Top 3 Cryptos That Could Turn $100 Into $5,000 in 2025 – Including This Meme-to-Earn Token’s Game-Changing Potential

Ethereum (ETH): The Cornerstone of Web3 Growth

Ethereum is often called the backbone of blockchain innovation, and for good reason. While it might not deliver the same overnight 100x gains as some newer tokens, it has a proven track record of building lasting value. If you’re serious about long-term portfolio growth, ETH is a cornerstone worth holding.

- Pioneering Smart Contracts: Ethereum was the first blockchain to enable programmable smart contracts, paving the way for decentralized apps (dApps), NFTs, and the DeFi boom. Entire industries now run on ETH’s backbone.

- Proof-of-Stake and Beyond: After the 2022 Merge, Ethereum became more eco-friendly, cutting energy use by over 99%. The next big leap, sharding upgrades, is set to drastically reduce gas fees and increase scalability.

- Developer Powerhouse: With the largest developer community in Web3, Ethereum continues to attract talent and projects, keeping it ahead of competitors.

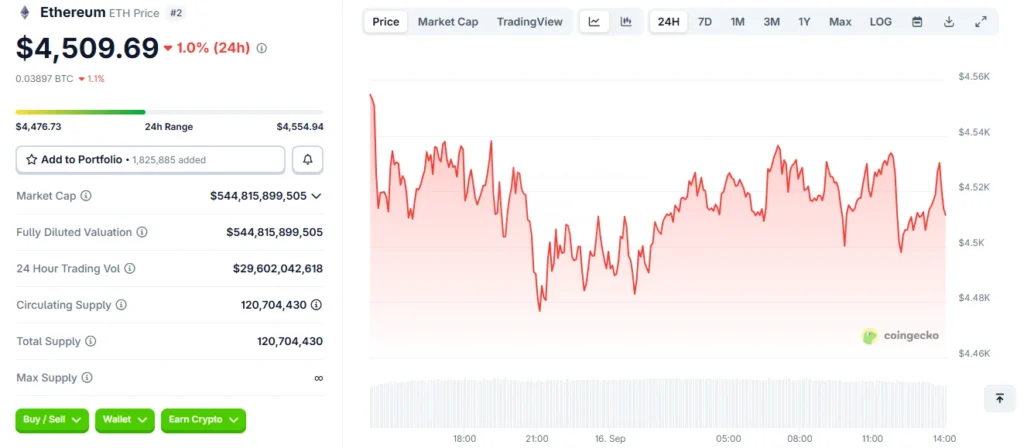

Ethereum ranks #2 globally with a market cap of approximately $546.6 billion as of September 2025

Source: Coingecko – Ethereum

Shiba Inu (SHIB): Meme Coin With Real Utility

Shiba Inu is no longer just a “Dogecoin copycat.” Over the past two years, SHIB has proven its staying power by expanding its ecosystem and delivering real utility while keeping its meme coin charm alive.

- Shibarium Layer-2 Network: This major upgrade provides faster and cheaper transactions, opening new opportunities for developers and users.

- Massive Burn Program: Through the Shibburn initiative, billions of SHIB tokens are removed from circulation monthly, making the supply scarcer over time.

A Loyal Army of Holders: With more than 1.3 million wallets, SHIB’s community (often called the “Shib Army”) remains one of the most active and passionate in crypto.

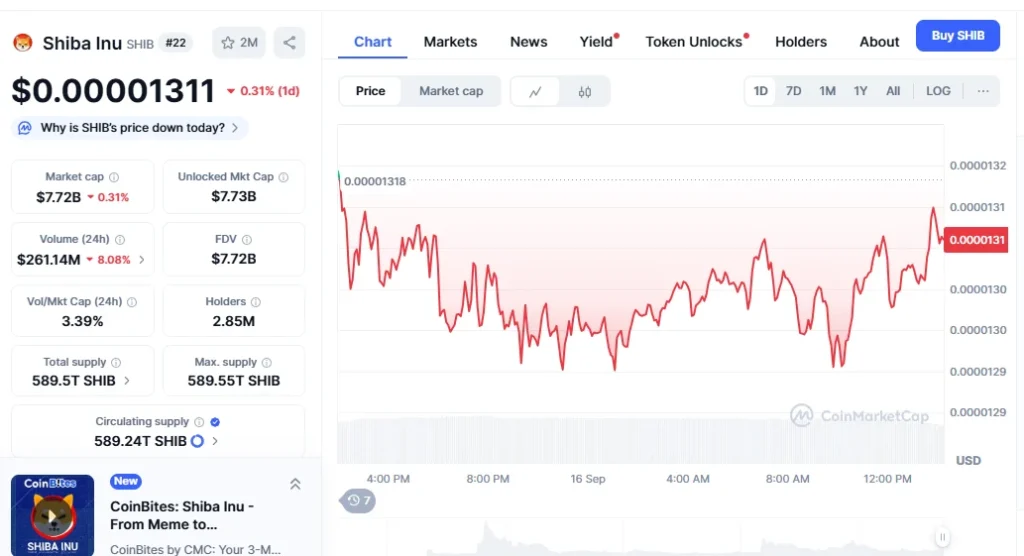

SHIB consistently ranks among the top 20 tokens by market cap on CoinMarketCap.

Also, visit the twitter page : Shibburn on X

Moonshot MAGAX ($MAGAX): The First Meme-to-Earn Presale

While Ethereum offers stability and SHIB blends memes with utility, Moonshot MAGAX is the wildcard that could multiply early investments. As the first AI-powered Meme-to-Earn token, MAGAX is redefining how meme coins create and distribute value.

- Founder-Led Vision: Led by Jatinder Pal Singh, a former Apple senior, MAGAX has strong leadership and technical credibility.

- Loomint AI Platform: This proprietary system scans viral content across TikTok, X, and Reddit, rewarding creators and amplifiers automatically. Memes now generate real economic rewards.

- Scarcity by Design: MAGAX has a fixed supply of 1 trillion tokens. Its buy-back-and-burn program, funded by ad revenue and transaction fees, creates constant deflationary pressure. MAGAX Whitepaper.

- Community-Driven Growth: With DAO governance, staking rewards, and referral bonuses, MAGAX empowers holders to shape its future.

Presale Stage 2 is live at ~$0.00027 per token. Early buyers get up to +5% bonuses.

Secure your MAGAX tokens now

Balancing Stability & Moonshots

The best portfolios balance safety with upside potential:

- Ethereum (ETH) provides long-term security and dominance in smart contracts.

- Shiba Inu (SHIB) blends meme energy with actual ecosystem utility.

- Moonshot MAGAX ($MAGAX) offers a once-in-a-cycle presale opportunity with disruptive Meme-to-Earn technology.

If you missed out on Dogecoin’s early days or Shiba Inu’s 2021 rally, MAGAX could be your second chance at a moonshot.

Don’t wait! The MAGAX presale is filling fast, and early stages carry the biggest upside.

You May Also Like

Wormhole Unleashes W 2.0 Tokenomics for a Connected Blockchain Future

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps