Ethereum Price Holds Range Yet Whispers Grow About A Parallel Asset Set To Outperform In 2025

The Ethereum price may be holding steady at support, but the real buzz on the street is that Rollblock could explode as the breakout star of 2025.

ETH is building long-term infrastructure, while Rollblock is catching on fast among everyday retail traders and gamers. For investors, the choice feels like standing at the fork between blue-chip stocks and the next Amazon – safe versus explosive, steady versus a potential 50x.

Rollblock (RBLK): Retail And Gamers Fuel The Hype

Rollblock (RBLK) is quickly becoming the talk of retail investors.

It has already raised over $11.7 million in presale funds, with more than 85% of tokens sold at the low price of $0.068, and the end date for this sale is now just 13 days away. Momentum is everywhere, from gamers logging into its platform to crypto fans eager for a piece of a live GambleFi ecosystem.

This is not just another cryptocurrency launch. Rollblock is a working Web3 platform packed with many thousands of AI-powered games, live poker, blackjack, and a popular sports prediction league.

Fiat payments through Apple Pay, Google Pay, Visa, and Mastercard make onboarding simple, while mobile adoption is set to drive the next wave of users.

- Over $15 million in bets already placed

- Staking rewards up to 30% APY

- 30% of revenue used for buybacks, 60% of those tokens permanently burned

- Licensed under Anjouan Gaming and fully audited for transparency

- Presale bonus of 20% still live for a short time

Tokenomics: Deflationary Power In Action

Rollblock’s token design has been built to ensure longevity. It has a hard cap of one billion tokens that cannot be inflated. 30% of platform revenue is used to buy back RBLK, with 60% of the tokens burned to shrink the supply and 40% fueling industry-leading staking rewards up to 30% APY.

With scarcity locked in, plus presale tokens moving fast, Rollblock stands out as one of the best crypto presale options of the year.

The tweet about its first-ever tutorial shows how the team is onboarding new users with simple guides, ensuring retail and gamers feel comfortable diving in.

Ethereum (ETH): Holding The Line

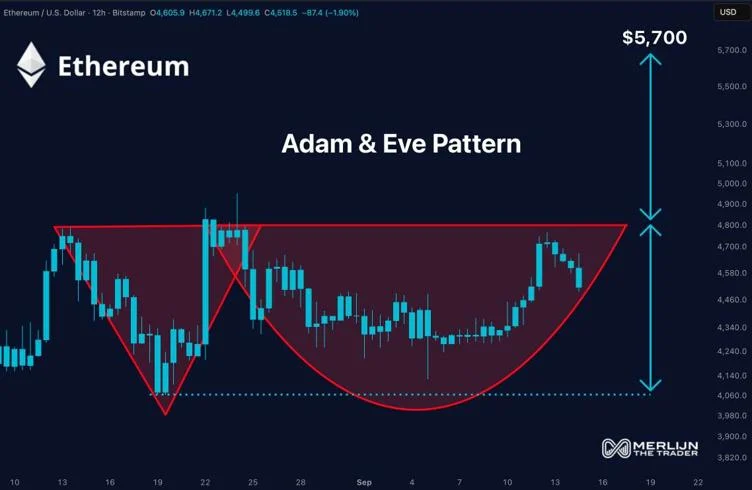

Ethereum is trading at $4,508.19 today. ETH has been steady, but technical analysts are spotting potential upside from here. As @EtherGuru08 wrote, “The ETH Adam & Ev

Beyond the charts, Ethereum unveiled a sweeping privacy roadmap, rebranding its PSE program to “Privacy Stewards of Ethereum.” The plan introduces private writes, private reads, and private proving, ensuring that user data remains safe while expanding Ethereum’s utility in finance and governance.

With 36 million ETH staked and exchange reserves at record lows, institutional confidence is building. This stability, coupled with ambitious upgrades, could anchor Ethereum’s role as one of the top cryptocurrencies in the market.

Quick Comparison

| Token | Price | Market Cap | Total Supply | Revenue Share | Upside Potential |

| Rollblock | $0.068 | Low (Presale) | 1B capped | 30% buybacks + burns | 50x possible |

| Ethereum | $4,508 | $544B | Unlimited | None | 25% upside |

RBLK: A Fork In The Road

Both Ethereum and Rollblock tell compelling stories at this time, but they appeal to different types of investors. Ethereum is building long-term infrastructure, while Rollblock captures attention as the next big crypto with immediate FOMO-driven growth.

Rollblock looks like the best crypto to invest in right now, thanks to its deflationary design, presale buzz, and user adoption. In a market full of choices, Rollblock could be the hand that pays out bigger than anyone expects.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

This article is not intended as financial advice. Educational purposes only.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

UK Looks to US to Adopt More Crypto-Friendly Approach