Top Fed Official Michelle Bowman Says Staff Should Hold Small Amounts Of Crypto To Understand It

Federal Reserve Vice Chair for Supervision Michelle Bowman said Fed staff should be allowed to hold small amounts of cryptocurrency to gain firsthand experience with blockchain technology.

Speaking at a blockchain event in Wyoming, Bowman argued that the central bank should consider letting employees own “minimal amounts of digital assets” to gain a better understanding of how it works.

She stressed that direct participation is the best way to understand how ownership and transfers function on the blockchain

“There’s no replacement for experimenting and understanding how that ownership and transfer process flows,” Bowman said. “I certainly wouldn’t trust someone to teach me to ski if they’d never put on skis, regardless of how many books and articles they have read, or even wrote, about it.”

She didn’t say what types of products or what amounts she would suggest the Fed should allow.

Fed Staff, Spouses Not Allowed To Own Crypto

Her comments come despite rules introduced in 2022, when the Fed banned staff and their spouses from holding crypto or related products after revelations that three senior officials engaged in controversial trading during the early stages of the pandemic.

As a result of those tightened rules, Fed staff and their spouses are not allowed to own crypto or products that are linked to digital assets, including crypto ETFs (exchange-traded funds) and shares in digital asset companies.

By easing the restrictions, Bowman also believes that it will be much easier to recruit and retain “examiners with the necessary expertise.”

Regulators ”Overly Cautious” About New Financial Products

Bowman added that regulators remain “overly cautious” about adopting new financial products, but urged her peers to recognize the benefits of “embracing technology in the traditional financial sector.”

Bankers have grown increasingly concerned that the technology will render their legacy systems obsolete and negatively impact their current business models, especially given the fact that Bitcoin and its blockchain technology was invented to cut out middlemen in financial transactions.

Since Donald Trump entered the White House for a second term, several banks and financial institutions have become more involved in digital assets under the President’s pro-crypto policy.

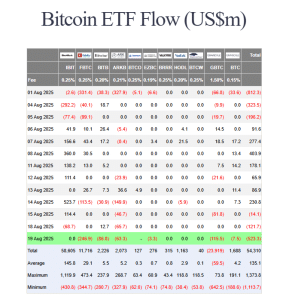

Most notably, asset management giant BlackRock now manages the largest spot Bitcoin and spot Ethereum (ETFs) globally in terms of cumulative inflows. Since each of the product’s respective launches, BlackRock’s spot Bitcoin ETF (IBIT) has seen over $58.6 billion in cumulative inflows, while the figure for BlackRock’s ETH ETF (ETHA) stands at over $12 billion.

US spot Bitcoin ETF flows (Source: Farside Investors)

Bowman said that technology will inevitably “change the banking system regardless of how banks and regulators choose to respond.”

Regulators and financial institutions will have to choose whether to embrace the change and help shape a “reliable and durable” framework for crypto, or “stand still and allow new technology to bypass the traditional banking system altogether,” she added.

Bowman acknowledged that risks come with adopting new technologies, but said those perceived risks can be offset by “the potentially extensive benefits of new technology.”

SEC Also Changing Its View On Crypto

The Securities and Exchange Commission (SEC) is also embracing crypto. Speaking at the same event as Bowman, SEC Chair Paul Atkins suggested that only a small number of crypto tokens should be considered securities.

That marks a major pivot from the views of former Chair, Gary Gensler, who opted for a regulation-by-enforcement approach to regulating the digital asset industry and alleged that the “vast majority” of crypto companies were selling unregistered securities.

“There are very few, in my mind, tokens that are securities, but it depends on what’s the package around it and how that’s being sold,’ Atkins said.

Atkins’ comments come as members of Congress plan to pass a new law, called the Digital Asset Market Clarity (CLARITY) Act, to establish a crypto market structure next month.

You May Also Like

Wiki Cat Climbs 293% Amid Market Slump as Meme Coin Breakout Tool Snorter Bot Token Nears $3.5 Million in ICO

New Crypto Assets Group Backed By Trump Gets Green Light