Turn crypto into daily income: How JAMining’s fixed-return model works

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As crypto markets stay uncertain, JAMining offers a way to earn daily USD-based returns from digital assets; no trading, hardware, or market timing needed.

Table of Contents

- How it works

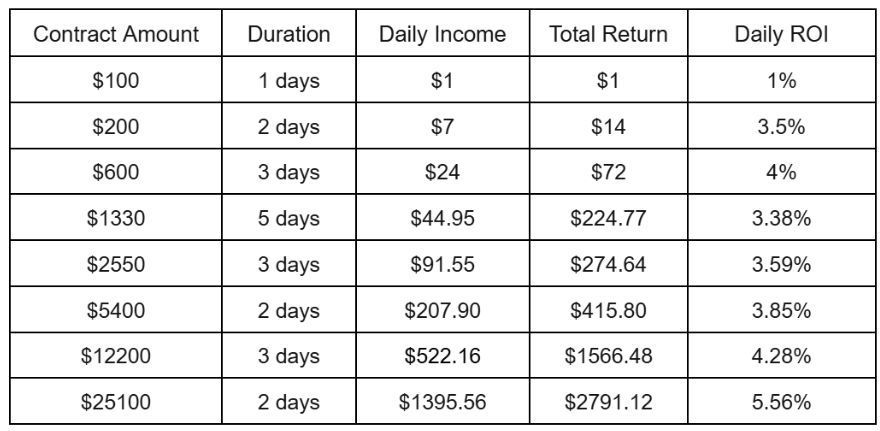

- Sample profit contracts (as of August 2025)

- Why users are switching to JAMining

- About JAMining

- JAMining uses renewable-powered, AI-optimized cloud infrastructure and emphasizes global compliance and ease of use.

- Users deposit crypto (BTC, ETH, DOGE, XRP) into fixed-term mining contracts and receive daily USD profits.

- Original crypto is returned at contract maturity, allowing for potential asset appreciation alongside fixed income.

While many cryptocurrency investors remain stuck in a cycle of “buy and hold,” awaiting the next bull run, a growing segment of the market is opting for immediate, predictable returns. At the center of this shift is JAMining, a global cloud mining platform that bypasses the volatility of token prices by delivering daily USD-denominated profits, credited directly to user accounts, with no delays, no hardware required, and no market guesswork.

With Bitcoin hovering in a narrow range and Ethereum struggling to maintain momentum, JAMining’s model offers an alternative: turn digital assets into daily income without selling them. Users deposit their preferred cryptocurrency, BTC, ETH, DOGE, or XRP, and initiate short-term mining contracts. All earnings are settled in U.S. dollars, and the original crypto deposit is returned at maturity, allowing users to benefit from both fixed yield and any potential rebound in the asset’s value.

“It’s no longer about speculating on price,” said a JAMining spokesperson. “It’s about making your crypto work for you, starting now, not months from now.”

How it works

JAMining uses proprietary, AI-enhanced mining infrastructure hosted in low-emission, renewable-powered data centers. The platform optimizes hash power across BTC, ETH, and DOGE pools based on real-time yield metrics. Users access everything via a web interface or mobile app, with no technical setup or energy concerns.

Importantly, the platform’s fixed-income model is structured to offer clarity and transparency, essential in a space often marred by complexity and misinformation.

Sample profit contracts (as of August 2025)

Discover more contract details on the official website.

All returns are credited in USD, ensuring no exposure to price dips during the contract period. Upon contract completion, users withdraw their original crypto or reinvest it into new contracts.

Why users are switching to JAMining

- No hardware needed – 100% cloud-based access

- No price timing required – Profits accrue regardless of market performance

- Dual return potential – Earn fixed USD returns plus crypto appreciation on withdrawal

- Global compliance focus – Infrastructure aligned with major financial regulations

- Eco-friendly – Powered by renewable energy sources across multiple regions

About JAMining

JAMining is a globally accessible cloud mining platform providing fixed-income contracts to users seeking stability in the digital asset space. With an emphasis on compliance, sustainability, and user-first innovation, JAMining continues to redefine how crypto holders earn yield, without speculation, without waiting.

Discover how to start earning in minutes on the official JAMining website.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Negentropy Capital announces dissolution and will liquidate remaining funds and project quotas

From XRP to ETH: Why crypto investors choose Quid Miner’s mobile cloud mining platform