Grok’s $ADA ‘Uptober’ Prediction: Is $1 In Sight, As $SNORT Becomes the Best Crypto to Buy Now?

One of the busiest ants around was Cardano ($ADA), which has gone up by 5.4% in the last day (alongside an 18% increase in the daily trading volume). In fact, $ADA is green on the daily, weekly, and monthly charts, something uncommon after the recent September dump.

So, we wanted an impartial view about Cardano and its performance this month, so we turned to Grok to see what the AI had in mind.

Grok sees Cardano flirting with the $1 mark, but it also sees potential in Snorter Token ($SNORT) as the best crypto to buy now, if you don’t want to miss out on a real firecracker.

Cardano’s Chill Vibes Right Now

Cardano’s known as the smart, eco-friendly blockchain that’s all about doing things right, not rushed. As of today, $ADA’s hanging around the $0.83 zone, give or take a few cents, after a slight dip yesterday.

It’s been consolidating in the cozy support zone, like it’s catching its breath after a long hike.

The networks’ humming with Voltaire upgrades, making governance smoother than ever, and devs are flocking to DeFi builds in places like Africa. Its fundamentals are as solid as your grandma’s fruitcake.

Chasing the $1 Dream: Is It Real This Time?

So, the big question: does Grok see $ADA finally crack $1 this Uptober? Short answer: yes, it’s a real possibility.

Grok pointed us in the direction of some X analysts, who emphasized that $ADA closed September at $0.9278, shrugging off a tiny 5% dip, which is only a 0.8% loss, while the rest of the market experienced a 1.5% loss. It’s showing resilience.

Many things are fueling Cardano’s fire, but with a Grayscale ETF promised and whales accumulating 200M $ADA, it’s straight-up adoption magic that’s bound to manifest in green chart action.

On the charts, it’s lining up like a pro: the double bottom between $0.85 – $0.90 is eyeing a neckline smash at $0.95, which could launch it to $1.05. The 50-day moving average is $0.88, giving $ADA a solid floor.

Sentiment’s buzzing too, with the Fear and Greed at 52, a sweet, mild greed spot, and $ADA’s history showing green in six out of eight Octobers, the vibes all good.

Cardano Pullback Alarm – Watch Out for These Signs

However, it’s not all sunshine and rainbows; other analysts are sounding the alarms on potential pullbacks. Some have cited a double top that’s already snapped the neckline at $0.85, projecting a slide to $0.7682 or even lower if selling heats up.

So if you’re concerned about $ADA, you could look at Snorter Token ($SNORT), the token designed to give you a trading edge in an increasingly volatile market.

Enter $SNORT: The Meme Coin with Deadly Accuracy and Big Backing

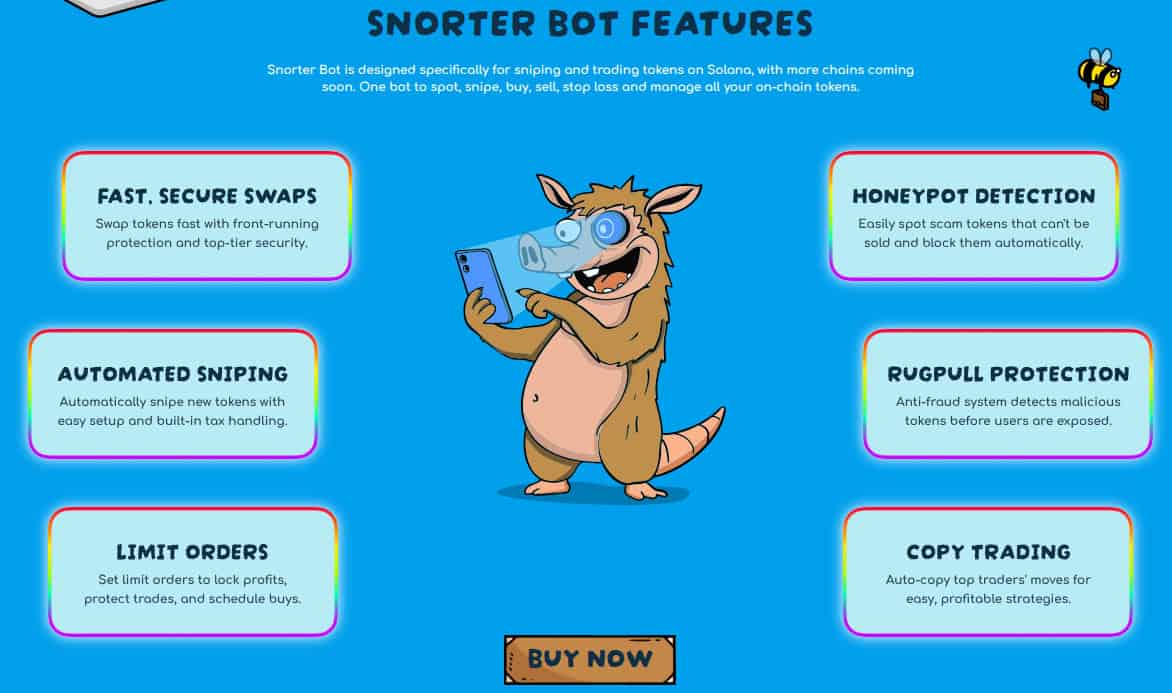

Meet Snorter Token ($SNORT), the aardvark-mascot token that’s more than just cute memes. It’s the fuel for Snorter Bot, a Telegram wizard on Solana and Ethereum, that snipes new launches across chains like Ethereum and BNB before you can say FOMO.

Its presale is already on fire, raising over $4.1M, and right now, you can grab a healthy 113% staking rewards. Whales have been getting in on the action too, with big ticket purchases of $107.1K, $91.1K, and $59K, showing big investors see the value of $SNORT.

However, you’ll have to hurry as the presale ends on October 20th, so don’t miss your last chance to buy to get the biggest returns.

$SNORT’s Bevy of Benefits

Sniping’s not all $SNORT can offer, though. You get reduced trading fees at just 0.85%, compared to the standard 1.5%, so every swap feels lighter on your wallet.

Holders can also unlock premium features like copy trading, for mirroring whale moves, plus voting rights on upgrades, giving you real skin in the bot’s evolution. It’s a community-fueled utility that rewards loyalty, not just hype.

$SNORT also has security in mind, with honeypot detection and rug pull protection, meaning you can trade with peace of mind.

Don’t miss your chance to get in on the action and grab your $SNORT now for $0.1065. Our Snorter Token price prediction sees an end-of-2025 high of $1.07, meaning you’d see a potential return of 905% if you invested today.

You May Also Like

Here’s Why Mantle (MNT) Price Is Pumping Today

Cashing In On University Patents Means Giving Up On Our Innovation Future