Solana Takes Center Stage to Boost Its Corporate Crypto War Chest

Solana (SOL) continues to gain traction among corporate treasuries, mirroring the trend seen with Bitcoin and Ethereum. Public companies are increasingly holding Solana assets, which not only supports the token’s credibility but also showcases how traditional finance is integrating digital assets into their strategic holdings. As Solana’s ecosystem matures, its treasury activity presents a compelling alternative to ETFs, offering more active management and strategic growth potential within the crypto markets.

- Solana treasuries have accumulated over 6.3 million SOL, representing more than 1.6% of the circulating supply.

- Major institutions are holding Solana to leverage its high throughput and low transaction costs, with many aligning toward long-term investment strategies.

- Unlike ETFs, Solana treasury companies actively stake and deploy assets, participating in DeFi to generate yield.

- Market analysts believe Solana ETFs are poised for approval once regulatory uncertainties resolve, boosting institutional adoption.

- Solana’s growing treasury activity helps counteract inflation, with the network’s inflation rate set to decline to 1.5% over time.

Why Solana DATs look promising

Ranked as the sixth-largest cryptocurrency by market capitalization, Solana’s blockchain is often viewed as a viable competitor to Ethereum in the smart contract and DeFi spaces. Known for its high throughput and low transaction fees, Solana presents a compelling treasury asset, though its institutional adoption still lags behind Bitcoin and Ether.

Currently, Solana treasury holdings total approximately 2.46% of the total SOL supply, valued at nearly $3 billion. The largest holders include Forward Industries with 1.249%, and smaller allocations are held by DeFi Development Corp (DFDV), Upexi, and Sharps Technology.

DFDV, formerly a real estate platform, has been one of the top performers following its rebranding to focus on Solana treasuries. Source: Google FinanceJoseph Onorati, CEO of DFDV, commented, “We evaluated multiple layer 1 blockchains, and Solana emerged as the clear front-runner in technology. While Ethereum maintains the mindshare, Solana surpasses it across usage metrics and efficiency, yet trades at a fraction of Ethereum’s market cap.” He sees significant growth opportunities for Solana from this position.

Until now, no spot Solana ETFs exist, but market experts expect approval once the U.S. Securities and Exchange Commission (SEC) resumes normal operations following the ongoing government shutdown. Such ETFs would allow investors to gain exposure passively, mirroring the asset’s price movements.

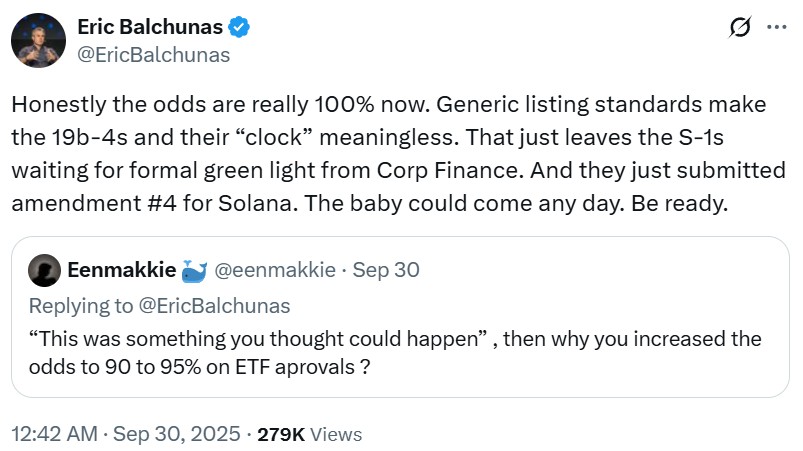

Bloomberg analyst Eric Balchunas predicts a near-certain approval for Solana ETFs. Source: Eric Balchunas

Bloomberg analyst Eric Balchunas predicts a near-certain approval for Solana ETFs. Source: Eric Balchunas

Unlike ETFs, which passively track prices, Solana treasury companies can actively deploy their holdings. For example, DFDV stakes SOL by running its own validator nodes and engaging in DeFi yield farming, aiming to grow their asset base even in flat markets. Although ETF providers are beginning to include staking features, DATs maintain greater operational flexibility for expanding their token holdings.

“Digital asset treasuries are a superior vehicle and are expected to eventually replace ETFs entirely,” Onorati stated.

Furthermore, Solana’s ecosystem familiarity is a key advantage. With widespread industry awareness, many institutional investors are willing to hold Solana long-term, which helps deepen its market penetration. Despite initial setbacks from the FTX collapse, which negatively affected Solana’s reputation, visibility from the incident has ultimately increased awareness of its active ecosystem and ongoing projects.

In March 2024, FTX’s estate announced the sale of 41 million SOL tokens at a 68% discount to institutional investors. This large transaction helped lock in billions of dollars’ worth of SOL under long-term vesting, turning a potential market overhang into a significant institutional bet on Solana’s future growth.

Constraints in Solana DAT models

While promising, Solana treasury models face challenges such as limited liquidity and competition for investor capital. Compared to Bitcoin and Ether, Solana’s treasury holdings and trading volume are relatively thin, which could impact market stability. Tim Chen, strategy lead at Mantle, noted, “Liquidity comparison really matters — Ethereum proxies are growing, and Solana DATs trade far less.”

Additionally, concentration risk remains a concern if a single entity accumulates a large share of SOL, raising questions about market influence and stability. Currently, the largest holders control only a few percent of supply, but further accumulation could attract regulatory or market scrutiny.

Crypto economist Thomas Chen categorized digital asset treasuries into three types: Bitcoin as a store of value, Ethereum and Solana as evolving but mature options, and other altcoins as higher risk with potential for dynamic use cases. He emphasized that these models are still in early phases but could outperform larger-cap assets if implemented effectively.

Solana DATs go global

Solana treasury activity is expanding internationally, with DFDV launching treasury franchises in South Korea and Japan. These efforts aim to adapt Solana’s treasury models to different regulatory and economic environments, similar to innovative strategies seen in Japan’s Metaplanet and Nakamoto models. While some critics see these initiatives as rebranding efforts, Onorati argues they’re about efficiency and fast-tracking market entry.

As Solana’s corporate adoption accelerates, its treasury activity not only helps stabilize the coin’s inflation rate — which is programmed to decline to 1.5% — but also signals growing institutional confidence. Long-term holders benefit from these strategies, which counteract token dilution and foster ecosystem expansion.

Ultimately, Solana’s treasury movement exemplifies how crypto-native mechanics are integrating into traditional corporate finance, paving the way for broader institutional participation and real-world impact on the blockchain. As the network continues to develop, it could redefine how companies engage with digital assets and leverage blockchain technology for strategic growth.

This article was originally published as Solana Takes Center Stage to Boost Its Corporate Crypto War Chest on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

Why The Green Bay Packers Must Take The Cleveland Browns Seriously — As Hard As That Might Be