Financing Weekly Report | 11 public financing events; Chronicle, an oracle service on the Ethereum chain, completed a $12 million seed round of financing, led by Strobe

Highlights of this issue

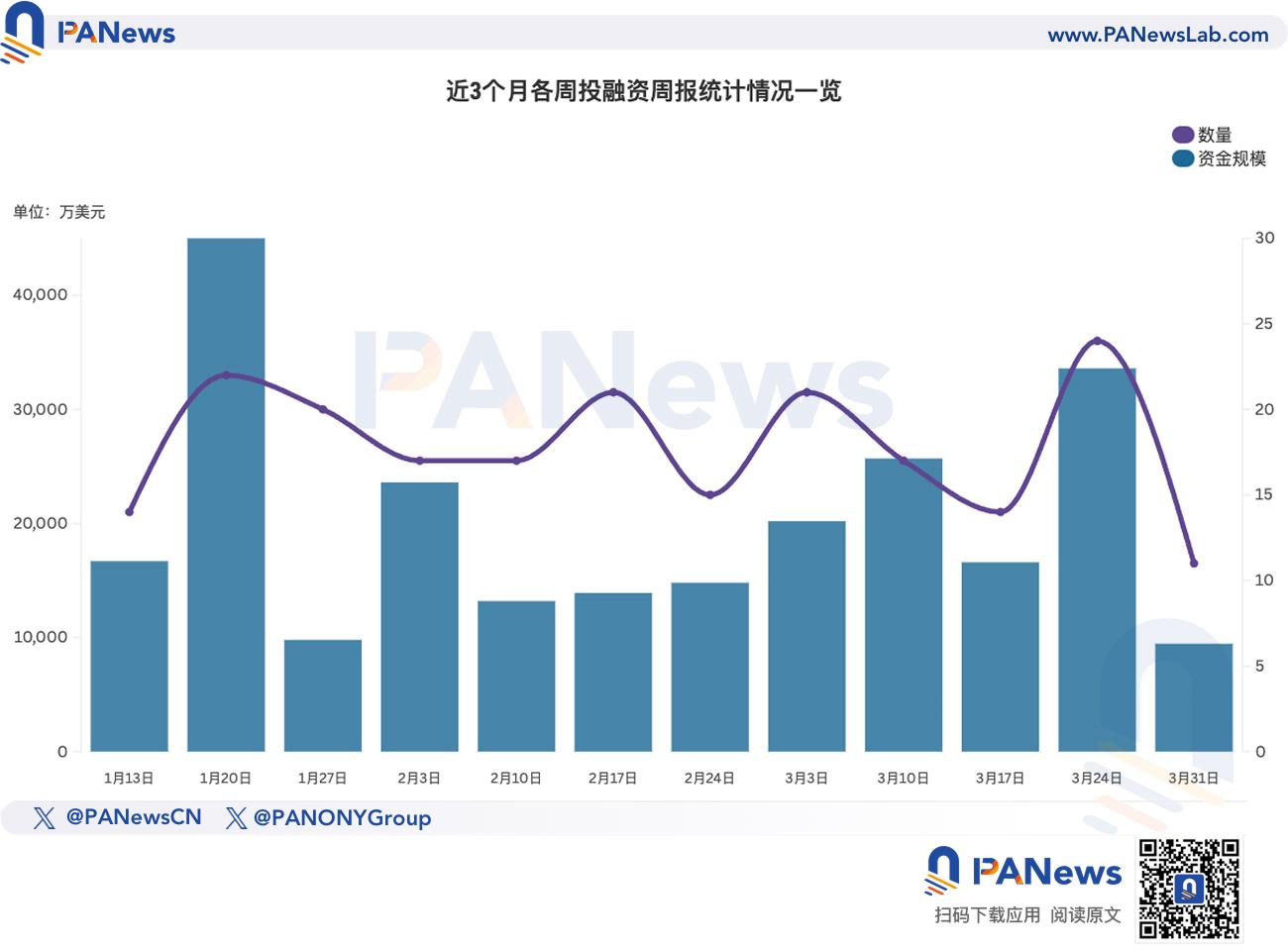

According to incomplete statistics from PANews, there were 11 investment and financing events in the global blockchain last week (3.24-3.30), with a total funding scale of approximately US$94.5 million, a significant decrease compared to the previous week. An overview is as follows:

- DeFi announced two investment and financing events, among which the on-chain order processing company Warlock Labs completed $8 million in financing, led by Polychain Capital;

- The Web3 game track announced two investment and financing events, among which Planetarium Labs, the developer of the blockchain game Immortal Rising 2, completed a $3 million financing;

- Web3+AI announced one investment and financing event. AI proxy public chain Hibit completed a $5 million financing, with Waterdrop Capital and others participating in the investment.

- The Infrastructure & Tools sector announced two investment and financing events, among which the Ethereum on-chain oracle service Chronicle completed a $12 million seed round of financing, led by Strobe;

- Other categories announced one investment and financing event. Memecoin incubation platform Coresky completed a $15 million Series A financing, led by Tido Capital.

- The centralized financial sector announced two investment and financing events. Among them, Rain, a debit card issuer that allows stablecoin settlement, completed a $24.5 million financing, led by Norwest Venture Partners.

DeFi

On-chain order processing company Warlock Labs completes $8 million financing, led by Polychain Capital

On-chain order processing company Warlock Labs has completed $8 million in financing. Polychain Capital led the investment, with participation from Greenfield Capital, Reciprocal ventures, Symbolic Capital, Ambush Capital and TRGC. The company aims to prove that the submitted order flow has not been tampered with to ensure fair trading.

Solana Ecosystem Restaking Protocol Fragmetric Completes $5 Million Financing, Led by RockawayX

Solana Ecosystem Re-Pledge Agreement Fragmetric Completes $5 Million in Financing, Led by RockawayX, with Participants from Robot Ventures, Amber Group, Hypersphere, and BitGo. Currently, Fragmetric has received a total of $12 million in financing. According to previous news , Solana Re-Pledge Agreement Fragmetric Completed $7 Million in Seed Round Financing, Led by Finality Capital Partners and Hashed.

Web3 Games

Animation IP ecosystem Tarta Labs completes $4.5 million in financing, with HashKey Capital and others participating

Anime IP ecosystem Tarta Labs announced the completion of a $4.5 million financing round, with participation from BITKRAFT Ventures, The Spartan Group, Infinity Ventures Crypto, HashKey Capital, and Gam3Girl Ventures. It is reported that Tarta Labs' first game Spot Zero will enter CBT1 (Closed Beta 1) in April this year.

Blockchain game Immortal Rising 2 developer Planetarium Labs completes $3 million in financing

Planetarium Labs' dark fantasy blockchain game "Immortal Rising 2" successfully completed a $3 million financing led by Solarium Labs before TGE (March 27) and successfully completed the NFT sales. Investors in this round of financing also include Spartan Group, Immutable, MARBLEX, Comma3 Ventures, Sovrun, 32-Bit Ventures, Notch Ventures, Cristian Manea, Niels de Ruiter and other Web3 institutions and angel investors. The new funds will be used to expand the ecosystem and enhance gameplay. Planetarium Labs is a community-driven Web3 game company that previously completed a $32 million Series A financing led by Animoca Brands .

AI

AI proxy public chain Hibit completes $5 million financing, with Waterdrop Capital and others participating

AI agent public chain Hibit announced the completion of US$5 million in financing, with participation from Bochsler Finance, Nvdia, Distributed Shenbo, Waterdrop Capital, Web3 Venture, Betterverse DAO, Hitters and many traditional entrepreneurs. This round of funds will be used to promote the ecological construction of Layer2 infrastructure, Hibit DEX, full-chain interoperability technology and AI Agent economy. Hibit is an independent Layer2, which has covered multiple public chains such as TON, Kaspa, Solana, ETH, BTC, BNB, ICP, etc., focusing on secure cross-chain solutions for non-cross-chain bridges. Its core product Hibit DEX supports millions of TPS, permissionless listing, and integrates CEX and DEX features to serve AI agent and Meme community scenarios.

DePIN

DeCharge, a decentralized charging project based on Solana, completes $2.5 million in seed round financing

DeCharge, a decentralized charging project based on Solana, announced the completion of a $2.5 million seed round of financing, led by Lemniscap, with participation from Colosseum, Daedalus, Escape Velocity, and Levitate Labs. According to reports, DeCharge is a community-driven electric vehicle charging network built on Solana. It achieves decentralized ownership and monetization of electric vehicle charging through modular charging stations, allowing anyone to host and operate charging infrastructure.

Infrastructure & Tools

Chronicle, an Ethereum-based oracle service, raises $12 million in seed funding led by Strobe

Chronicle, an oracle service on the Ethereum chain, has completed a $12 million seed round of financing, led by Strobe (formerly Blocktower Venture Capital), with participation from Brevan Howard, 6th Man Ventures and others. The new funds are intended to support its service provision for data infrastructure for tokenized assets.

Arcium, a parallel privacy computing network, completes $1 million in angel round financing

Arcium (formerly Elusiv), a parallelized privacy computing project, announced the completion of a $1 million angel round of financing, with investors including Jordi Alexander, Joe McCann, WereMeow, Fedor Holz and RunnerXBT. Arcium said that this round of financing brings its total financing to $11 million. According to reports, Arcium is a decentralized confidential computing network that uses a distributed architecture and multi-party computing (MPC) to ensure data integrity and confidentiality by processing encrypted data across multiple nodes without exposing the complete data set.

other

Meme:

Memecoin incubation platform Coresky completes $15 million Series A financing, led by Tido Capital

Memecoin incubation platform Coresky announced the completion of a $15 million Series A financing round, led by Tido Capital, with participation from WAGMI Ventures, CoPilot Ventures, Web3 Vision Fund and Parallel Ventures, bringing the total financing amount to $21 million. The Coresky platform promotes the community to fairly launch the memecoin project through user voting.

Centralized Finance

Rain, a debit card issuer that allows stablecoin settlement, completes $24.5 million financing, led by Norwest Venture Partners

Rain, a company that issues debit and credit cards, has raised $24.5 million in funding, led by Norwest Venture Partners, with participation from Galaxy Ventures, Goldcrest, Thayer and Hard Yaka. Rain's valuation in this round of financing has not been disclosed. Rain is a company that issues debit and credit cards that allow customers to settle payments using stablecoins. Rain will use the funds raised in this round to expand its team, develop new technologies and apply for additional regulatory licenses.

Remittance app Abound completes $14 million financing, led by NEAR Foundation

Abound, the remittance app spun out of Times Internet in 2023, has raised $14 million in its first external funding round. The seed round was all equity-funded and was led by NEAR Foundation, with participation from Circle Ventures, Times Internet, and other investors. The company plans to use the new funds to expand its business scope, increase its product offerings, and improve its technology infrastructure. Originally called Times Club, Abound allows users to send remittances to India, earn rewards, and get cash back on services such as live sports, grocery shopping, and OTT subscriptions. The company plans to explore ways to give users access to high-yield savings, India-centric investments, and cross-border credit solutions. Abound currently has 40 employees, primarily based in India. The company plans to expand its headcount and build a management team in the United States.

Venture Capital

Crypto VC Maven 11 Completes Third Fund Raising with $107 Million

European crypto venture capital firm Maven 11 has closed its third fund at $107 million, slightly above its initial $100 million target, and about nine months later than initially expected. The fund is backed by Theta Capital Management and new institutional backers in Europe and Asia, with Maven 11 not naming all LPs, but noting that London-based investment firm Karatage is one of the participants. The size of the third fund is still smaller than Maven 11's second fund, which closed at $120 million in May 2023.

Balder Bomans, CIO and managing partner of Maven 11, said that the fund has supported several startups in the past year, including decentralized trading platform GTE, on-chain competition platform JokeRace, on-chain major brokerage August and Ethereum expansion startup Spire Labs, and has deployed about 15% of the funds, with the remaining funds planned to be deployed in the next 3-4 years. The third fund will support equity and token rounds ranging from $500,000 to $5 million. Its investment focus covers emerging areas such as consumer applications, infrastructure, and the intersection of artificial intelligence and cryptocurrency.

French state-owned bank Bpifrance sets up €25 million fund to invest in cryptocurrencies

French state-owned investment bank Bpifrance plans to invest up to 25 million euros (about 26.95 million U.S. dollars) to purchase niche cryptocurrencies to support French cryptocurrency projects. This is the first time that Bpifrance has set up a fund to directly purchase cryptocurrencies. Previously, the bank has invested 150 million euros in blockchain projects, but only involved a "small amount" of cryptocurrency investment.

You May Also Like

Here’s What Next For Ethereum