Shutdown Threat Delays Data, Fuels Uncertainty Across Markets

Will US Congress pull off a last minute spending bill?

Well, that's the question on everyone's mind as the US government shutdown on October 1 looms.

For global markets and cryptos, this week's US jobs data takes centre stage.

While investors were set to keep a careful eye on the US labor data that are due out this week to gauge the Federal Reserve's possible next moves, the uncertainty surrounding Friday's important payrolls report come into play.

The report may not be released because of the budget impasse in Congress.

The latest regulations state that in the case of a closure, the Bureau of Labor Statistics, which is in charge of several US economic releases that are considered gold standard, would stop operations and probably postpone Friday's payroll report.

The could potentially bolster demand for safe haven assets like gold further.

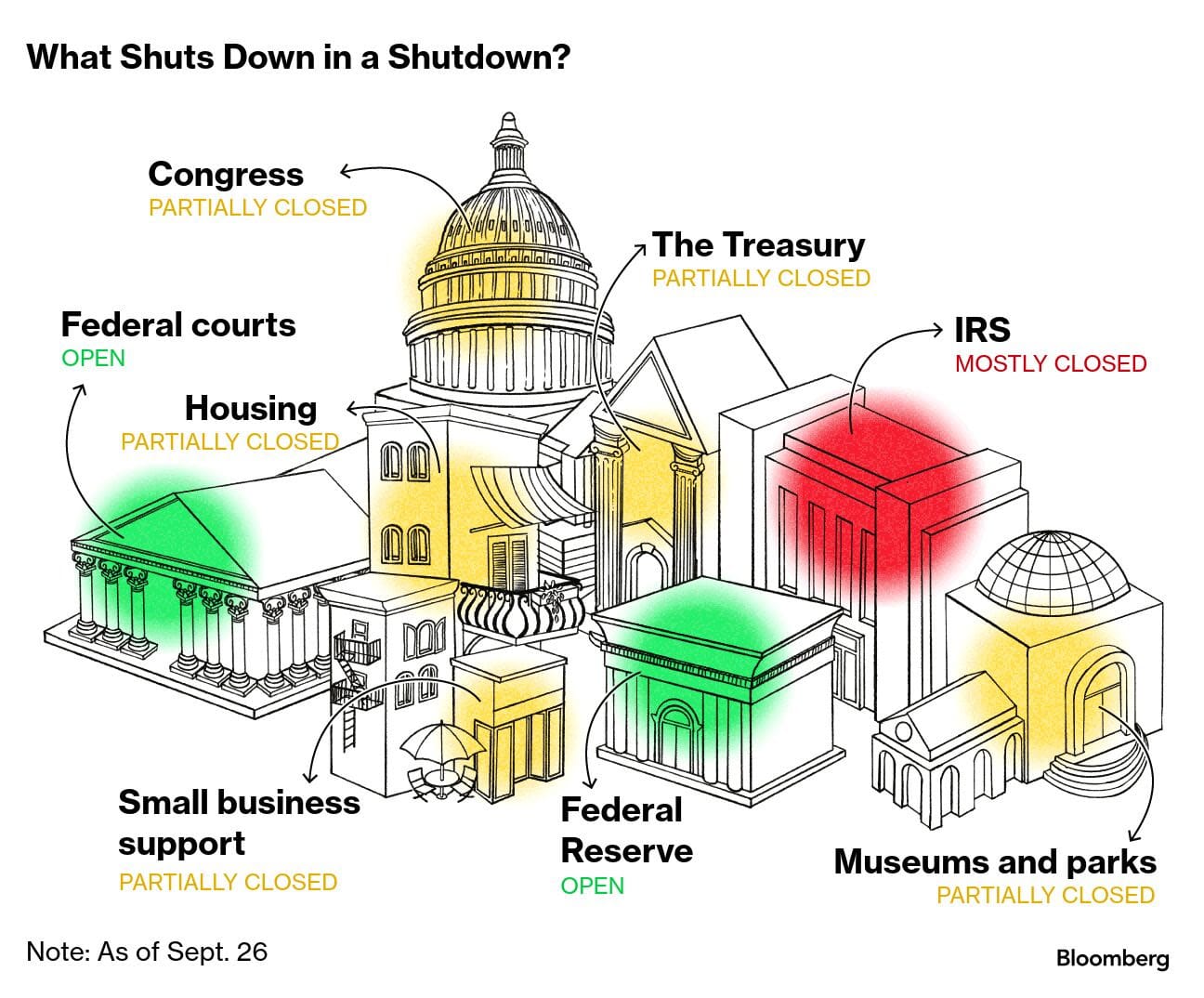

The US government is on the verge of shutting down, which would prevent politicians, businesses, and investors from accessing crucial data needed to assess the state of the economy.

There would be furloughs or layoffs for non-essential workers if Congress can not come to a compromise before the current fiscal year ends on Tuesday, which would put a stop to many federal operations.

Republicans have offered a deal, but Democrats are wary and are instead trying to undo some big healthcare savings that Republicans have promised.

Right now, Democrats are taking advantage of a window of opportunity to push for the long-term continuation of tax credits for middle-class families that are part of the Affordable Care Act.

Along with a demand to reverse Medicaid cuts linked to US President Donald Trump's recent tax-and-spend bill, this action is meant to forestall a possible spike in premiums beginning January 1.

The goal of the Democratic Party is to re-establish financing for medical research and to stop the president from abdicating his constitutionally guaranteed authority to veto congressionally-established funds.

There were few takeaways from Monday's discussion between President Trump and Democratic leaders at the White House, raising the possibility that a shutdown is inevitable.

Jobs Data the Main Cue for Fed Rate Path

Amid uncertainty, the indicators used to evaluate the economy could get murky. The worsening job market and rising unemployment rates in the US contribute to some of that unpredictability.

With so few people getting hired and fired in the present climate, many people are missing out on possibilities. Finding entry-level jobs is difficult for a lot of people, not just recent college grads.

Part-time work is appealing to unemployed professionals in their mid-30s and 40s, but hiring has stalled in several industries, including manufacturing and professional services. The percentage of people without a job for more than six months has hit a record high, with the exception of the years affected by the pandemic, since the middle of the 2010s.

In response to the concerning decline in job growth, the Fed cut rates last month. So, the NFP data this week was set to define the Fed's rate path and for investors to see if the central bank's own dot plots would prove right.

But the risk of delayed data from a US shutdown adds to the drama and uncertainty.

For what its worth, if we take this week's employment data at face value, it might support more rate cuts. Probably the majority of investors are preparing for more bad news on the US jobs market.

In context, BRN's predicted net employment creation of 75,000 might not appear so awful. Remember that Federal Reserve Chair Jerome Powell estimates that the payrolls' "breakeven rate"—the level of hiring needed to maintain a constant unemployment rate—is likely somewhere between 0 and 50k.

However, the overall job market continues to appear bleak. Last but not least, the lifeblood of the US economy-consumers-are taking notice of the worsening hiring conditions.

"We believe there is a strong argument for Fed's follow-ups in October and December after September rate cut. Further supporting the need for immediate action is our argument that the economy will feel the effects of rate cuts more gradually than in the past," a BRN analyst said.

The Fed may not be able to do much in the near future if the jobs market continues to cool and it becomes clear that it is seriously behind the curve.

This is still an if, of course.

What would that do to cryptos remains to be seen, although the moves this week so far suggests an upside for digital assets in line with gold.

Data or no data, for now, cryptos have reversed course and are gaining this week, with the risks of what's happening in the U.S. likely to keep that momentum going.

You May Also Like

Here’s Why Mantle (MNT) Price Is Pumping Today

Cashing In On University Patents Means Giving Up On Our Innovation Future