Polkadot Bets on pUSD Stablecoin — But Can It Escape aUSD’s Shadow?

Polkadot (DOT) is preparing to launch a new stablecoin, pUSD, through the RFC-155 proposal. The Polkadot community is championing pUSD as a key solution to unleash its DeFi potential, cut dependence on USDT/USDC, and boost ecosystem autonomy.

However, some are concerned that they might repeat past mistakes. pUSD is an over-collateralized stablecoin fully backed by DOT, deployed on Asset Hub, and using the Honzon protocol developed by Acala. Acala is the former issuer of aUSD, a stablecoin project that failed disastrously.

Can pUSD Stablecoin Avoid the Same Fate as aUSD?

Reusing Honzon – the framework Acala previously relied on to issue aUSD is raising concerns. That incident eroded trust in the Acala team, with some even accusing them of “blaming a hack” while failing to compensate users adequately.

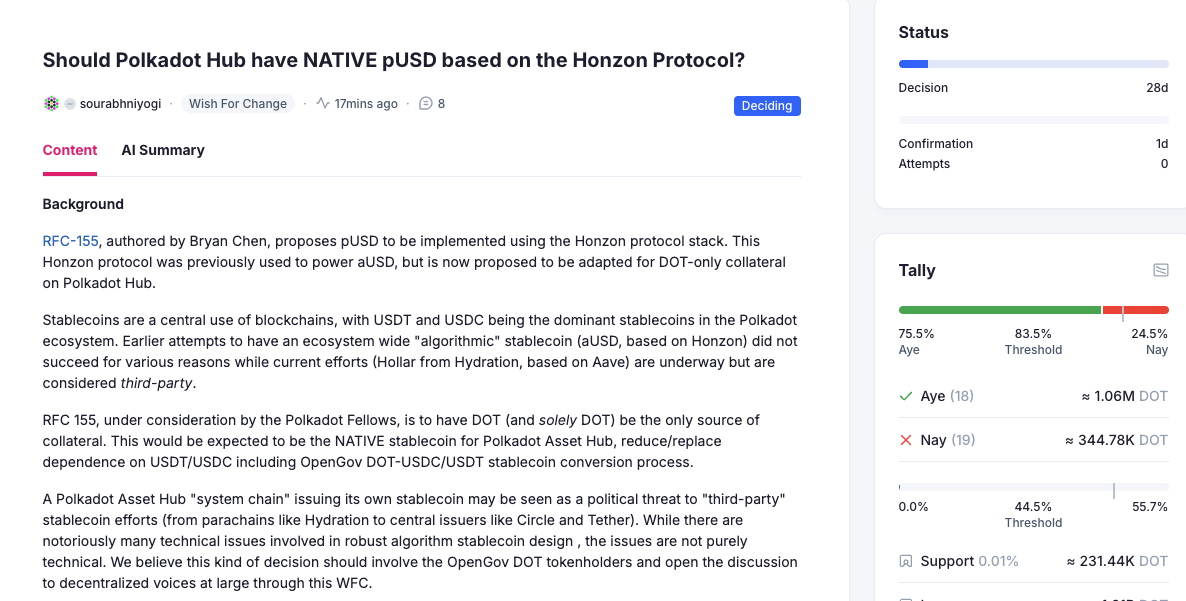

Approval rate of the proposal at the time of writing. Source: Polkadot

Approval rate of the proposal at the time of writing. Source: Polkadot

Even those who support Polkadot launching its native stablecoin still see Honzon and Acala as lessons that cannot be ignored. They propose the project should “move forward independently from the Acala team.” In addition, they call for the Technical Council to take clear responsibility for governance.

Too Many Risks

Setting aside concerns about Honzon and the Acala team, Polkadot’s pUSD also faces skepticism within the community. One primary reason is the structure that DOT solely backs it.

While the exact overcollateralization ratio remains unclear, this could trigger liquidation cascades and add selling pressure on the token. Although the pUSD model is safer than Terra’s UST because it is overcollateralized, relying only on DOT as collateral introduces significant risks.

Previously, MakerDAO’s DAI also started as ETH-only collateral. But today, MakerDAO supports Multi-Collateral DAI (MCD). They allow users to back DAI with crypto assets such as ETH, WBTC, LINK, UNI, stETH, and even Real World Assets (RWAs) like US Treasuries.

Additionally, another X user pointed out that the Polkadot ecosystem already has more advanced native solutions like HOLLAR. The Hydration runtime builds this stablecoin, optimizes it for appchains, and positions it as superior to the legacy aUSD architecture. Therefore, many argue that instead of repeating a “regular” EVM model, Polkadot should leverage its unique strengths. This would enable the creation of a stable, secure solution worthy of its ecosystem’s potential.

pUSD is undoubtedly a strategic move by Polkadot to unlock DeFi potential. It could bring significant benefits if it proves secure and sees widespread adoption in the ecosystem. However, the ghost of aUSD’s failure continues to cast doubt within the community.

To avoid repeating the same mistakes, Polkadot must work to dispel those lingering concerns. The fact that the DOT supply is capped at 2.1 billion, as reported by BeInCrypto, could help fuel the ecosystem’s growth.

You May Also Like

BNB Chain Integrates Chainlink to Bring US Government Economic Data Onchain

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon