch of NET Dollar, a U.S. dollar-backed stablecoin designed for AI agent micropayments on Thursday.

The connectivity cloud company plans to deploy NET Dollar as the payment backbone for autonomous AI systems that book flights, order groceries, and manage calendars without human intervention.

“For decades, the business model of the Internet ran on ad platforms and bank transfers,” Prince stated, adding that “The Internet’s next business model will be powered by pay-per-use, fractional payments, and microtransactions.”

The stablecoin will leverage Cloudflare’s global network to process payments at internet speed, targeting fundamental limitations in current financial systems designed for human-initiated transactions.

AI Agents Drive New Payment Infrastructure Requirements

NET Dollar emerges as AI agents increasingly require payment systems capable of handling millions of automated transactions without human oversight.

Traditional payment rails, such as wire transfers and credit cards, cannot accommodate the instant settlements and micropayments that autonomous systems demand.

The company’s stablecoin will allow global payments across different currencies and time zones, facilitate instant programmatic transactions for time-sensitive purchases, and provide compensation for content creators and API developers.

Personal AI agents could automatically purchase the cheapest available flight tickets or buy items the moment they go on sale, while business agents might pay suppliers immediately upon delivery confirmation.

Cloudflare is simultaneously contributing to open standards, including the Agent Payments Protocol and x402, which simplify payment processing across the internet infrastructure.

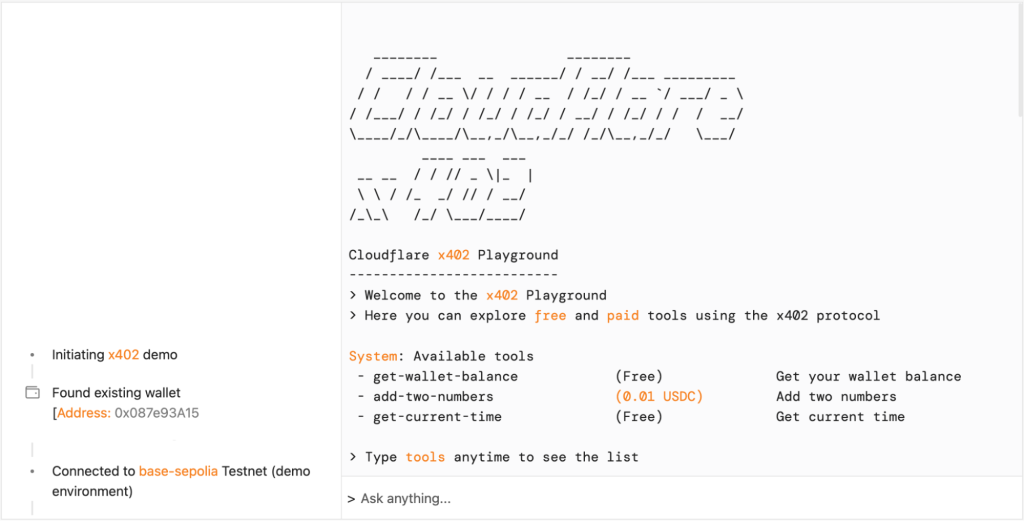

The x402 protocol, developed with Coinbase, converts the HTTP “402 Payment Required” error code into a functional payment system, allowing machines to purchase data and services directly.

Amazon Web Services is already exploring x402 integration for cloud computing payments, potentially transforming the $1.9 trillion cloud market expected by 2030.

x402 Playground / Source: Cloudflare

x402 Playground / Source: Cloudflare

Regulatory Framework Shapes Stablecoin Infrastructure Development

The NET Dollar announcement comes amid unprecedented regulatory clarity for stablecoins, with the U.S. GENIUS Act providing comprehensive federal guidelines that have reshaped industry strategy.

The U.S. Commodity Futures Trading Commission has launched an initiative allowing stablecoins to serve as tokenized collateral in derivatives markets, with CFTC acting chair Caroline Pham calling it the “killer app” for modernizing financial infrastructure.

European markets are simultaneously positioning themselves for competition, with nine major euro banks backing a MiCA-regulated stablecoin set to launch in the second half of 2026, seeking to challenge U.S. dollar dominance.

Meanwhile, the regulatory momentum has allowed tech giants to embrace stablecoin integration, with Google adding stablecoin support to its new AI payment framework through partnerships with Coinbase and the Ethereum Foundation.

Google’s James Tromans called stablecoins “probably one of the most important payment upgrades since the SWIFT network,” with a network effect that has triggered a growing consensus among tech giants regarding the role of programmable money in autonomous systems.

Within the same interval, the broader stablecoin market has expanded from $4 billion in 2020 to over $280 billion today, with bots already accounting for 70% of stablecoin transfer volume, according to industry data.

In fact, recent industry projections from Citigroup have shown that the stablecoin sector could reach over $2 trillion in market capitalization by 2030.

Major stablecoin issuers now rank 17th globally in U.S. Treasury holdings, surpassing countries such as South Korea and Germany in their influence on government debt markets.

Additionally, Cloudflare is not the first to implement an AI-powered payment system. Circle co-founder Sean Neville recently launched Catena Labs with $18 million in funding to create the first fully regulated AI-native financial institution, positioning stablecoins as essential infrastructure for autonomous economic activity.

While stablecoins are growing and being adopted across various verticals, banking industry groups are pushing back against the growth, warning that regulatory gaps could trigger $6.6 trillion in deposit outflows from traditional banks.

However, Coinbase research suggests that most stablecoin activity occurs internationally, does not pose a threat to banks, and could instead strengthen dollar dominance without materially impacting domestic banking deposits.

You May Also Like

Avalanche Jumps 10% While Market Sinks—MAGAX Presale Targets 1,350% Upside

HYPE Price Prediction: ASTER vs HYPE Battle Heats Up as Analysts Call HYPE “Golden Buy” at $42 – Who Wins?