Floki Or Pepeto, Which Is The Best Crypto To Buy Now Before The Next Bull Run, And Why A 100x Shot Is On The Table

The trick is not luck, it is catching the right setup at the right moment before the crowd. That is the goal here, pinpoint the next window.

First we will put Floki (FLOKI) under the light, in Q4 2025 it reads less like a meme and more like a toolkit, and we will test if it still belongs among the best crypto to buy now for any Altcoin hunter. Then we will move to a newer name on shortlists, Pepeto (PEPETO). It sits earlier on the curve with real tools and a roadmap, and big wallets are watching. By the end, you will see what fits your goal, steady brand with products or early stage upside with room to run, and where the next shot at outsized returns might sit.

Pepeto, Real Tools For An Ethereum Based Meme Coin With High Growth Potential

As we said, the decision that changes everything in crypto is getting in early. The biggest runs start before the crowd shows up, often in presales. That is what brings us to Pepeto (PEPETO) today, a memecoin with culture up front and real tools under the hood, and a team aiming for much more than a hype token. The token is currently priced at $0,000000156, and the project already raised more than $6,8M so far. The team want to be remembered in this market, building something useful and lasting that makes a real impact. That alone tells you where this project is heading.

Pepeto lives on Ethereum mainnet, close to deep liquidity and active builders. It is not blindly copying other projects, it is learning from them. What worked, energy and speed, stays, and what did not, hype that fades, gets fixed with Technology and Optimization you can actually use. The team is rolling out PepetoSwap, zero platform fee, and a cross chain Pepeto Bridge to solve real trader problems, faster routing, lower slippage, simpler liquidity, smooth cross chain moves.

Lesson learned, utility first, so attention sticks after launch and culture turns into daily volume. The vision is big, a hub for all memecoins, and the market is already responding, 850+ projects have applied to list before launch. Because every swap touches the PEPETO token, real activity can convert into steady demand over time.

Think of it as a memecoin engine with rails, culture lights the spark, tools keep it rolling. In short, this looks like the complete formula, Power, Energy, Precision, Efficiency, Technology, Optimization, culture plus product plus distribution in one place.

That is why a 100× in the next cycle is on the table, at today’s stage, a $5,000 stake would map to roughly $500,000 if those targets land. It is the kind of upside small investors still chase, as many still regret missing on coins like SHIB/DOGE, and exactly the asymmetry big investors want when they diversify into a high potential, real utility meme play, life changing chances that rarely come twice.

Floki In Q4 2025, What It Is, How It Works, And Is It One Of The Best Crypto To Buy Now

Floki started as a meme, but in Q4 2025 it reads like a toolkit, Valhalla is live on mainnet with a playable build, FlokiFi Locker secures LP tokens and NFTs, staking pays with burn on exit penalties, and TokenFi ties the brand into new launches. Think of FLOKI as a Swiss army knife, play in Valhalla, lock liquidity, stake to earn, plug into launches, while the meme energy keeps users engaged. The near term roadmap ships to where users already are, a Valhalla mobile app and more beyond a coin tools.

The numbers explain the hype, from an all time low near $0.0000000428 (Jul ’21) to ~$0.0003449 (Jun 5 ’24) was ~8,000x, turning $1,000 into ~$8,000,000. Today, around ~$0.00010 and ~$1B market cap, even a full return to the ATH is 3 to 4x, strong, but no longer life changing. That is why hunters of outsized gains are scanning earlier in the curve, presales, where the ceiling is still wide open.

Sources: Floki.com • Valhalla (play) • FlokiFi Locker

Conclusion, Floki Versus Pepeto, Where The Bigger Upside Likely Sits

Floki is proven, deep liquidity, real products, a brand that still moves crowds. It is a solid core hold for Q4 2025. Because it is established, the 50 to 100x window is mostly gone. Meanwhile Pepeto tells a different story.

Based on its story, the value it brings, and a visionary team, this looks ready to start a new era of memecoins, treated as assets, not coins you gamble on. That is rare, and it is why many investors see this as the chance you should not miss. If you are reading this now, you are still early, and skipping this presale could be the costliest decision you make this cycle, especially if you were lucky enough to hear about it at this stage. The window is open today, it will not stay open forever.

To buy PEPETO, make sure to use the official website, https://pepeto.io/ As the listing draws closer, some are attempting to capitalize on the hype by using the name to mislead investors with fake platforms. Stay cautious and verify the source.

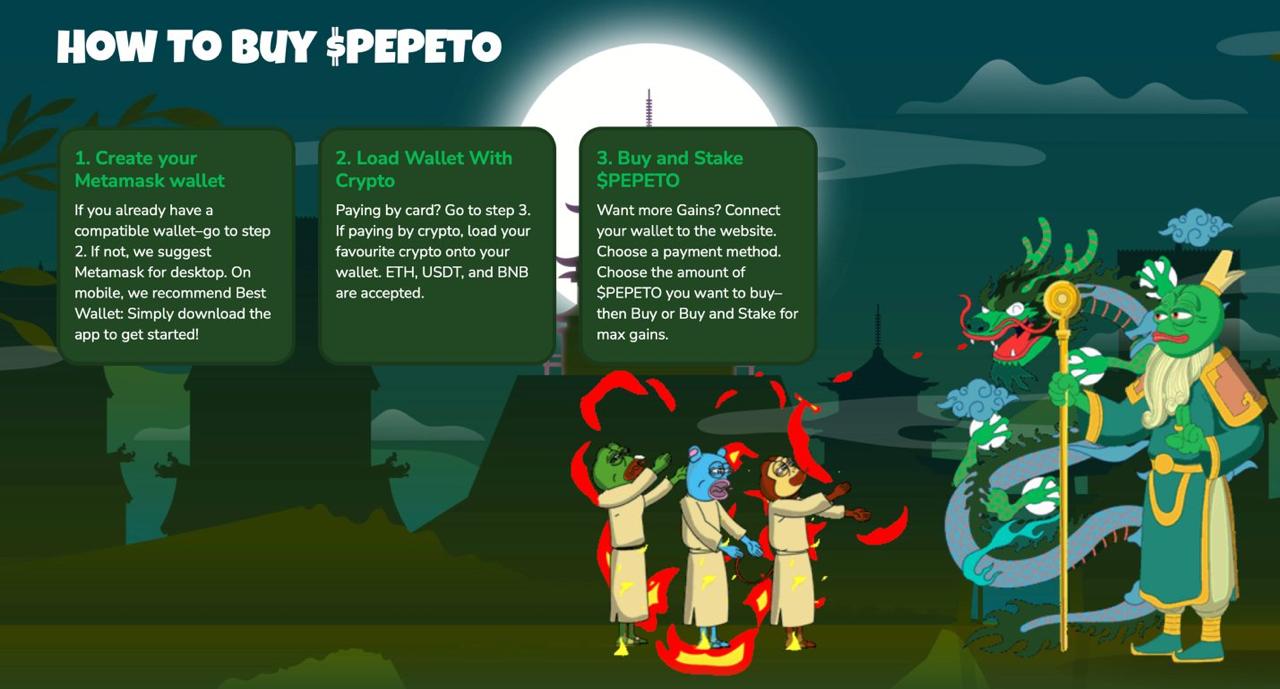

How To Act Now And Buy Pepeto:

To learn more about PEPETO, visit its Telegram, Instagram, and Twitter.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Floki Or Pepeto, Which Is The Best Crypto To Buy Now Before The Next Bull Run, And Why A 100x Shot Is On The Table appeared first on Coindoo.

You May Also Like

South Korea’s $657 Million Exit from Tesla Signals a Big Crypto Pivot

CME to launch Solana and XRP futures options on October 13, 2025