Solana DePIN Report: From "mining" to "mapping", how can ordinary people make money without doing anything?

Original article: Dune, Slice Analytics

Compiled by: Yuliya, PANews

Among the many innovations in the blockchain industry, the decentralized physical infrastructure network (DePIN) is rapidly emerging as a bridge for real-world assets to be put on the chain. Whether it is shared GPUs, telecommunications networks, or street map collection, DePIN is reshaping the way infrastructure is built and operated through cryptographic incentive mechanisms. Solana is gradually becoming the core platform of this trend, and its high-performance network provides an ideal expansion soil for the DePIN project.

Based on the latest research report jointly released by Dune and Slice Analytics, this article conducts an in-depth analysis of the development status, market performance and on-chain data of multiple core DePIN projects on Solana. The report data is as of April 22, 2025, providing us with a clear picture of this emerging ecosystem and revealing the real and verifiable growth trajectory behind it.

DePIN Concept and Solana Advantages

What is DePIN?

Decentralized Physical Infrastructure Network (DePIN) is an innovative model that uses cryptocurrency incentives to launch and operate real-world infrastructure. These projects typically target markets with strong demand but inefficient supply, and revitalize idle resources (such as idle GPUs, wireless bandwidth, etc.). Unlike the traditional infrastructure model dominated by large enterprises, DePIN distributes ownership to individuals, thereby improving efficiency, enhancing resilience, and expanding accessibility.

Why Solana?

Solana, with its high throughput, low transaction fees, and composable infrastructure, is an ideal platform for transparent expansion of DePIN applications. Its thriving ecosystem and strong developer community are making it the center of this emerging field. As Amira Valliani, head of DePIN at the Solana Foundation, said:

"Decentralized Pinning is about to reach escape velocity. This innovative business model has proven its ability to scale physical infrastructure networks faster and cheaper in a community-driven way — and it’s all happening on Solana. The world’s largest decentralized pinning projects chose to build on Solana because of its high-performance and active capital markets, and stayed because of its thriving community ecosystem."

DePIN Market Overview

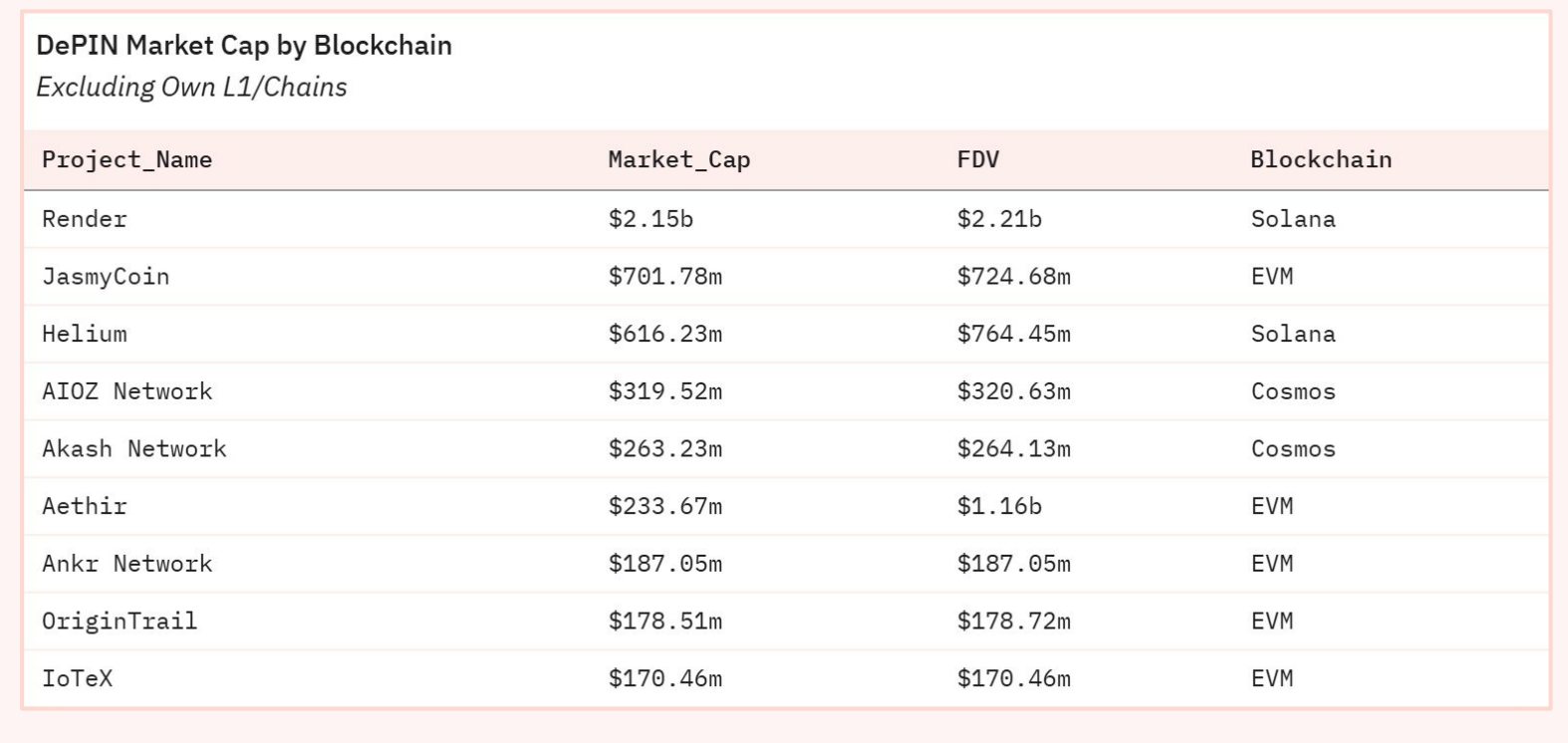

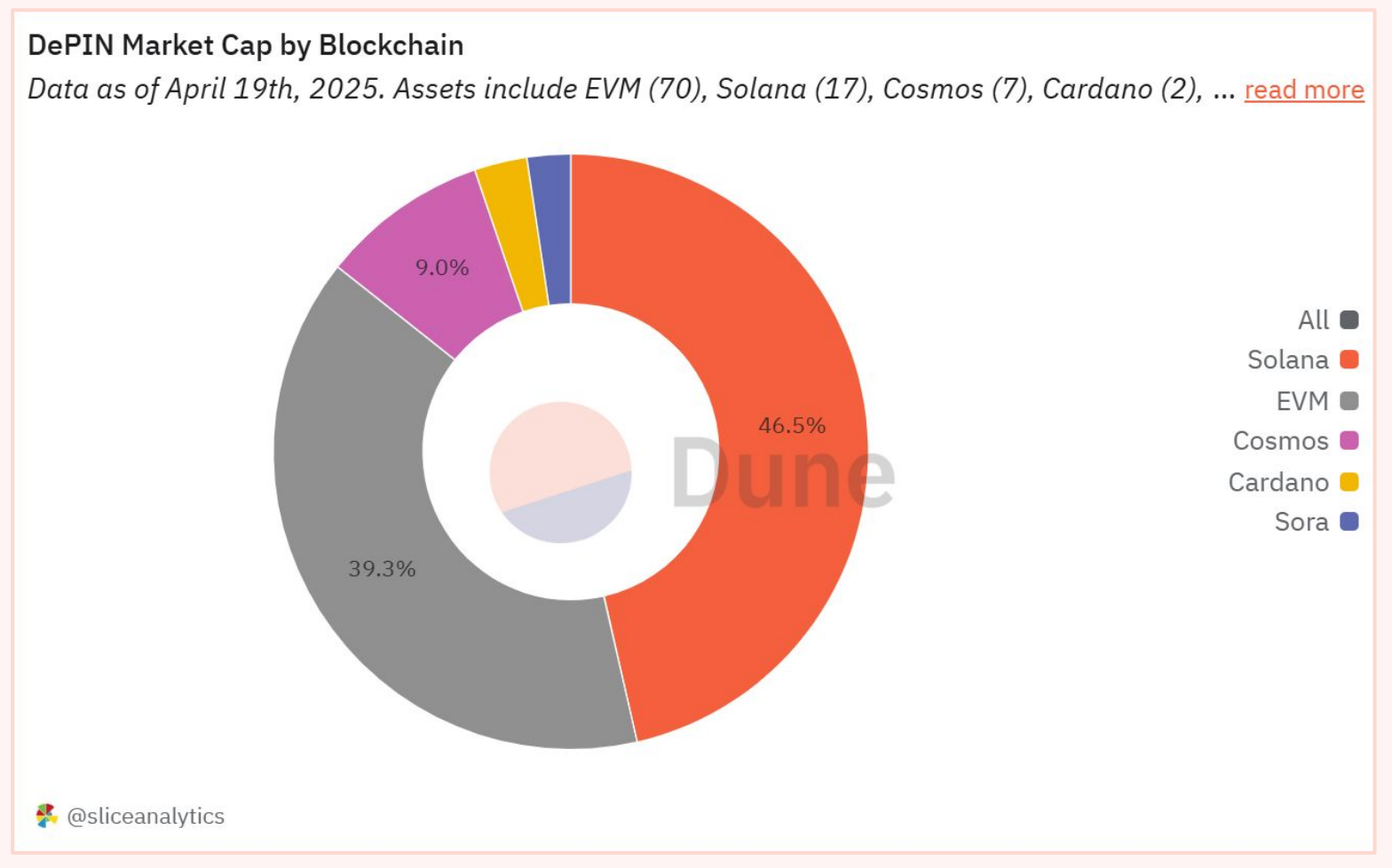

As of April 2025, the total on-chain market value of global DePIN projects (excluding independent project L1/chain) has reached US$7.1 billion, of which the total market value of DePIN projects on Solana is US$3.25 billion, ahead of other blockchain platforms such as EVM ($2.84 billion) and Cosmos ($652.5 million), Cardano ($195.2 million), and Sora ($160.1 million).

Calculated by average market capitalization per project, Solana once again leads with $191.3 million, followed by Cardano ($97.6 million), Cosmos ($93.2 million), Sora ($80.1 million), and EVM ($40.6 million).

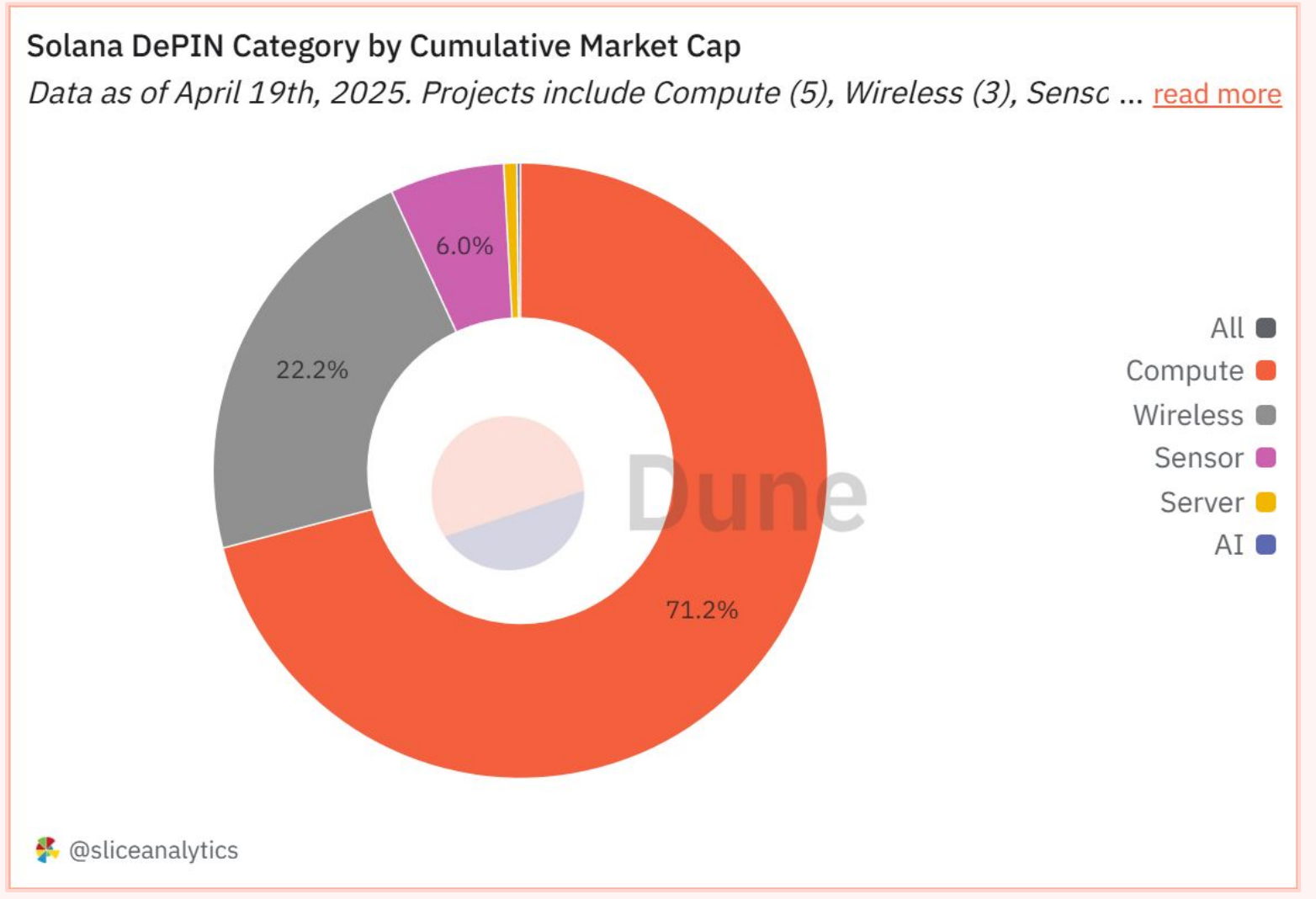

Project Category Distribution

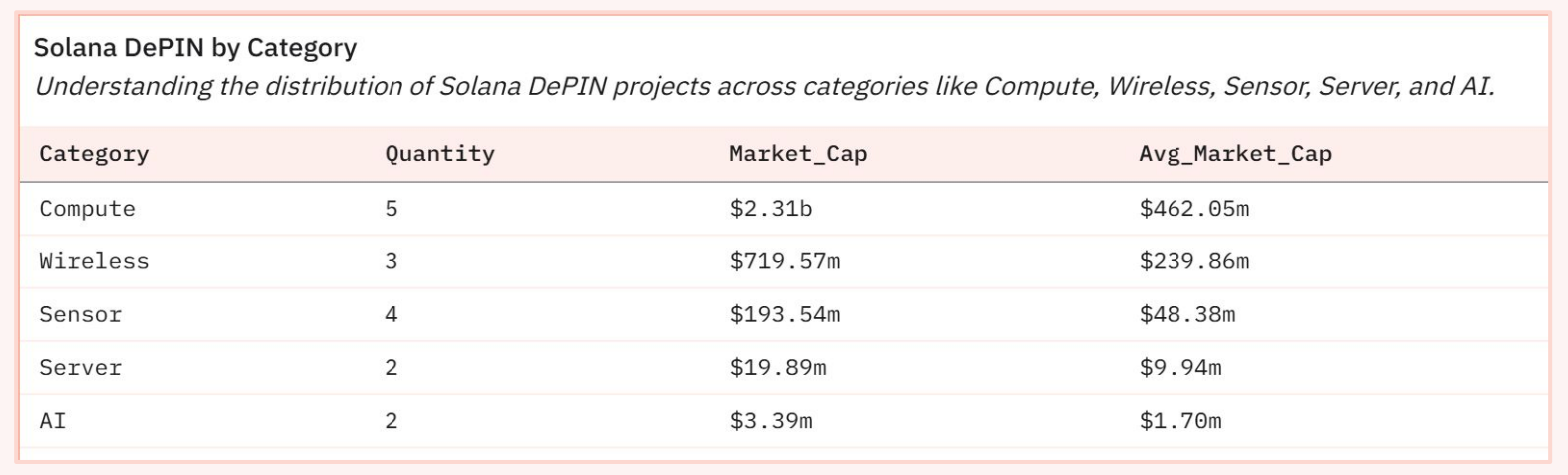

DePIN projects are mainly divided into five categories:

- Compute : 71.2% of the market share, providing decentralized processing power, GPU and computing infrastructure, such as Render, io.net, Nosana, LooPIN Network, Hivello

- Wireless : 22.2% market share, providing community-driven wireless and mobile access networks, such as Helium, ROAM Token, Helium Mobile

- Sensor : Collect real-world data through distributed sensor devices, such as Hivemapper, Geodnet, WeatherXM, and NATIX Network

- Server : Provides distributed cloud and storage servers for hosting or accessing data, such as Shadow Token, ScPrime

- AI: Decentralized networks that support AI data generation, annotation, or robotics, such as UpRock, Homebrew Robotics Club

The compute and wireless categories together account for 93.4% of the market share and are also the categories with the highest average market capitalization. Compute networks such as Render and io.net provide high-market-cap utility tokens for AI workloads, while wireless projects such as Helium and ROAM represent the most mature and widely adopted infrastructure layer.

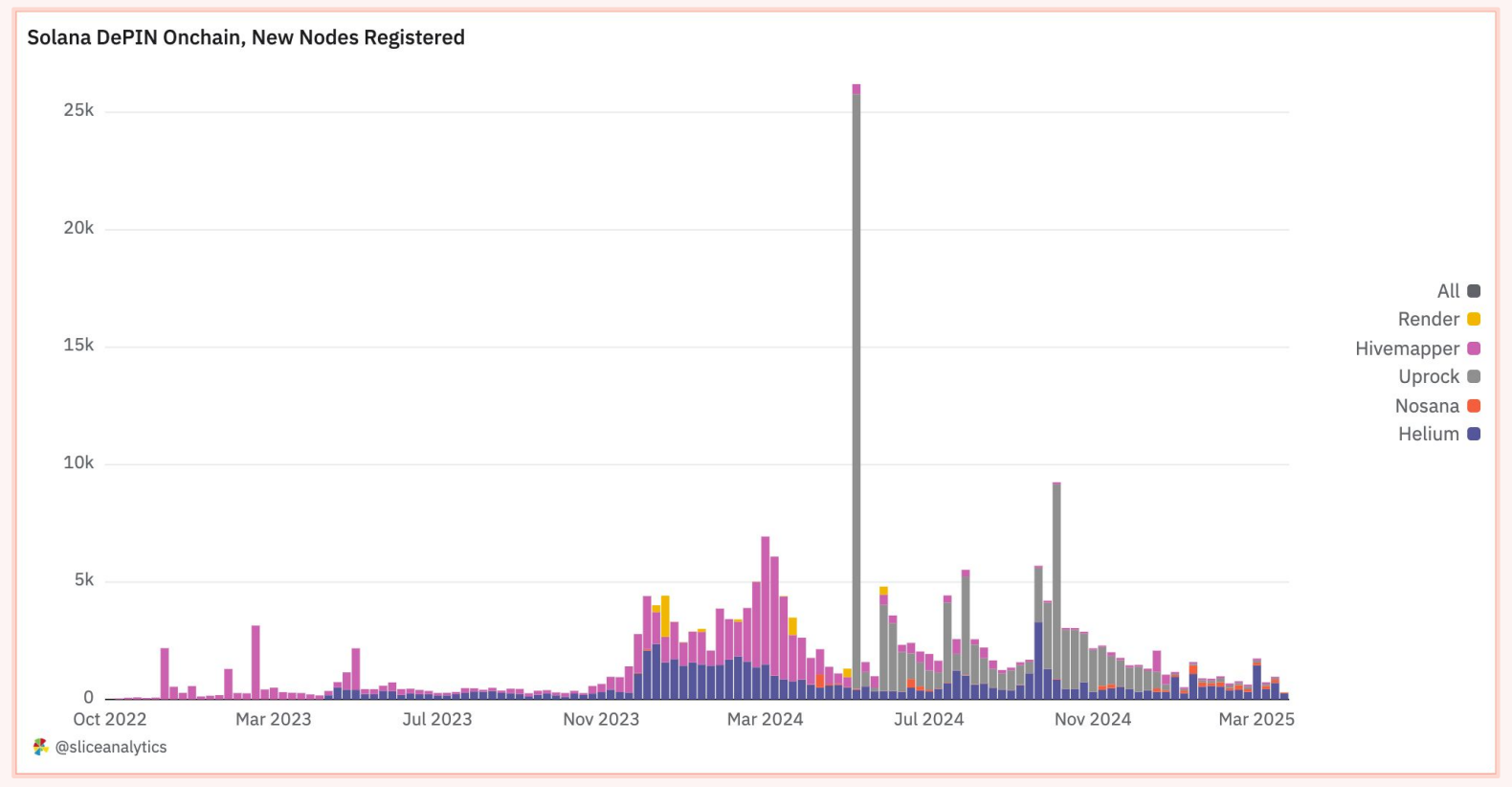

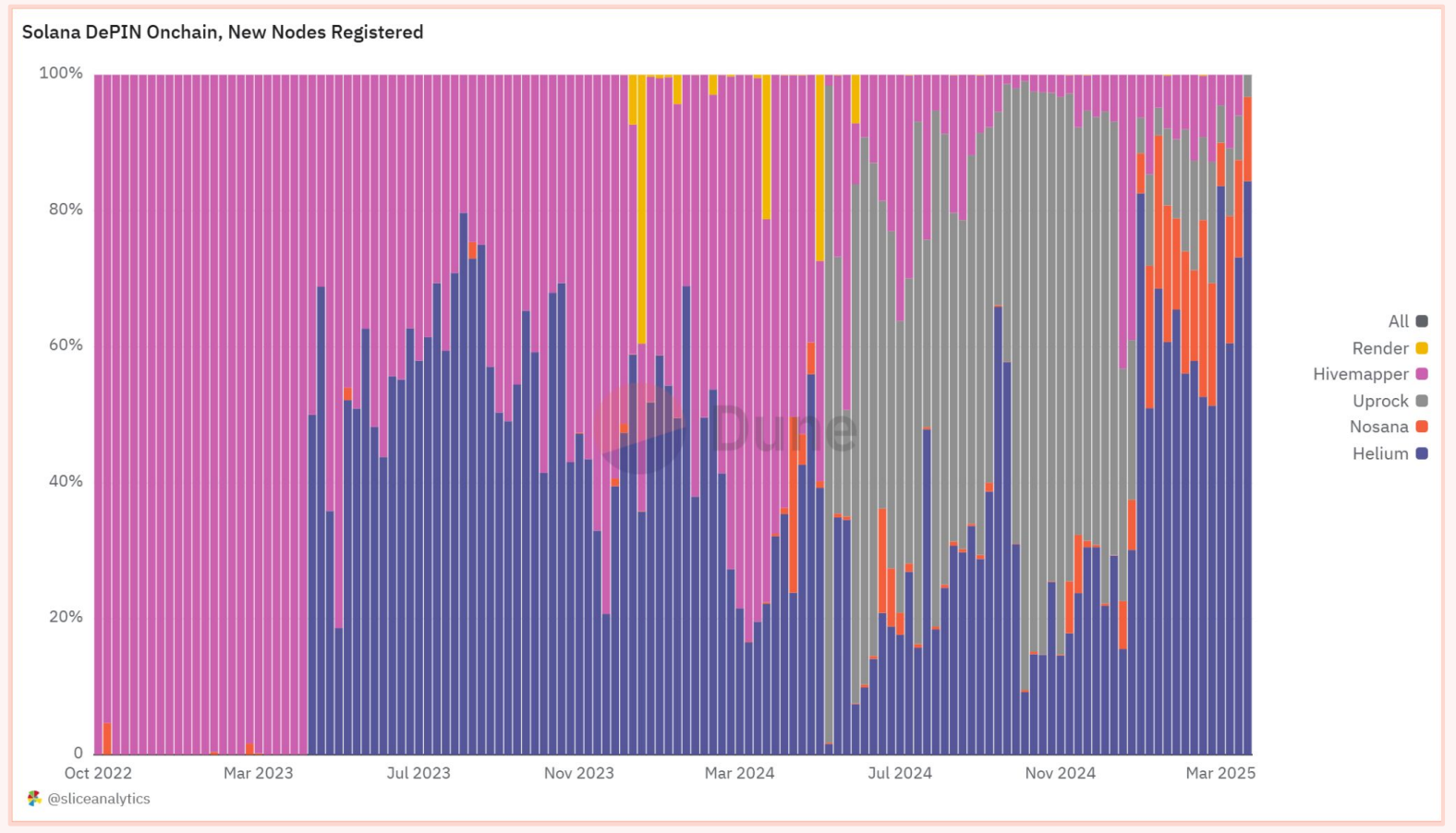

Node Growth and Network Participation

As of April 22, 2025, the total number of registered on-chain nodes for the DePIN project on Solana reached 238,165. DePIN nodes are physical or digital infrastructure units, such as GPUs, IoT hotspots, or dashcams, that perform key network functions such as computing, data collection, or wireless transmission. The growth in the number of nodes reflects the scale, decentralization, and practicality of the network, with more nodes generally meaning stronger coverage, higher participation, and reliability.

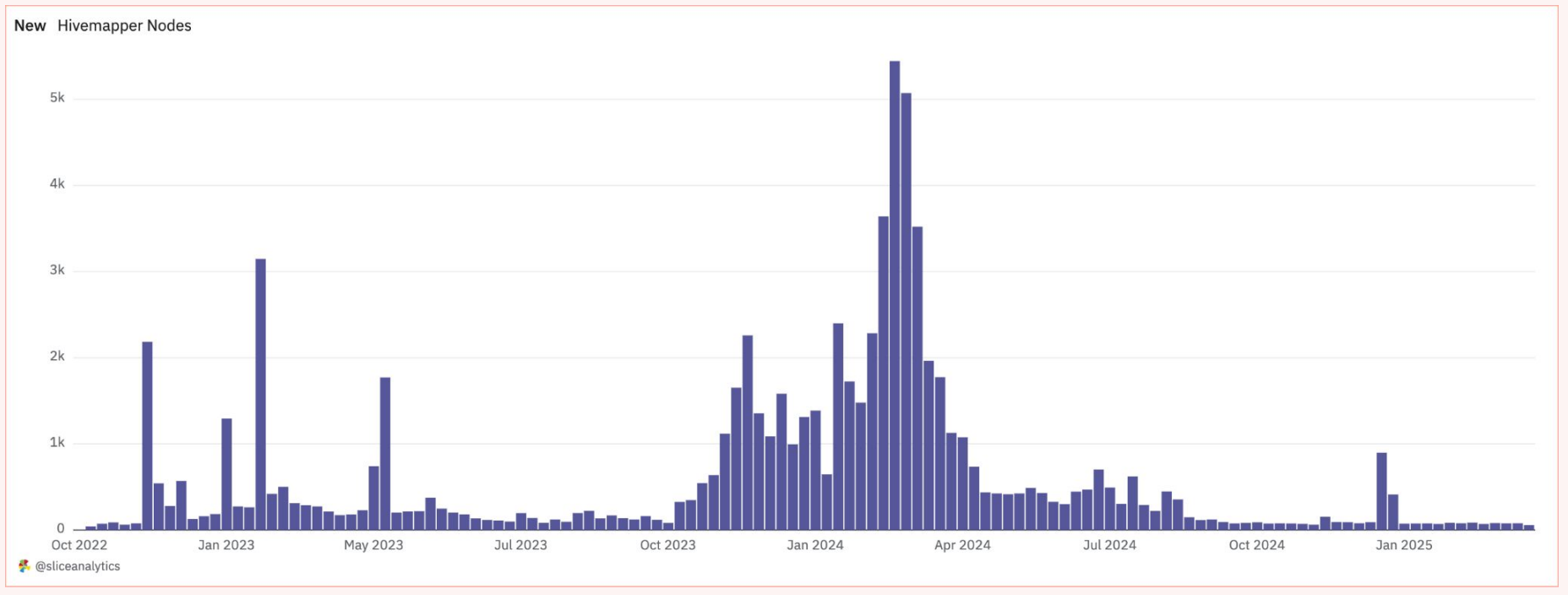

In terms of node growth, the Solana DePIN project shows obvious changes. Hivemapper initially led, but Helium quickly surpassed after the launch of Helium Mobile and now accounts for more than 60% of the new node share. Although Render contributes fewer new nodes, it leads in per-node revenue. Nosana gains traction in early 2025, while Uprock flattens out after rapid growth in late 2024.

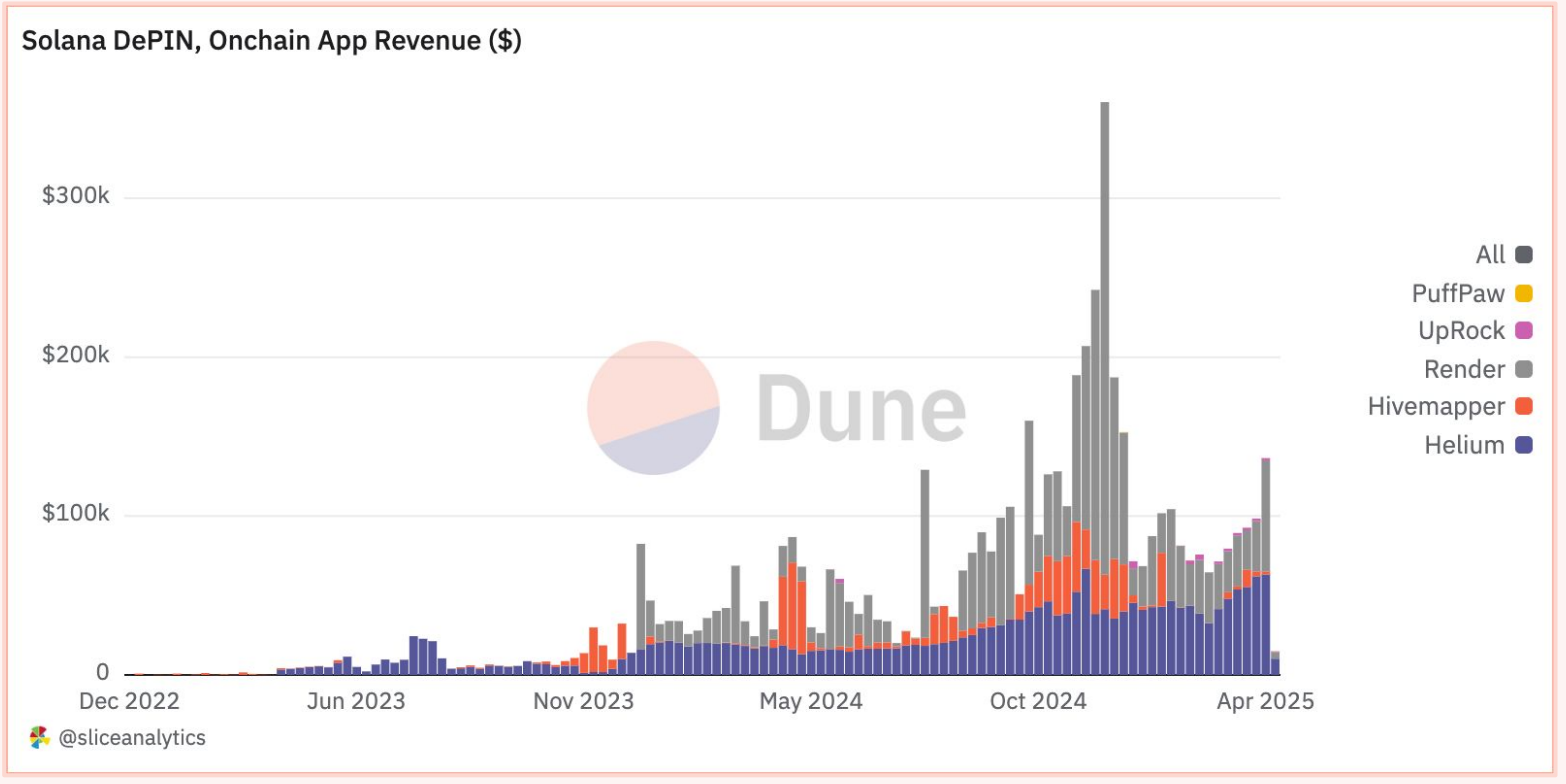

On-chain network income

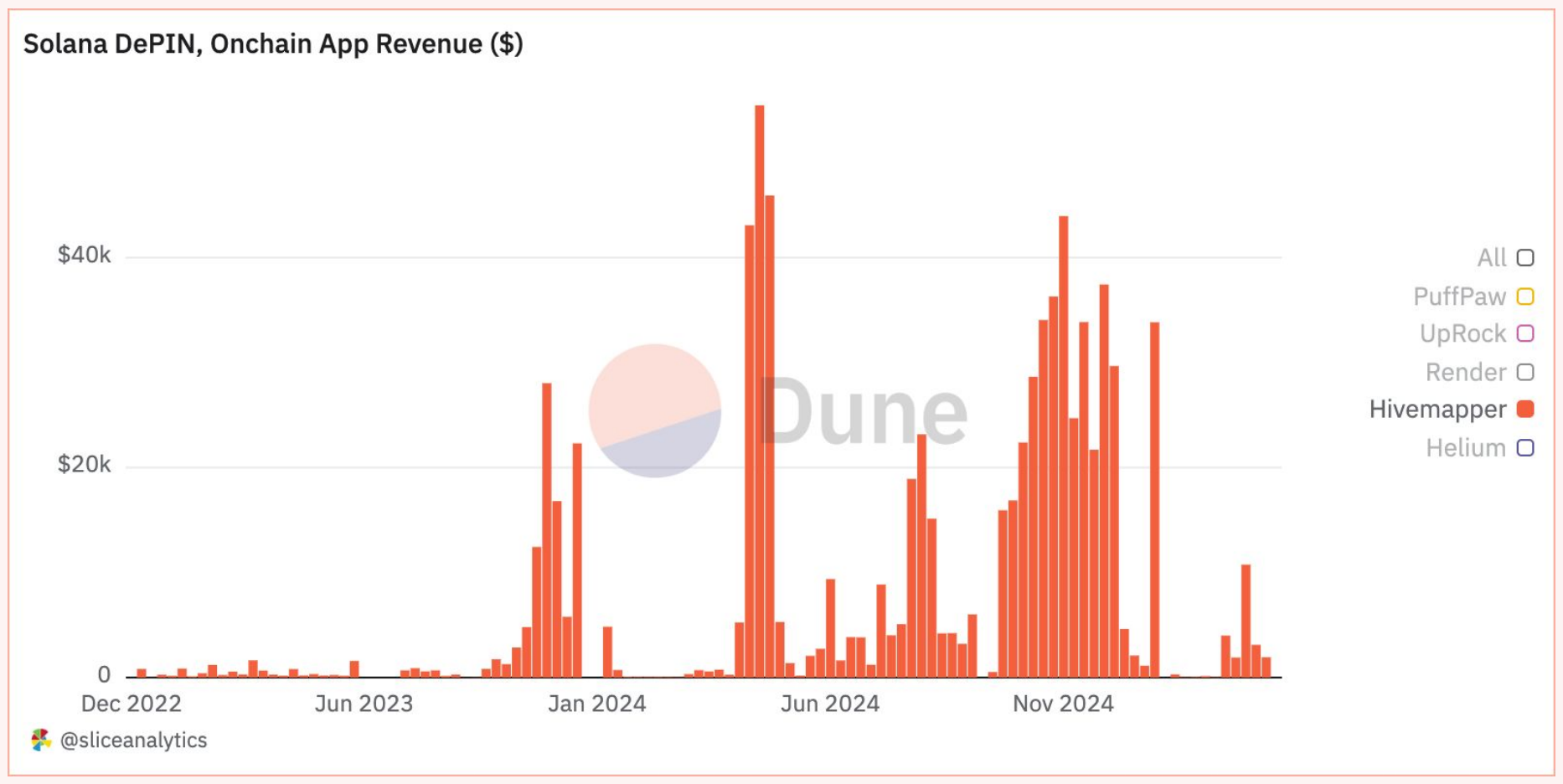

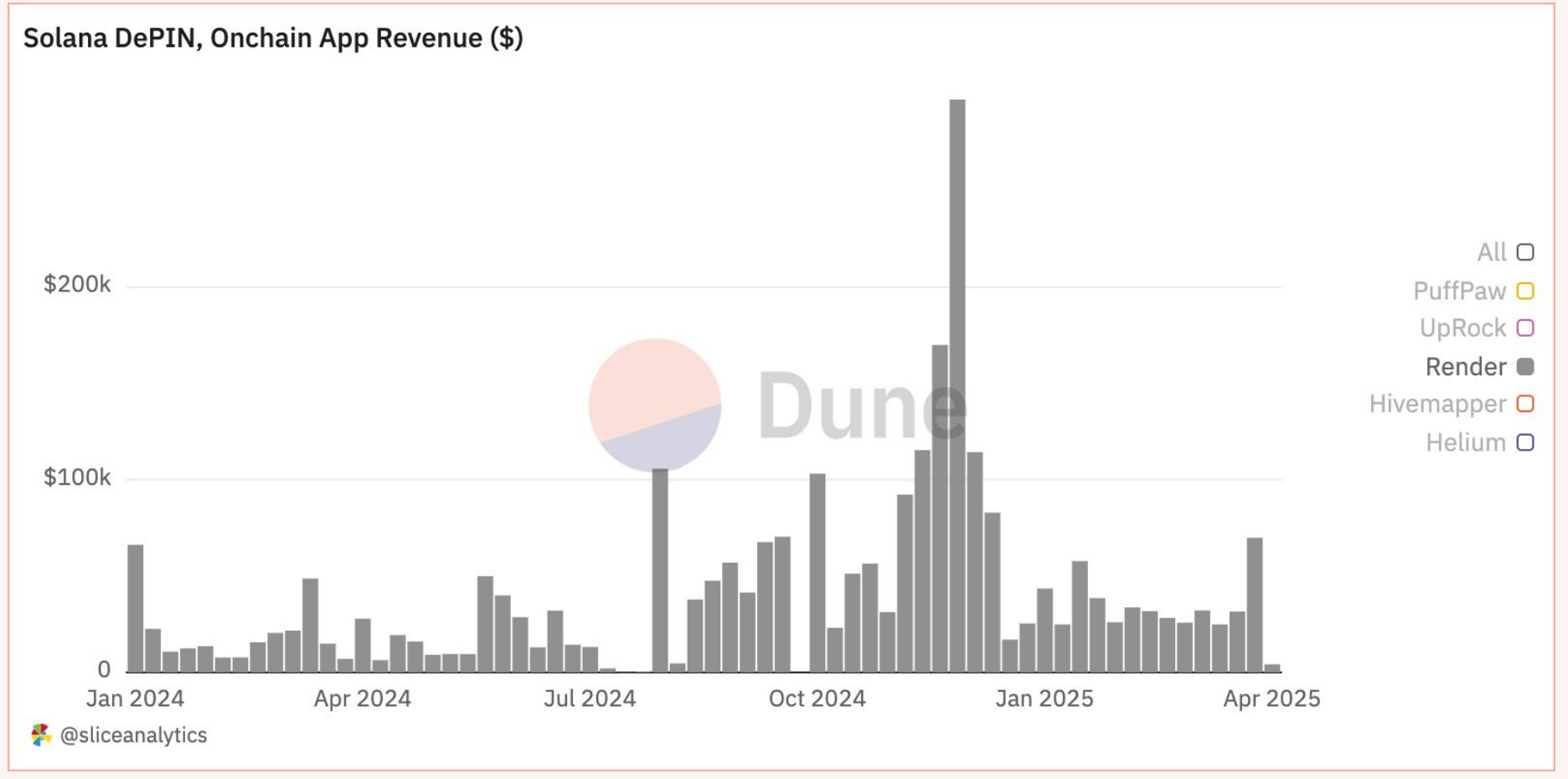

As the cryptocurrency industry matures, on-chain revenue has become a key indicator for assessing project feasibility, product-market fit, and sustainable business models. As of April 22, 2025, the total on-chain revenue of the DePIN project on Solana reached $5.98 million.

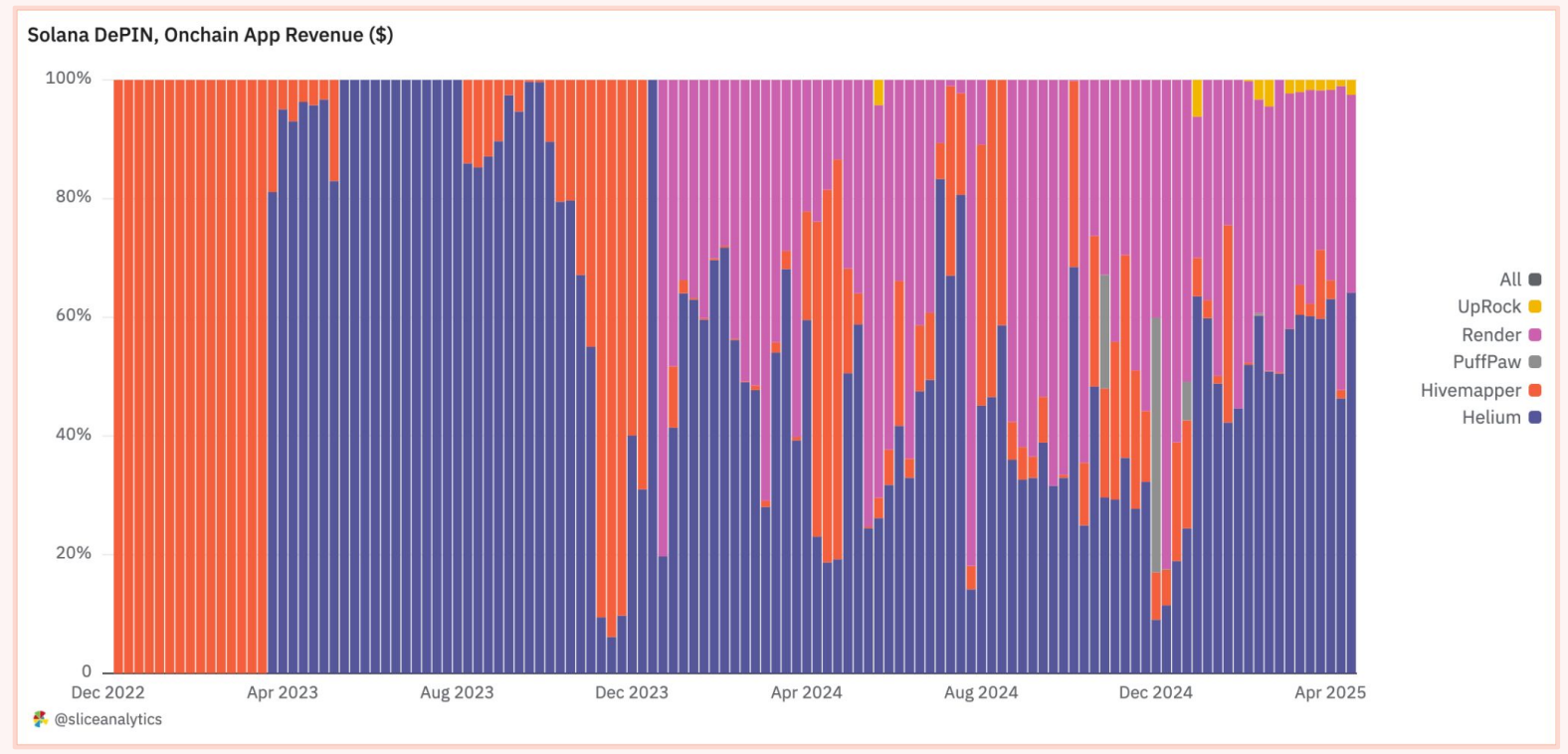

DePIN projects have steadily increased revenue on Solana, from approximately $4,000 per week in April 2023 to over $100,000 per week in early 2025, peaking at $130,000 in mid-April. Helium is the top weekly earner at $60,000 (60% share), while Render leads in total revenue ($2.65 million compared to Helium’s $2.3 million). Render also holds the record for peak weekly revenue of $300,000 set in late 2024. These trends highlight rising adoption, with each project gaining traction at different points in the DePIN growth cycle.

Analysis of major projects

1. Helium: The leader in decentralized wireless networks

Helium is a decentralized wireless network that enables individuals to deploy hotspots and provide low-cost, secure connectivity for IoT and mobile devices. Users are rewarded with HNT tokens for extending coverage and routing data.

Key Milestones:

- 2013: Helium is founded

- 2019: Helium hotspots launched, users start earning HNT for coverage

- 2023: Migrate to Solana for increased scalability and speed

- 2024: Public launch of Helium Mobile, a decentralized 5G service

- 2025: Zero Plan, the first free 5G mobile phone plan in the United States, is launched

- 2025: SEC drops lawsuit against Nova Labs, confirming Helium’s token model does not violate securities laws

- 2025: Helium partners with AT&T to provide nationwide Wi-Fi coverage

Key Stats:

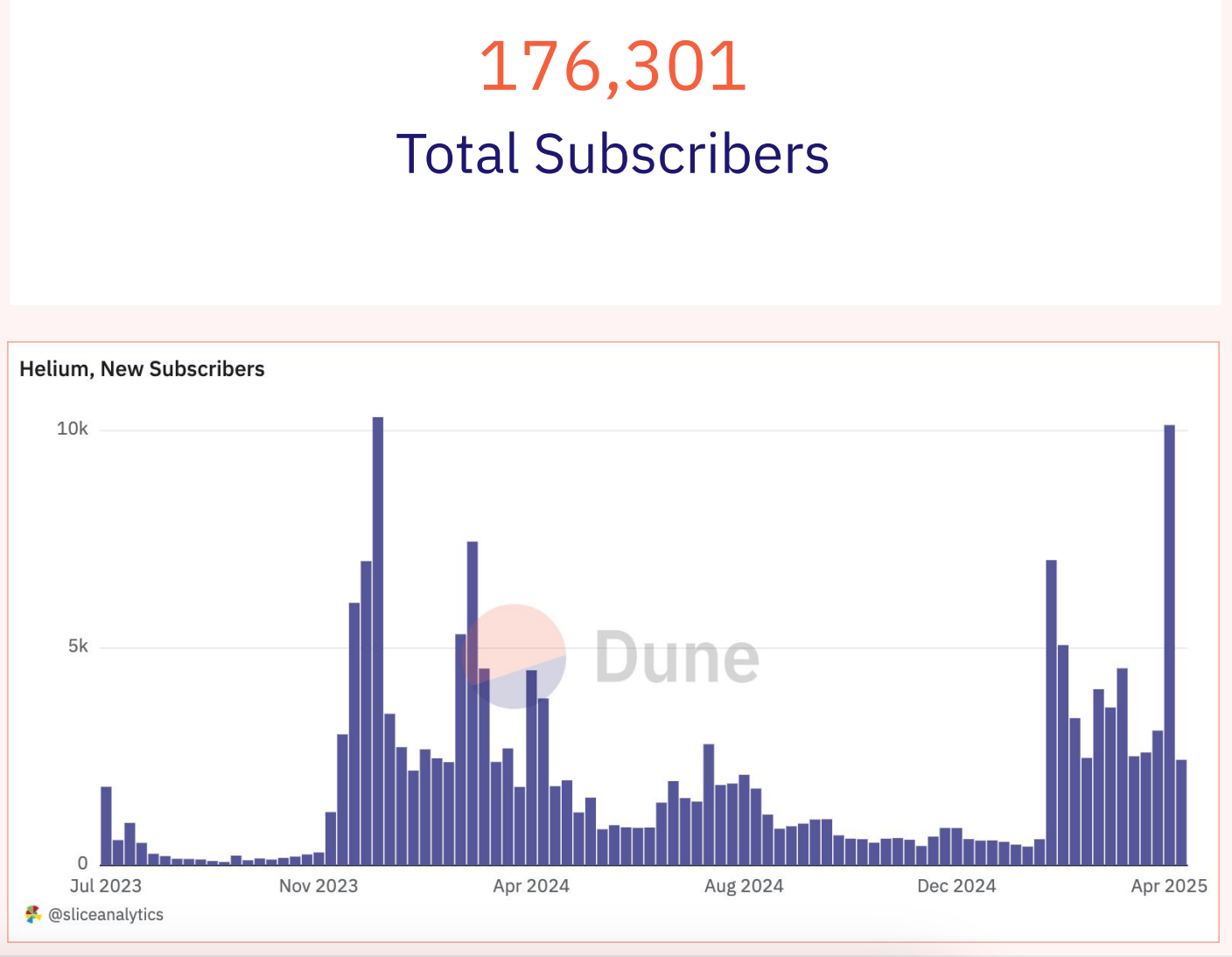

- Total subscribers: 176,301

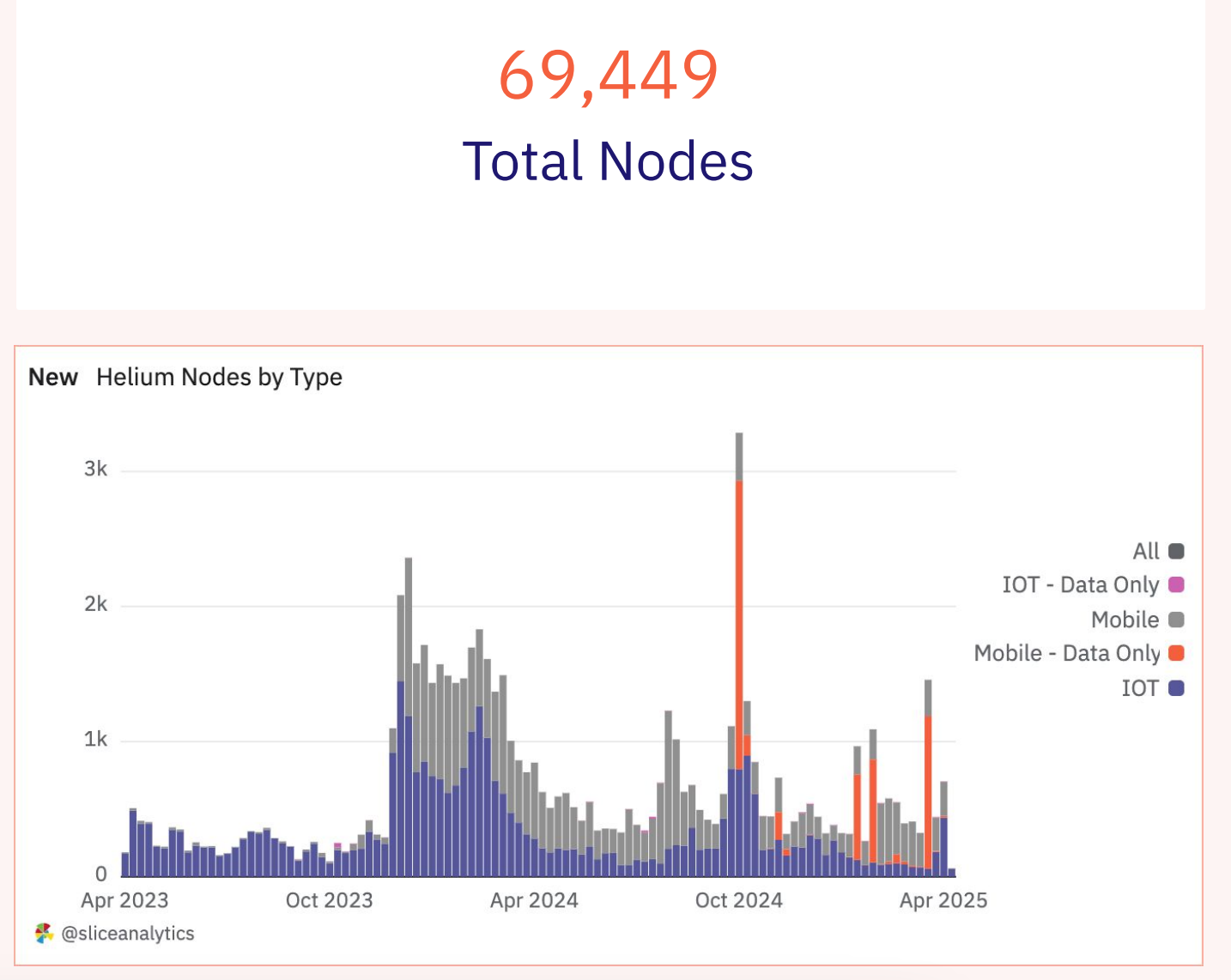

- Total nodes: 69,449

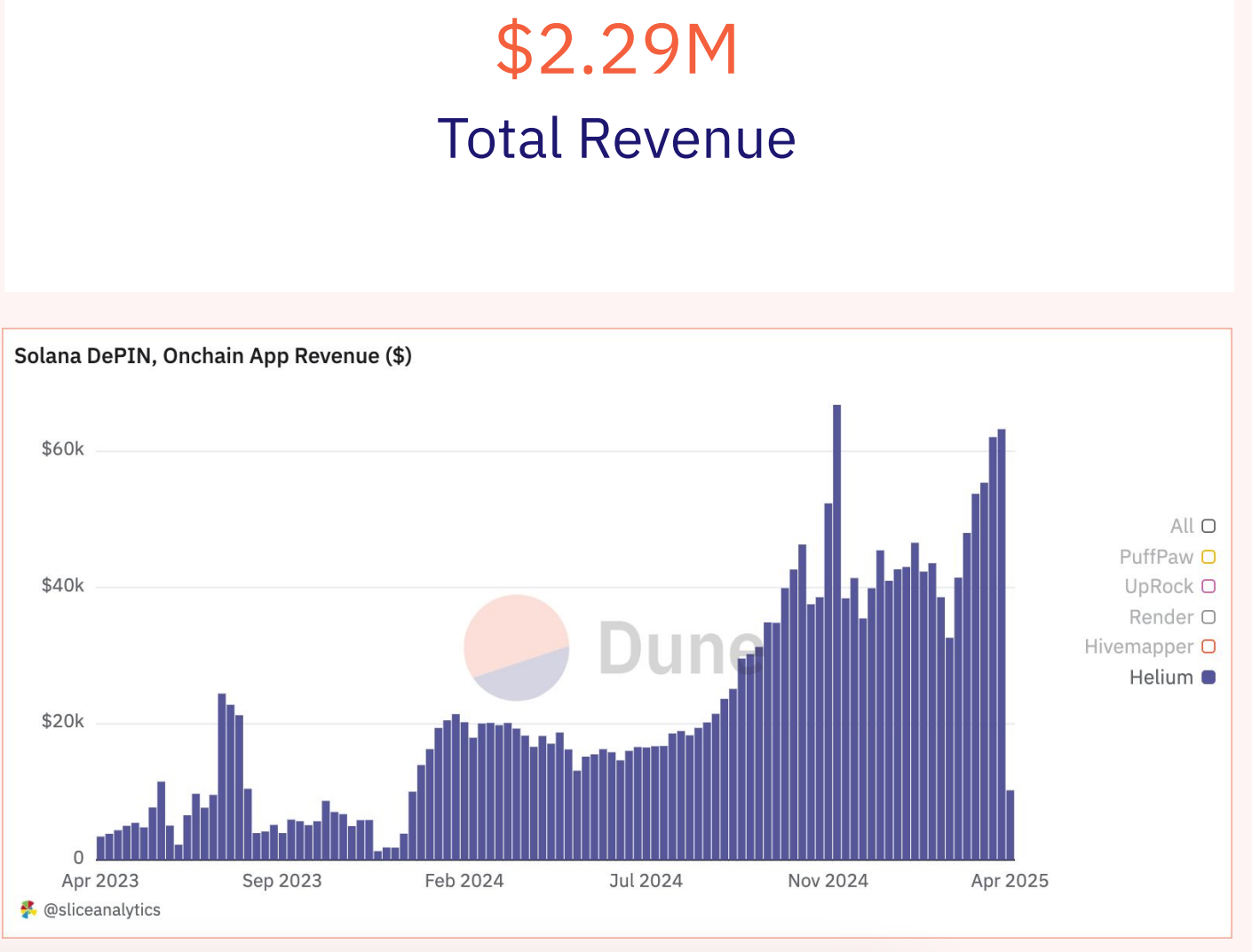

- Total on-chain revenue: $2.29 million

Helium's subscriber growth is subject to clear product-driven inflection points. In January 2024, Helium Mobile saw 10,300 new subscribers in the week following its official launch, facilitating the deployment of more hotspots and network expansion. Subsequently, the launch of Zero Plan (the first free 5G mobile phone plan in the United States) in February 2025 triggered a second wave of growth, quickly filling up the waiting list. After the free plan was opened to everyone in April, the number of users peaked again at 10,000.

As of the reporting period, Helium had a total of 176,301 subscribers and 69,449 nodes. The composition of nodes shows a changing trend, with particularly strong growth in the mobile data-only category. The report points out that two major events drove the peak of node deployment. The first was the collaboration with Ameriband in October 2024, which added more than 100,000 data-only hotspots at retail and commercial sites in the United States; the second was the cancellation of the Zero Plan waiting list in April 2025, when user growth accelerated again.

Helium generates on-chain revenue through its unique burn-mint model, where users can convert HNT into non-transferable data credits (DCs) to access services on its IoT and mobile networks. Specifically, mobile data is billed at $0.50 per gigabyte (i.e. 50,000 DCs), while IoT usage is charged per 24-byte message increment. The company's revenue has grown steadily, reaching a record of $66,000 per week in December 2024 and reaching a sustained peak of $63,000 per week again in April 2025.

2. Hivemapper: Decentralized Map Network

Hivemapper is a decentralized, community-driven mapping network where users are rewarded with HONEY tokens for collecting street-level images through dashcams. By turning everyday driving into a data source, Hivemapper provides fresher and more dynamic maps for areas such as transportation, logistics, and autonomous driving.

Key Milestones:

- 2022: Launch of Hivemapper network and HONEY token

- 2023: Network maps more than 1 million unique road kilometres

- 2024: Launch of Bee dashcam for high-quality image capture

- 2024: Release Beekeeper, a fleet management tool with no SaaS lock-in

- 2025: Bee Maps begins serving major customers such as TomTom, Mapbox and Trimble

Key Stats:

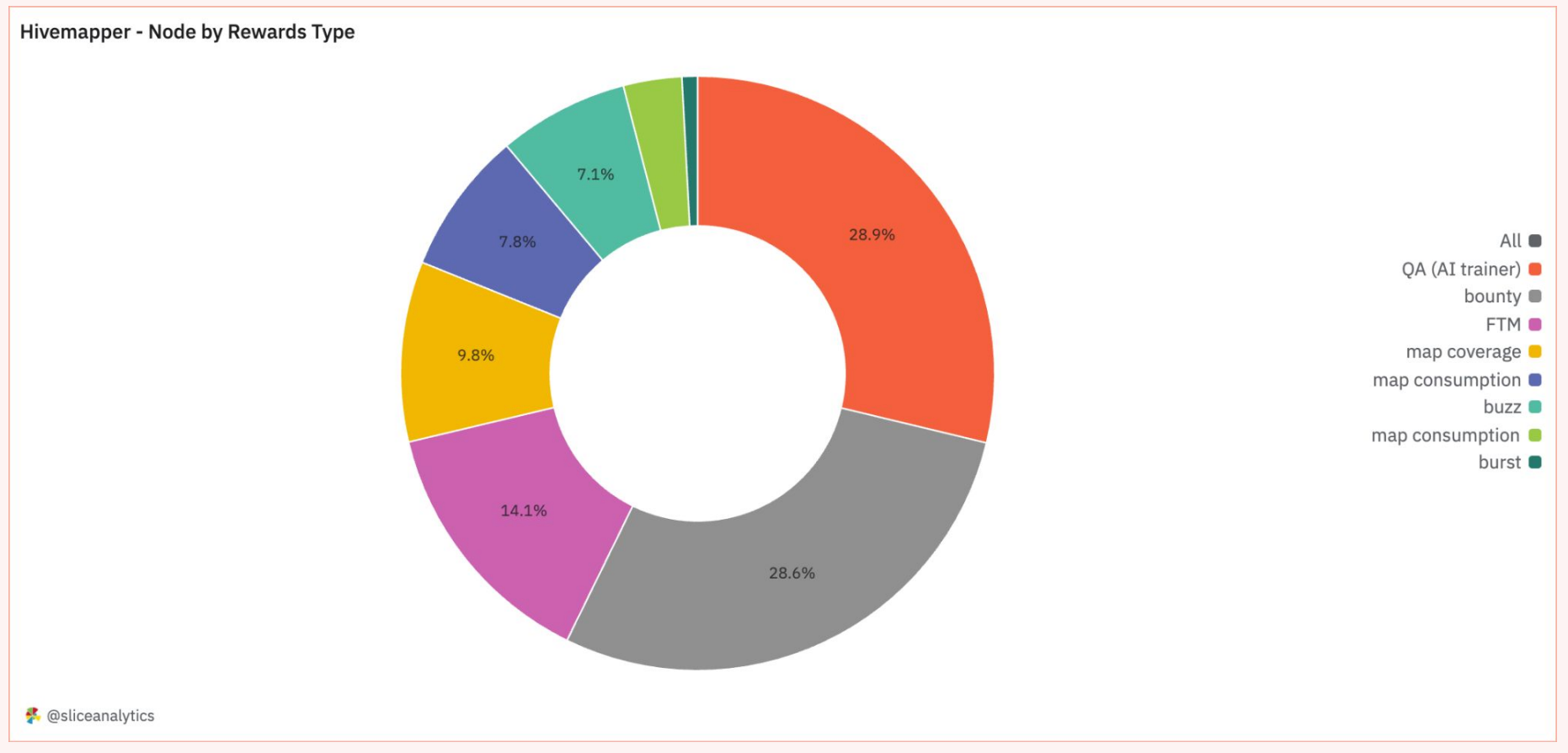

- Total nodes: 77,483

- Weekly rewards: Over $60,000 in HONEY

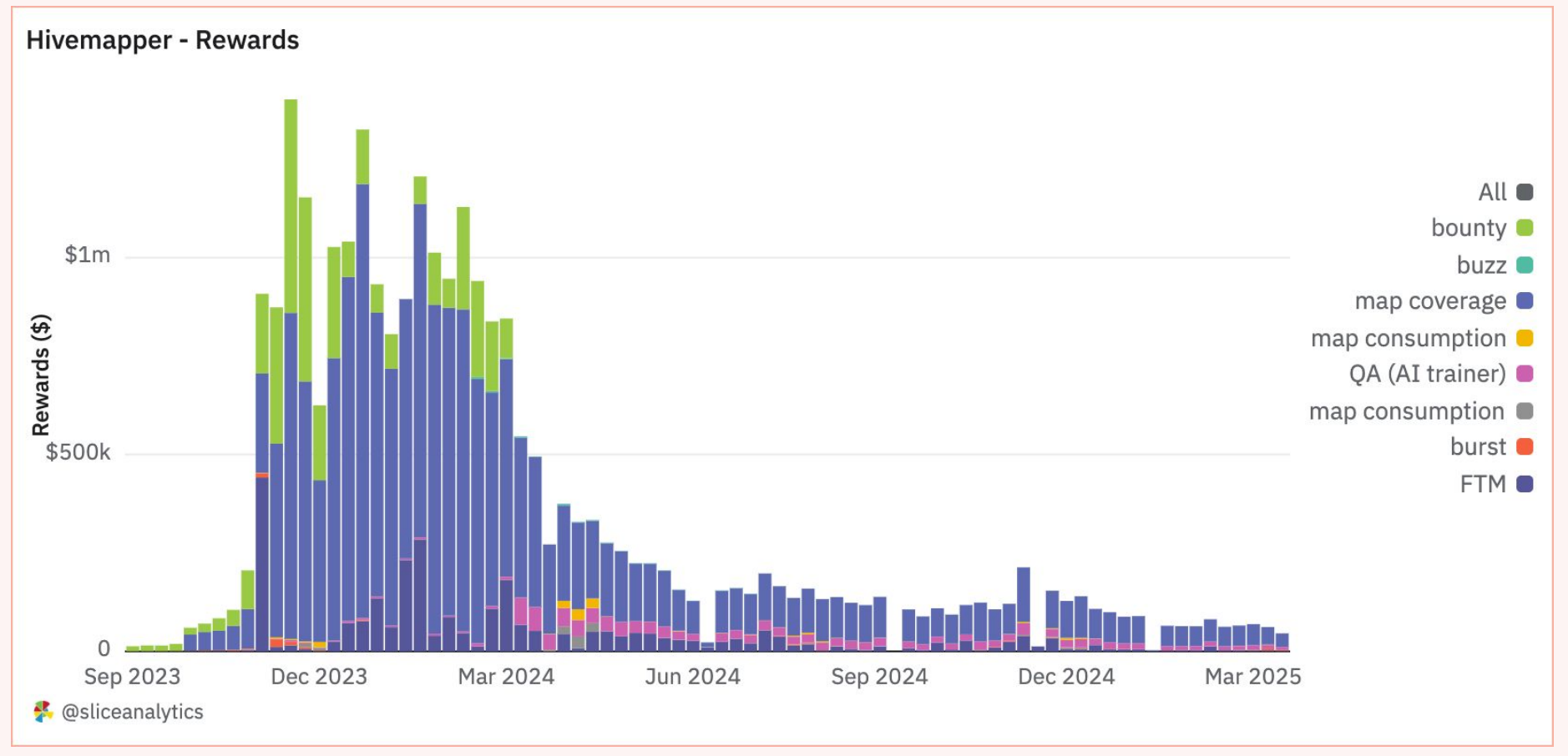

As of April 2025, the network has 77,483 nodes, most of which are active in AI training and bounty activities, but less than 10% of nodes are rewarded for map coverage. Although Hivemapper's weekly rewards have declined from the peak of $1.4 million in December 2023, the network still distributes more than $60,000 in HONEY tokens per week. It is worth noting that although less than 10% of nodes actively contribute to map coverage, these nodes always receive about 80% of the total rewards.

Hivemapper earns revenue by selling Map Credits (worth $0.005 each), which are purchased by burning HONEY tokens and used to access map data. Revenue trends show a peak of $30,000 per week by the end of 2023 and exceeding $50,000 per week between April and May 2024.

3. Render: Decentralized GPU Rendering Network

Render Network is a high-performance distributed GPU rendering network that facilitates a computing marketplace between GPU providers and requesters using industry-leading OTOY Inc. software. GPU owners can monetize their idle GPUs by providing computing power to creators seeking rendering resources. It provides scalable, economical rendering services for 3D graphics, dynamic design, and AI workloads.

Key Milestones:

- 2021: Render decentralized rendering network launched

- 2023: Migrate to Solana and upgrade token to RENDER

- 2024: OctaneRender for Blender integration via RNP-017

Key Stats:

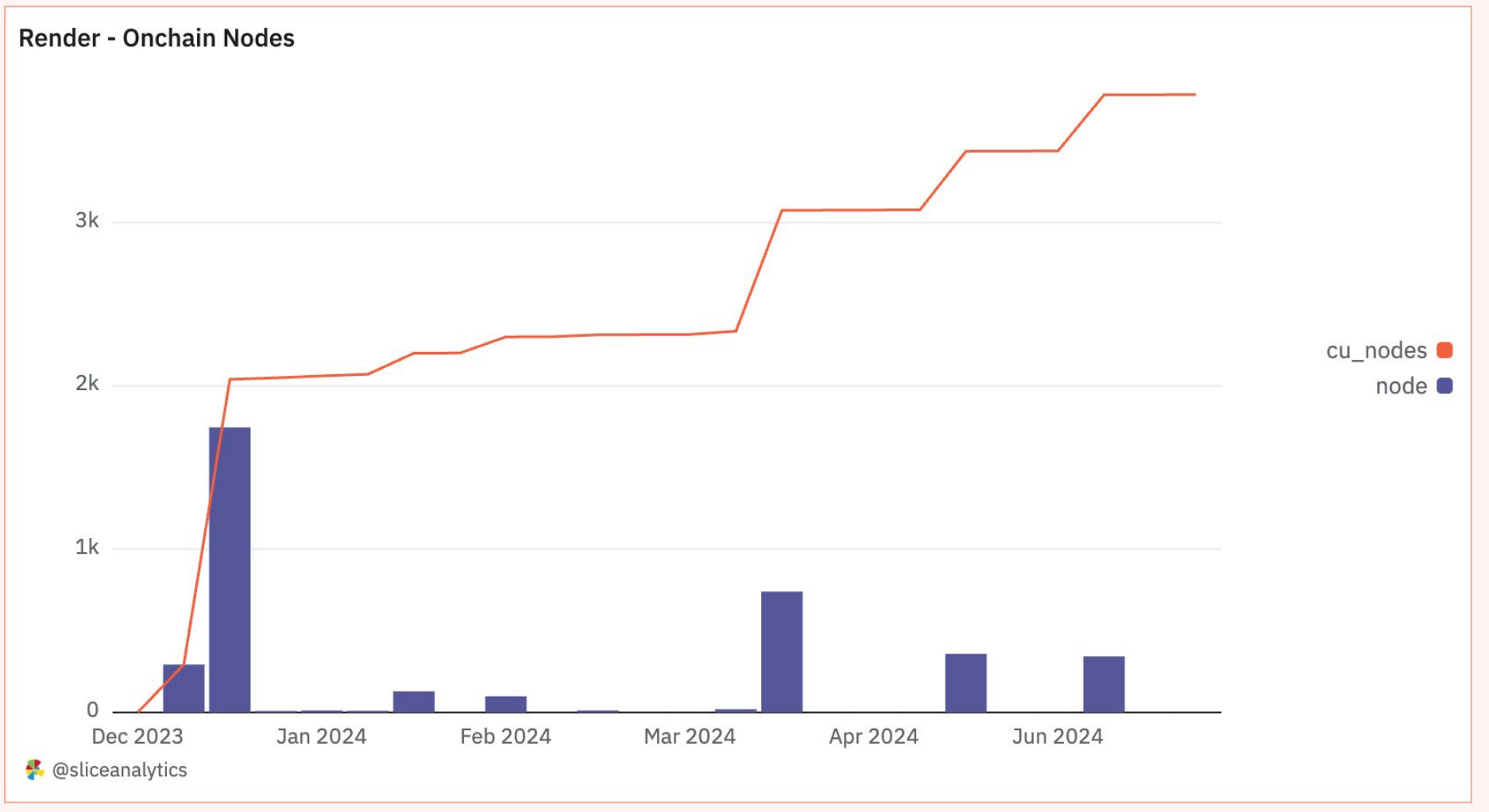

- Active on-chain nodes: 3,784

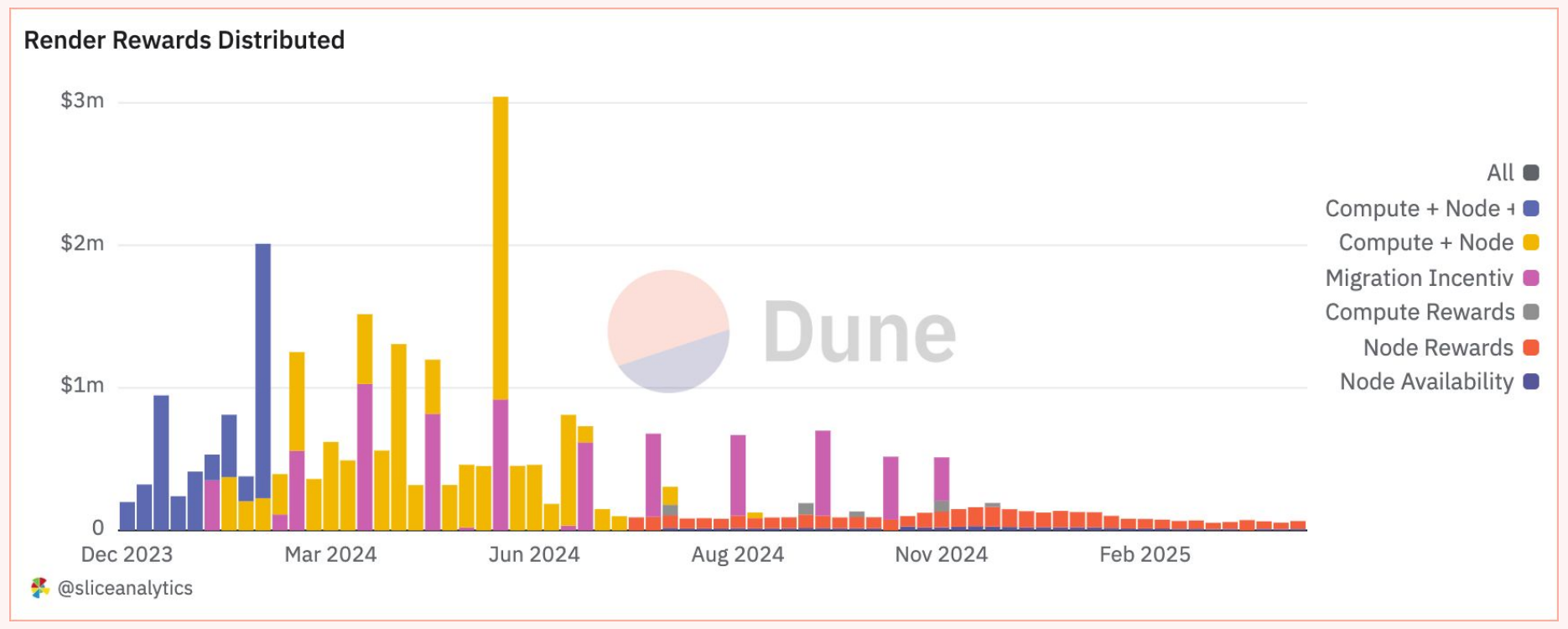

- RENDER tokens burned: over 121 million

- Tokens distributed to node operators: Over 2.4 million

The Render network allows anyone with idle GPU capacity to become a node operator and contribute computing power to decentralized rendering and AI infrastructure. Node operators rent out their GPU power to artists, studios, and AI developers who need scalable, on-demand computing, and in return they receive RENDER tokens.

As of April 2025, the Render Network has 3,784 active on-chain nodes, providing decentralized computing power for a growing ecosystem of creative and AI applications. To date, users accessing GPU power have burned more than 121 million RENDER tokens, while more than 2.4 million tokens have been minted to reward node operators, showing healthy demand and active participation in the ecosystem. Earlier news showed that revenue peaked at nearly $300,000 per week from November to December 2024, thanks to key upgrades (RNP-016 to 018), expanded artist incentives, and the Advent Calendar event with free GPU points and prizes. Another significant peak occurred in mid-April 2025, with weekly revenue reaching $70,000, indicating that creator demand and network adoption are recovering.

4. Nosana: Decentralized AI computing network

Nosana is a decentralized computing network that allows users to run AI inference tasks through a global GPU host grid. Participants register idle GPUs as nodes and earn $NOS tokens by completing tasks in the network's specific job market. Nosana's solution provides a scalable, censorship-resistant alternative that leverages underutilized GPU resources around the world, providing a more cost-effective option for AI computing.

Key Milestones:

- 2024: Launch of the global test grid

- 2024: Release Node V2, significantly improving performance

- 2025: GPU Market Mainnet Launch

Key Stats:

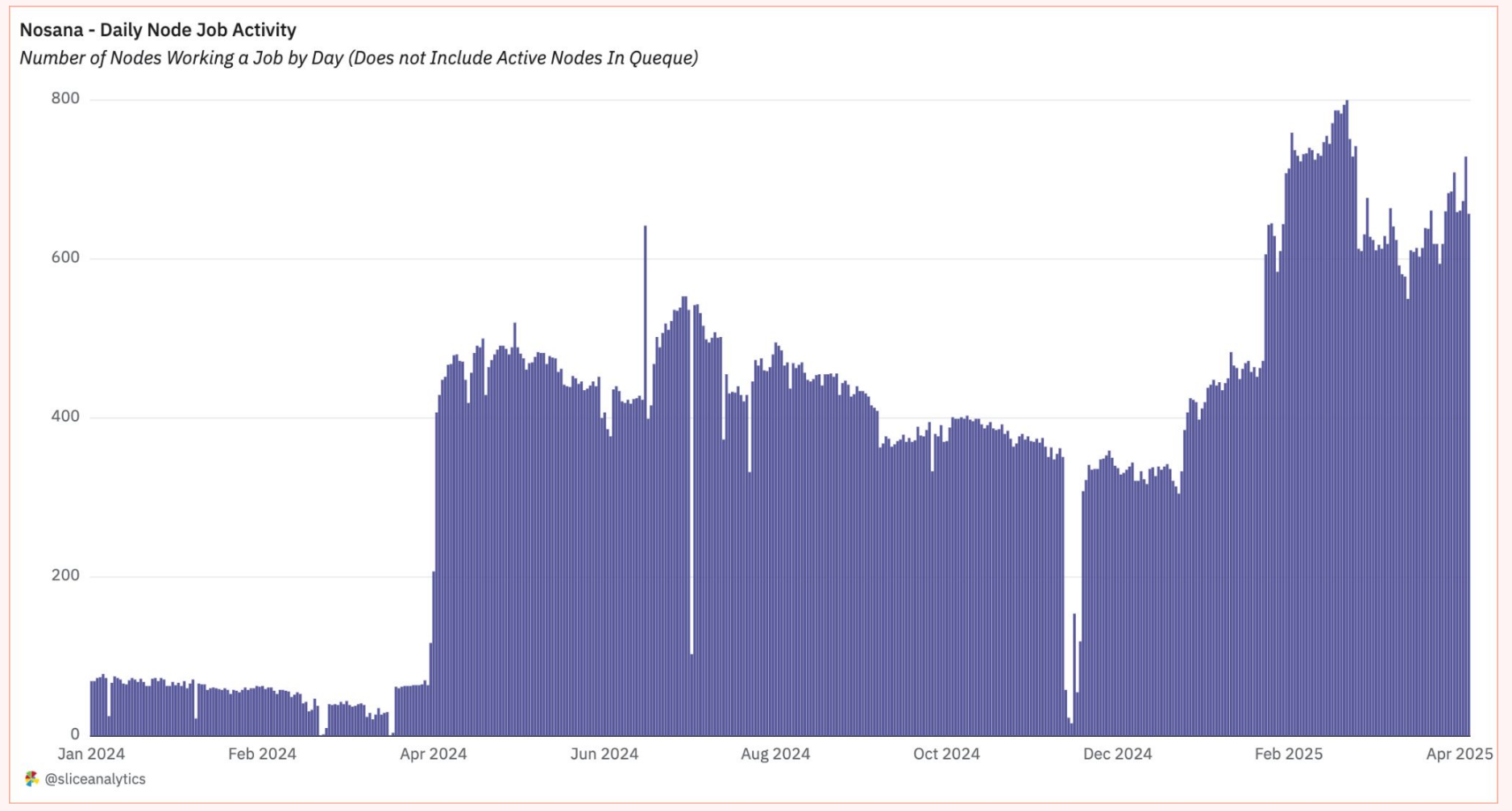

- Number of nodes worldwide: More than 4,200

- Daily active nodes: from an average of 300 in 2024 to more than 600 in 2025

In January 2025, Nosana officially launched its decentralized GPU marketplace to the public. This launch, after a year of closed beta, triggered a significant increase in node activity: daily active nodes increased from an average of 300 in 2024 to over 600, peaking at over 800 in March 2025. This growth indicates increasing adoption among GPU hosts and AI developers.

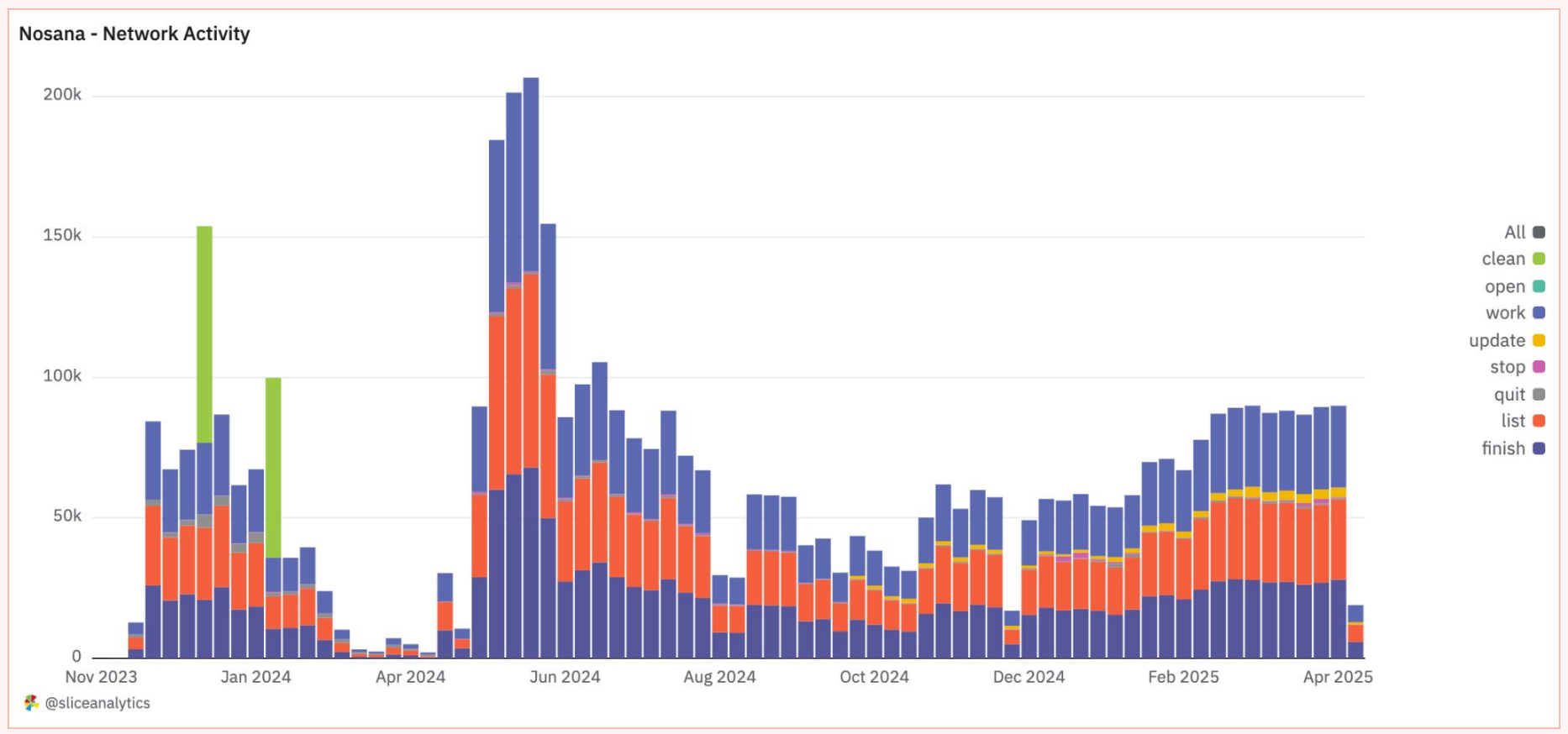

With over 4,200 nodes onboarded worldwide, Nosana has demonstrated scalable performance and sustained activity, becoming a strong decentralized alternative to traditional computing providers. Its on-chain activity is driven by node operators interacting with the work market, reflecting the actual usage of its decentralized GPU network. The network reached an all-time high of over 200,000 operations per week in May 2024 and has stabilized at around 80,000 operations, showing healthy, sustained demand for computing tasks.

Most of the activity comes from three key instruction types: create new jobs, queue nodes to perform tasks, and complete tasks and pay rewards. These three instructions represent the core work life cycle on the network and maintain a relatively stable usage pattern. Less common instructions such as stop, exit, and cleanup, about 1,000 times per week, show a low rate of early task termination or cleanup, further indicating system stability and good alignment of incentive mechanisms.

5. UpRock: Mobile-first data intelligence network

UpRock is a decentralized data intelligence network driven by a mobile-first DePIN model. Users can share unused internet bandwidth and computing power through the UpRock app, turning everyday devices into passive data contributors and earning $UPT tokens. These resources provide real-time, geographically diverse, and censorship-resistant data support for AI models.

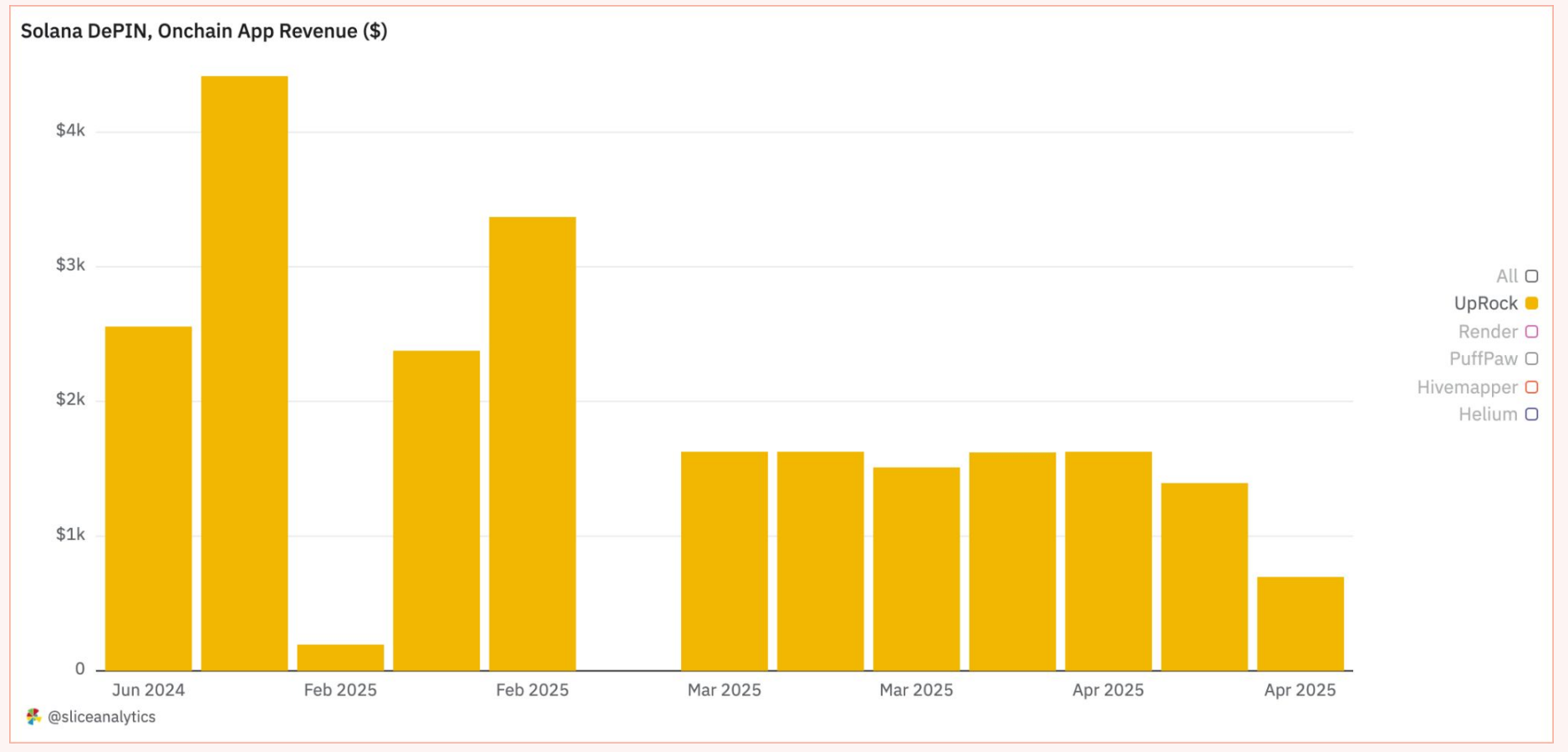

UpRock monetizes through SaaS subscriptions and pay-per-use APIs, with a portion of revenue used for on-chain $UPT token buybacks to fund contributor rewards and strengthen the ecosystem. After peaking at over $3,000 per week in February 2025, on-chain network revenue has remained stable at $1,500 per week.

Conclusion and key insights

- Solana’s leadership in DePIN : If the protocol chooses not to launch its own independent L1/blockchain, Solana has become the leading chain for DePIN, with a total market value of $3.25 billion for DePIN projects and an average market value of $191.3 million per project.

- On-chain activity proves the actual value of DePIN : DePIN is more than just a narrative. Projects such as Helium, Render, and Hivemapper have generated nearly $6 million in on-chain network revenue, a strong signal of real product-market fit.

- Computing and Wireless Categories Dominate the Market : The Computing (71.2%) and Wireless (22.2%) categories lead the market share in the Solana DePIN space (combined 93.4%).

- Node growth and service adoption accelerated : Helium surpassed 176,000 mobile users and 69,000 nodes, while Hivemapper and Render continued to expand their contributor base. Nosana doubled the number of active nodes after mainnet launch.

- Transparency challenges remain : Despite its practical applications, DePIN remains one of the most difficult areas of crypto to track on-chain activity due to its reliance on off-chain hardware and third-party integrations. While progress has been made, fully transparent and consistent on-chain measurement is still a work in progress.

You May Also Like

Is the last hope for the Bitcoin ecosystem dying? After two years of waiting, the RGB protocol mainnet launch is disappointing.

Galaxy's GK8 Launches Lido ETH Custody Service