Tether Shocks Wall Street With $127B in Treasuries – What’s the Catch?

Stablecoin giant Tether has released its Q2 2025 attestation, revealing $127 billion in holdings of U.S. Treasuries and a net profit of $4.9 billion for the quarter.

The report, completed by global accounting firm BDO, confirms the company’s asset backing for its USDT stablecoin and shows continued momentum in Tether’s global expansion.

As of June 30, the total value of Tether’s assets reached over $162 billion, with liabilities tied to issued tokens sitting just above $157 billion. That means the company’s assets continue to exceed its liabilities, reinforcing its solvency.

Tether Now Among Top 20 Holders of U.S. Treasuries With $127B Exposure

Tether’s exposure to U.S. Treasuries, $105.5 billion in direct holdings and $21.3 billion in indirect holdings, puts it ahead of several countries, including Germany, in total U.S. debt ownership. That amount has grown by $8 billion since the previous quarter, placing Tether among the top 20 holders of U.S. Treasury securities globally.

Tether CEO Paolo Ardoino commented on the findings, saying, “Q2 2025 affirms what markets have been telling us all year: trust in Tether is accelerating. With over $127 billion in U.S. Treasury exposure, robust bitcoin and gold reserves, and over $20 billion in new USD₮ issued, we’re not just keeping pace with global demand, we’re shaping it.”

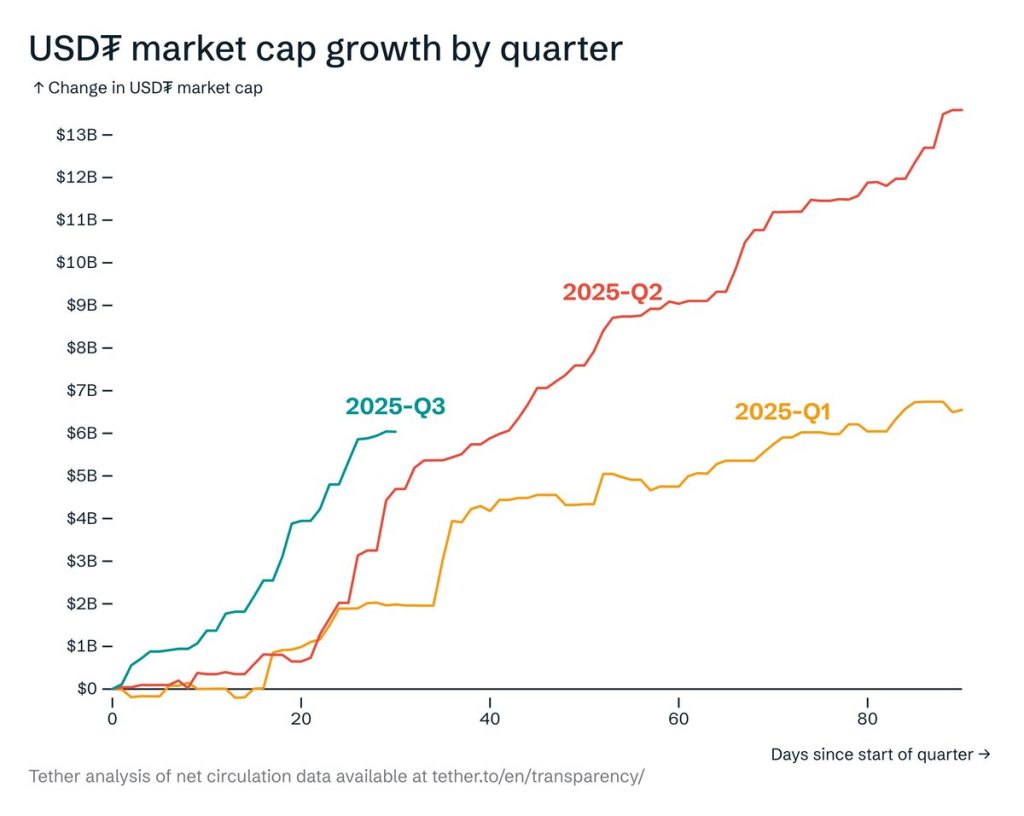

USDT’s circulating supply reached over $157 billion by the end of June, up by $20 billion since the start of the year. According to Tether, $13.4 billion of that was issued in Q2 alone, indicating growing demand across both emerging markets and digital finance platforms.

Beyond profits and supply growth, Tether’s report shows that the company’s shareholder equity remains steady at around $5.47 billion. This reserve buffer is meant to shield the company from shocks and ensure long-term operational strength.

Of the $4.9 billion Q2 profit, $3.1 billion came from recurring operations. The rest came from gains in Tether’s bitcoin and gold holdings.

Gregory Cowles, Chief Strategy Officer of Intellistake.ai, noted while speaking to CryptoNews that “when a stablecoin issuer starts to rival sovereign holders of debt, it shifts the conversation entirely. And with $4.9 billion in profit this quarter, most of it recurring, we’re seeing a model that isn’t just surviving—it’s thriving and operating at scale, showing real financial strength.”

Source: Paolo Ardoino

Source: Paolo Ardoino

In total, Tether has made $5.7 billion in profit during the first half of 2025. The company says it’s using this cash to fund long-term projects. That includes investments in technology platforms, data infrastructure, and media tools, such as the Rumble Wallet and XXI Capital.

The report also shows that nearly $4 billion of those investments have gone toward initiatives within the United States. Tether says it’s reinvesting more into foundational infrastructure than it ever has before.

Tether’s financial positioning comes as stablecoins draw closer attention from regulators. The U.S. has proposed several bills that would formalize the legal framework for digital dollars. In this context, Tether is pitching itself as a working example of a private sector solution that meets public objectives.

“USD₮ is helping billions access the stability of the U.S. dollar,” Ardoino said. “That mission has never been more urgent or more relevant.”

Connor Howe, CEO of Enso—a DeFi platform designed to be a DeFi-native liquidity layer—told CryptoNews, “Tether has positioned itself as one of the largest, if not the largest, influences of crypto adoption throughout the world. Netting $4.9b+ is great and shows how much of an impact Tether has had throughout the industry. Recently, their investment portfolios were released, further showing their ability to think out of the box compared to traditional crypto VCs; they enter new market segments to bring crypto adoption, like agriculture.”

Tether Expands Gold Reserves, Eyes U.S. Market Amid Stablecoin Growth

Stablecoins saw rapid growth in the first half of 2025, with total supply climbing from $204 billion to $252 billion, according to a report by CertiK. Monthly settlement volumes reached $1.39 trillion, driven largely by Tether’s USDT, which now commands over 62% of the stablecoin market.

Ardoino revealed that the company has amassed around $8 billion in gold reserves, stored in a private vault in Switzerland.

“We have our own vault. I believe it’s the most secure vault in the world,” Ardoino told Bloomberg, declining to disclose its exact location.

Ardoino framed the gold holdings as a hedge against potential fiat instability, citing growing concerns over U.S. debt. “If people start to get concerned about the potential increase of the debt of the U.S., they might look at alternatives,” he said.

Tether is also preparing for a return to the U.S. market following the recent passage of the GENIUS Act, signed by President Trump. The legislation introduces new federal oversight for stablecoin issuers, including a ban on interest-bearing tokens and stricter reserve disclosure requirements.

“We are well in progress of establishing our U.S. domestic strategy,” Ardoino said, noting a focus on institutional payments and interbank settlements.

You May Also Like

Coinbase shares fell 12%, their biggest intraday drop since April.

U.S. Treasury Secretary: Exploring the possibilities of decentralized computing and digital payments to unleash the potential of blockchain technology