Perplexity offers publishers cut of revenue to cover content use in AI search

AI search startup Perplexity has announced its plan to share its revenue among publishers after accusations of ripping content. According to Chief Executive Officer Aravind Srinivas, the company has allocated $42.5 million in revenue with media outlets.

In the new program, publishers will earn when their content receives web traffic through Perplexity’s Comet internet browser, appears in search queries on Comet and when it’s used to complete tasks by Comet’s AI assistant.

Aravind Srinivas said, “AI is helping to create a better internet, but publishers still need to get paid […] So we think this is actually the right solution, and we’re happy to make adjustments along the way.”

Perplexity’s new standard for compensation

Publishers complain that AI Overviews have cut valuable web traffic to their sites. However, Jessica Chan, head of publisher partnerships at Perplexity, said in an interview that the traditional model where media outlets rely on web traffic and clicks is “an old model.”

Their solution is to create a new standard for compensation. The deal is to give publishers 80% of the revenue while Perplexity keeps the other 20%.

Srinivas said that the plan to create revenue is through Comet Plus, a new Comet browser subscription level similar to Apple Inc.’s Apple News+. Customers will pay $5 a month to get a hand-picked content selection from the publishers in Perplexity’s new program.

This positions Perplexity as the first AI startup to come up with a new way to share revenue depending on how often content is used. AI businesses like OpenAI and Google have made custom multimillion-dollar arrangements with big publishers to license and distribute material.

Chan said that Perplexity is in talks with several media partners. The startup has previously worked with companies including Time, the Los Angeles Times, and Fortune to share ad revenue.

Pending lawsuits with publishers

Some media companies, like Forbes and Condé Nast, have had problems with Perplexity, saying that the business used their content in AI news summaries without authorization. Last week, the AI startup lost a request to have a copyright infringement case brought by News Corp.’s Dow Jones and the New York Post thrown out.

However, the company says it is confident that AI companies will win all the lawsuits. Perplexity spokesperson Jesse Dwyer said in a statement. “We look forward to settling the law on this early on, so that everyone can benefit from AI.” The 80% deal is one way of helping the company make amends.

In addition, Cloudflare, a business that works in cybersecurity, also said that Perplexity was crawling and collecting data from websites by getting over restrictions that were meant to protect against this activity.

However, the company claims that its AI assistant isn’t crawling the web; instead, it only goes to specific websites when a user asks. Because of this, it shouldn’t have to follow the same regulations.

Srinivas added, “That’s different from a web crawler,” which downloads information and uses it to build a new AI model.

Meanwhile, the AI firm is determined to become as big as Google. Previously, as reported by Cryptopolitan, it made a $34.5 billion offer to acquire Google’s Chrome browser, as the search giant faces a potential requirement to sell the web tool in US antitrust proceedings. While some critics dismissed the bid as unserious, Srinivas said that Perplexity has well-funded people who want to back them.

KEY Difference Wire: the secret tool crypto projects use to get guaranteed media coverage

You May Also Like

Rinse, Rug, Repeat: Deconstructing the Modern Memecoin Playboo

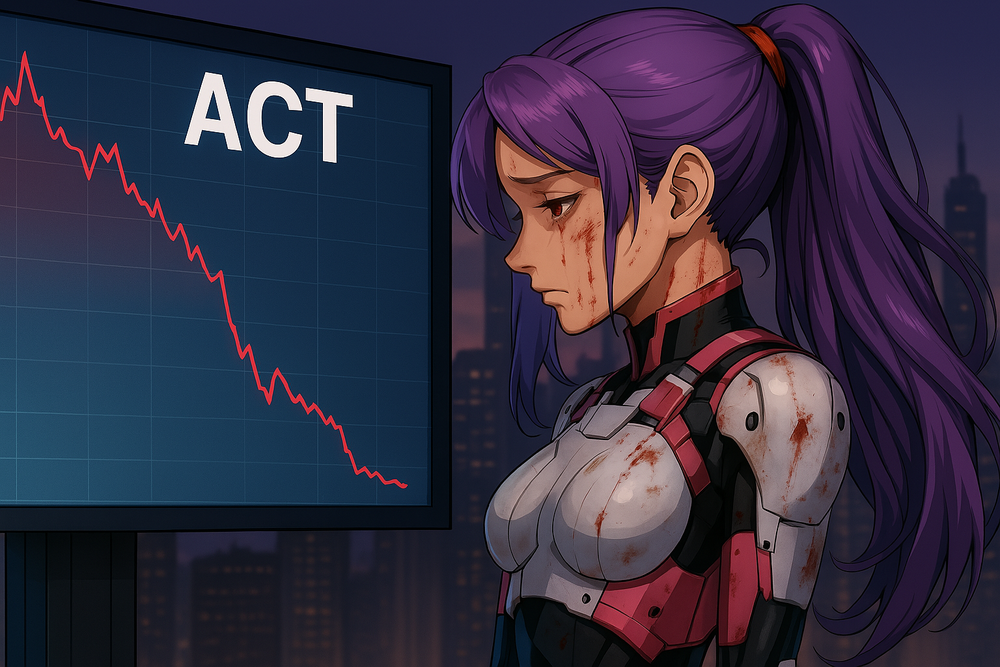

Deciphering the triple Rashomon behind the ACT flash crash, has the exchange’s risk control become a “nuclear button”?