James Wynn: From the slums to a crypto giant, a crazy $1.2 billion gamble

Author: Frank, PANews

Recently, the former PEPE boss has transformed into a contract giant, and has frequently opened contracts worth hundreds of millions of dollars on Hyperliquid, which has attracted the attention of the market. As one of the few giant whales who has publicly disclosed his identity on Hyperliquid and is active in the community, James Wynn's daily position changes have become a hot topic for many investors.

What is James Wynn's background, and how does he affect the entire market with his remarks and positions?

The "10U God of War" who started with PEPE

According to James Wynn's Twitter account, he was born in a "forgotten town" in the UK, which was full of crime, drugs, alcohol and poverty. James Wynn said that he lived in dire straits since he was a child and "barely made ends meet every week."

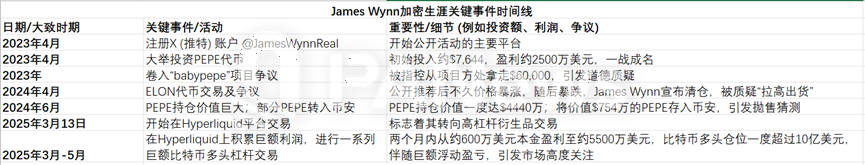

In 2022, after being exposed to cryptocurrency, James Wynn became a member of the 10 U Warriors. He often wandered between several ultra-small-cap MEMEs until he later discovered PEPE on iToken. Subsequently, James Wynn chose to buy PEPE heavily and made tens of millions of dollars. Previously, PANews also verified this from the chain in another report on James Wynn. (Related reading: Legendary Meme coin hunter James: Earned $25 million with $7,000, but now the shouting effect has failed )

Judging from the information on social media, James Wynn started to join Twitter in 2023, and almost all of his initial content focused on the promotion and publicity of PEPE coins. In April 2023, James Wynn predicted that the market value of PEPE tokens would rise to 4.2 billion US dollars. The market value at that time was 4.2 million US dollars. A year later, this prediction not only came true, but even exceeded his expectations at the time. In October 2024, the market value of PEPE exceeded 10 billion US dollars, becoming one of the MEME coins with the highest market value.

Of course, in this process, as one of the largest holders of PEPE coins, James Wynn also made huge profits. According to previous statistics from PANews, James Wynn's principal in PEPE transactions was only US$7,600, and his profits exceeded US$25 million by April 2024. Considering that PEPE later rose by about 3 times again, James Wynn's overall profits may exceed US$50 million.

Harvesting fans and transforming after reputation is damaged

By 2024, with the successful creation of PEPE's personality, James Wynn's posts began to involve more MEME coins (such as BIAO, ANDY, WOLF), and he often released CAs of some new tokens to shout orders. In April 2024, James Wynn recommended a token called ELON, and in the following days, he made crazy orders like he recommended PEPE. At the same time, James Wynn also quietly laid out this token using several wallets. Under the highly appealing recommendation, many community players began to follow up and buy ELON. When the token rose a hundred times, James Wynn claimed that there was a problem with the token and said that he had cleared the token. This wave of operations caused the price of ELON to fall by 70% in a short period of time, and many players were buried in James Wynn's liquidation landslide. Such operations also seriously damaged James Wynn's reputation in the community, and people began to realize that MEME gods are not reliable.

Subsequently, James Wynn's content gradually began to change, from a community promoter to an investor and analyst. In the second half of 2024, he began to gradually turn to Bitcoin trends and market analysis. He also changed his Twitter name from "James Wynn (The GOAT)" to the current "James Wynn Whale".

A high-leverage gamble worth $1.2 billion

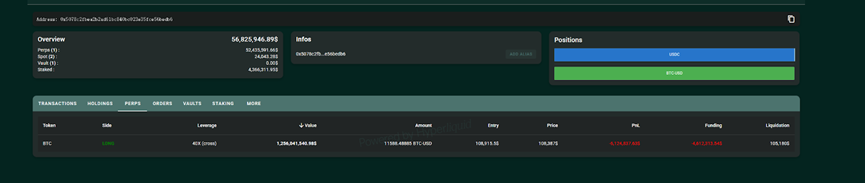

In March 2025, James Wynn officially began to switch to Hyperliquid and deposited approximately US$6 million for contract trading. In just two months, through high-leverage operations on Hyperliquid, as of May 24, James Wynn increased his profits to approximately US$48 million.

Especially in the past month, through frequent high-leverage and large-position investments, James Wynn not only frequently sent his operations to the hot lists on social media, but also used the profit of 36 million US dollars in a single month to once again prove his trading talent or luck.

His trading targets on Hyperliquid are surprisingly simple, mainly focusing on Bitcoin and a few meme coins such as PEPE, TRUMP and FARTCOIN. For example, on April 6, 2025, he went long on Bitcoin at an average price of $94,292 and 40x leverage; when the price of Bitcoin rose from $94,000 to $100,000, his floating profit reached $5 million. And his 10x leveraged long position in PEPE had a floating profit of up to $23 million. Trading in TRUMP and FARTCOIN tokens also contributed profits of approximately $5 million to $5.57 million and $4.3 million to $5.15 million, respectively.

As of May 24, James Wynn's total funds in Hyperliquid were approximately $55.8 million, compared to the opening position of $1.25 billion. His overall leverage ratio is about 22 times. Under such a leverage ratio, once the market volatility exceeds 5%, he may face full liquidation. Therefore, his trading style is a high-risk, high-return route and is not suitable for ordinary traders. Of course, considering that James Wynn had already earned tens of millions of dollars in principal on MEMEs such as PEPE, his position is also within his controllable risk range. On May 24, James Wynn closed his $1.2 billion position, with a loss of approximately $13.39 million. Due to the huge loss of this transaction, his overall income also fell back to around $40 million.

Looking back at James Wynn's crypto trading career, from being unknown to becoming the leader of MEME, and then transforming into a contract trading whale again. James Wynn's experience seems to best fit people's imagination of crypto wealth stories. And he himself seems unwilling to be a low-key person. Despite holding huge wealth, he is still active on social media. This exposure also brings him real benefits. During the MEME shouting period, he can use his influence to ensure that the MEME coins he invested in always have followers to carry the sedan chair. In the contract trading stage, as the market's attention increases, James Wynn's operations will also affect some traders' judgment of the market to a certain extent, and even form a copycat effect (but this effect may not be as obvious as during the MEME coin period).

In general, James Wynn's success seems to be a mixture of market timing, extraordinary courage (or extreme adventurism) and strong self-marketing ability. In the end, James Wynn's "history of success" may leave more questions than answers to the market. Is he a trading wizard with unique vision, or just a lucky guy who caught the trend of the times? Will he get rich or go bankrupt in the next stop?

All this is far from over. The crypto market has never lacked periodic "heroes", but becoming an "evergreen" still requires the test of time.

You May Also Like

a16z: The official X account was briefly hacked this morning and released false token information

Balancing Growth with Sustainability: Meet Mutuum Finance (MUTM)