ETH Price Prediction: Cardano Holders Snap Up Remittix Presale Tokens After Altcoin Goes Viral

The post ETH Price Prediction: Cardano Holders Snap Up Remittix Presale Tokens After Altcoin Goes Viral appeared first on Coinpedia Fintech News

A surprising trend has continued to emerge, with market watchers reporting large liquidations and capital rotation. Market watchers have revealed that Cardano and Ethereum investors are diversifying into an emerging Payfi solution, Remittix (RTX) which is gaining global attention and market watchers name it the next 1000x for 2026. Let’s talk about why they are convinced.

What the ETH Price Chart is Saying

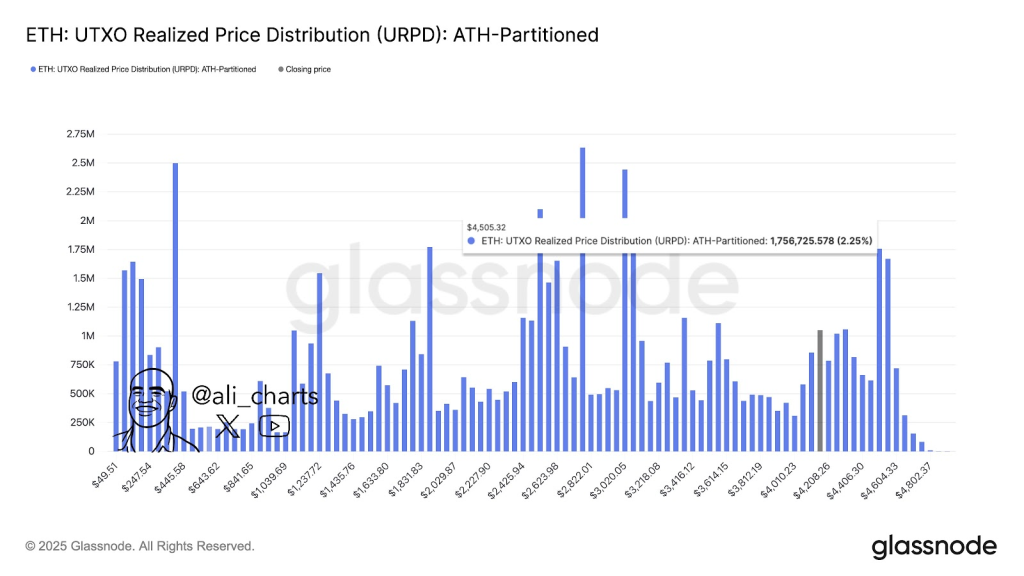

ETH Price is currently trading at $4,495, and according to our analysis, it is expected to reach $6,000 by 2026. According to Ali Martinez, ETH price needs to stay above $4,433 to potentially move towards the first significant resistance level at $4,505. Breaking above $4,636 could see ETH rise to the next resistance level at $4,784.

Source: Ali_chart via X.

If ETH price drops, the first support level to watch is $4,433. If this level does not hold, a further decline to the next support level at $4,276 is possible.

ETH Price peaking at $6,000 from the current level is less than 2x returns on investment, which has left investors unsatisfied. Rather than settle for less, they are diversifying into projects with massive potential.

Cardano’s Waning Position In The Market

Cardano has continued to build its ecosystem as the go-to blockchain for decentralised applications, governance systems, and identity solutions. If Cardano ecosystem expansion continues, increased decentralised finance (DeFi) adoption and a rise in institutional interest could lead to a surge in ADA’s price. Also, the delayed implementation has continued to slow down the ecosystem and raise doubts among investors.

Why Remittix Presale Is Going Viral

Remittix facilitates instant crypto-to-fiat transfers in over 30 countries and supports more than 40 cryptocurrencies. Users can send their cryptocurrency with a real-time FX rate, stake on the platform, and have zero transaction fees or charges

Remittix empowers crypto holders and businesses to facilitate crypto-to-fiat transactions worldwide, leveraging local payment networks and blockchain technology. It features deflationary tokenomics, with only 750 million RTX (50% of the total supply) available during the presale. Priced at $0.011, RTX has raised over $27 million in presale, with 674 million tokens bought.

Presale Highlights:

- The smart contract is fully CertiK audited, and liquidity and team tokens are locked for a period of 3 years.

- Remittix’s usefulness extends beyond cryptocurrency; it’s ideal for freelancers, international business owners, and those involved in remittances.

- Beta testing for the Remittix wallet is now live, with community users actively testing it.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

You May Also Like

Here’s Why Mantle (MNT) Price Is Pumping Today

Cashing In On University Patents Means Giving Up On Our Innovation Future