Justin Sun confirms USDJ service discontinuation—deadline set for August 31

Justin Sun’s first JST-stablecoin on the TRX ecosystem, USDJ, will formally end its services at the end of August. Here’s what we know so far about the permanent wind-down.

- The first JST-stablecoin on the Justin Sun-backed TRX ecosystem is shutting down after five years.

- Holders are urged to exchange the asset with another stablecoin before the deadline on August 31, 2025.

In a recent post, the JUST DAO reminded holders to migrate their remaining USDJ as soon as possible as to avoid losses that could come about from potential liquidity shortages or market volatility risks. On August 31, 2025, the USDJ protocol will officially end its services after five years of operating on-chain.

“Please act promptly: close your positions or swap $USDJ for $USDD or other assets to avoid potential losses from liquidity shortage or market volatility,” wrote JUST DAO officials in the X post posted on August 6.

To ensure the safety of user assets, officials have reminded all USDJ holders, collateral debt position users, and JustLend DAO lending users to settle related positions as soon as possible. Holders of USDJ are encouraged to exchange USDJ for other stablecoins such as the other Tron (TRX) stablecoins such as USDD, or even USDT (USDT) and USDC (USDC).

According to the official announcement shared in early June, the JustLend DAO has already suspended the USDJ token supply and borrowing features since May this year. Meanwhile, the USDJ protocol has also reduced the minting cap on USDJ to just 10 million tokens.

Since early June, the JustLend DAO have started raising the USDJ reserve factor to 100%, which is said to end interest on payments for suppliers. At the same time, the collateral factor will be reduced to zero, fully erasing USDJ’s value as a collateral asset.

The Justin Sun-backed protocol has also begun delisting USDJ from major exchanges, as well as reducing its liquidity and limiting exit options. Therefore, holders are strongly encouraged to swap out their USDJ for another asset before the deadline rolls around.

Why is the USDJ protocol shutting down?

Based on prior announcements, the JUSTLend DAO decided to suspend USDJ to make way for other “DeFi and TRON-based stablecoins like USDD” to evolve. It cited a shift in “stablecoin functionality and efficiency” to be another reason why the protocol is ending its services.

“To align with industry trends and optimize resource allocation, we are initiating the USDJ Sunset Plan after deliberation for an orderly transition,” wrote the JustStable team.

USDD (USDD) is a decentralized stablecoin issued by Justin Sun’s TRON DAO Reserve on the TRON Ecosystem. It is designed to maintain a 1:1 peg with the U.S. dollar via a combination of collateralization and algorithmic mechanisms.

Users are able to swap USDD for TRX when the stablecoin trades below $1 or mind USDD by depositing TRX when price exceeds $1.

What is the state of Justin Sun’s USDJ on the market?

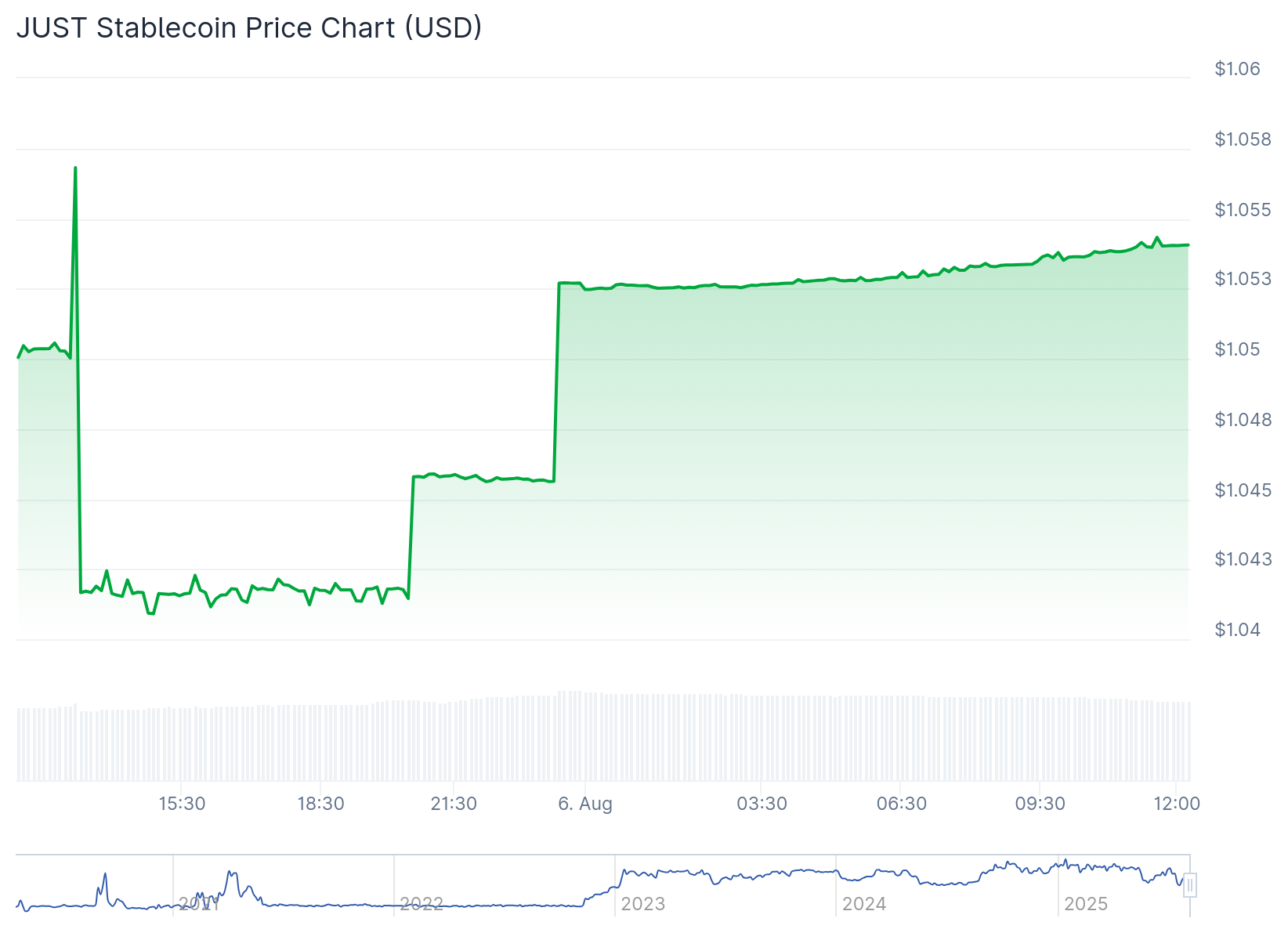

Despite news of the impending wind-down, the token’s price has actually risen slightly by 0.4% in the past 24 hours of trading. The price of the JUST Stablecoin or USDJ is currently at $1.05. However, its market cap value has plummeted to zero.

As per data from CoinGecko, the token is still being traded on the market. Most likely by traders swapping their assets before the deadline approached. In the past 24 hours, the trading volume for USDJ has reached $1.13 million. The total supply held by holders remains only at 108,393 tokens.

Moreover, it has a fully diluted valuation of $114,251 and a total value locked amounting to more than $47 million.

The origins of Justin Sun’s JST-collateralized stablecoin

Established back in 2020, USDJ is a stablecoin from the TRON ecosystem. It is primarily generated through decentralized smart contracts on the TRON network. According to the Djed white paper quoted in a previous report, anyone can pledge TRX as collateral to generate USDJ.

The token is pegged to the US dollar through Collateralized Debt Positions or CDPs, and also has autonomous feedback mechanisms.

In a post shared in January 2020, Justin Sun teased the launch of a “new decentralized stablecoin backed by $TRX & $BTT” which many construed as being the USDJ stablecoin.

You May Also Like

Japan’s Iron Lady Sanae Takaichi May Reshape Crypto Policy

Bitcoin mining company Cango mined about 616 bitcoins in September, bringing its total holdings to 5,810.