This Is The Best Meme Coin To Invest In 2025, With More Potential Than PEPE, Here’s Why

The post This Is The Best Meme Coin To Invest In 2025, With More Potential Than PEPE, Here’s Why appeared first on Coinpedia Fintech News

In 2023, Pepe shocked the market when a $10,000 investment exploded into $1 million within just a few months. But 2025 is a different game; hype alone won’t make that happen again. Investors now demand real utility pouring money into a token with no future prospects is like gambling. The smart move is in presales, where entry costs remain low and the growth ceiling is high. That’s where Pepeto (PEPETO) shines: a blend of presale momentum, hype, and genuine utility a sharper path for Shiba Inu and Pepe enthusiasts chasing the next big run.

Early SHIB and Pepe holders are closely watching this presale because the pattern feels familiar only tighter. The formula is simple: culture fuels initial excitement, utility sustains it, and the price stays well below a penny. Pepeto aims to turn attention into daily use and trading volume, not just fleeting headlines. If you’re hunting for the next defining story, many investors are already zeroing in on this space.

But first, let’s take a quick look back at how PEPE delivered outsized returns in 2023 and why Pepeto is poised to replicate or even surpass that success.

How Pepe Created Millionaires, And Why Pepeto Might Be Next

In April 2023, Pepe launched and surged over 10,000% by May, turning a few hundred dollars into life-changing sums for early supporters. Feeds, memes, and influencers fueled the rocket, and the chart reflected that hype. But for those watching from the sidelines, it was a painful reminder many still regret missing that explosive run. The inevitable came: by August, PEPE had given back over 70% from its peak, a stark lesson that hype alone fades fast when the mass joins the exit.

That’s why capital in 2025 keeps returning to Pepeto. It’s an Ethereum memecoin backed by real, tangible tools: PepetoSwap a zero-fee exchange optimized for quick trades; a native cross-chain bridge to move assets smoothly across networks; and staking offering up to 227% APY, designed to reward early supporters and incentivize holding.

All these elements craft a pathway where SHIBA INU and Pepe culture coexist alongside genuine on-chain usage. The presale has already surpassed $6.7 million, and a global community of over 100,000 members continues to grow.

For traders looking for SHIBA and Pepe-like returns with a stronger foundation, Pepeto feels like the next chapter familiar energy, a tighter product, and a clearer route to life-changing gains. Many analysts predict that once listings and deeper liquidity arrive, the upside could be enormous and at that point, it might be too late to get in.

Pepeto (PEPETO): An Ethereum Memecoin Built For Real Strength

Pepeto amplifies what made SHIBA INU and Pepe explosive energy and speed by adding the critical missing pieces. It operates on the Ethereum mainnet, close to deep liquidity pools and a vibrant community of builders. Most importantly, it provides an integrated hub designed to unify the wider memecoin scene, bringing everything together in one place.

Because every swap involves the PEPETO token, genuine on-chain activity can translate into consistent demand, making it highly likely that the token’s price will rise exponentially over the coming years.

Think of Pepeto as a memecoin engine on rails: culture ignites the spark, while practical tools keep it moving forward. The presale has already raised millions, while the entry point remains extremely low, drawing early attention. If listings, on-chain volume, and daily usage grow in sync, this setup points toward significant upside potential analysts predict up to 100x built for long-term endurance, not just a quick spike.

No other memecoin provides this level of practical value: speed, utility, and a shared platform for the entire memecoin community.

Why Pepeto Is The Best Meme Coin To Invest In 2025

Unlike Pepe and SHIBA INU, which launched on hype alone and saw rapid but short-lived surges, Pepeto is built with a clear mission: to be a lasting project. The team treats this as a legacy venture shipping quickly, refining every detail, engaging actively with the community, and consistently pushing for growth each week.

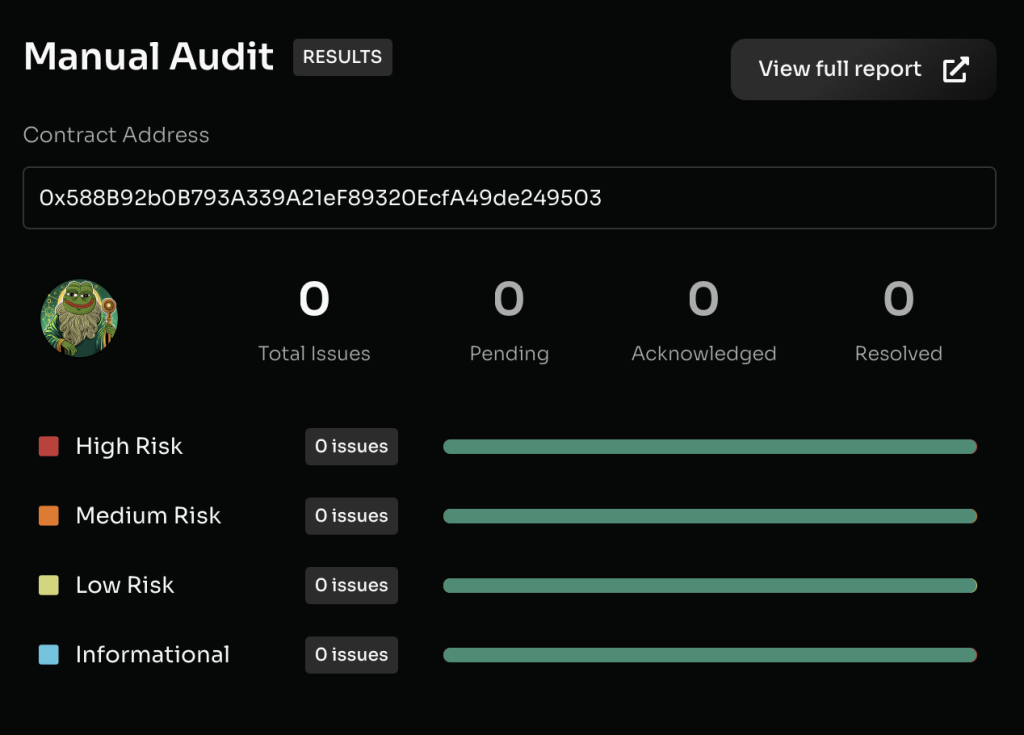

While SHIBA and Pepe began the early chapters, Pepeto aims for the entire story: a limited supply, practical products that users actually utilize, and code reviewed by independent experts like Coinsult and Solidproof providing a level of security many presales lack. This builds trust with big investors who see stability and potential, not just hype.

The presale rewards early supporters with priority access, staged price increases, and promising early traction suggesting a long line of buyers. That’s the advantage: utility combined with purpose, culture with tools, designed to continue growing far beyond hype-driven spikes.

If there’s a project poised to outshine Pepe and SHIBA in 2025, it’s Pepeto ready to be the one people brag they discovered first. No smart investor should miss this opportunity. The current presale price is just $0.000000154 the lowest it will likely ever be so don’t miss out on this rare chance.

Disclaimer

Only buy PEPETO from the official site: https://pepeto.io/ . As listings get closer, copycat pages and fake accounts may appear. Always double-check the URL and ignore unsolicited DMs.

Official Channels

- Website: https://pepeto.io/

- X (Twitter): https://x.com/Pepetocoin

- Instagram: https://www.instagram.com/pepetocoin/

You May Also Like

Bitwise CEO: In the next 6 to 12 months, the focus of the crypto field will be on the credit and lending market

US Deficit to Surpass $2 Trillion Despite Record Tariff Revenue