VeChain, Algroand & Remittix Are Tipped As The Best Altcoins To Buy Now In October

DeFi tokens have assembled for the final run-in of the year. 2025 is ending in a few months, and already, we have contenders for the best altcoins to buy.

VeChain is sporting an attractive opportunity for buyers, Algorand just got some catalysts for an October spike, and Remittix has been immaculate for the past quarter.

It’s a season for low-end altcoin investment; here are the best altcoins to buy in 2025.

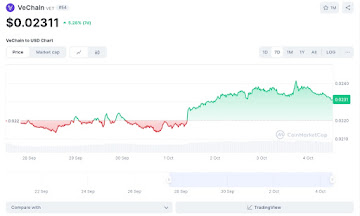

VeChain: Low Cost To Attract Buyers?

The VET token recently spiked, much to the surprise of altcoin traders. VeChain has been notably quiet despite the activity in the crypto market, and the 5.2% seven-day profits have indicated it could be a reliable investment for Q4.

It also helps that the VeChain token is currently valued at $0.02311 and holds some potential for the coming year.

Algorand Switches Gear For Q4 Heat

The ALGO token trades at a lowly $0.21, but its 5.43% in the past week has seen Algorand go up on the list of best altcoins to buy. The Algorand Foundation just changed CTOs, appointing ex-Ripple engineer Nicolaos Bougalis.

The appointment is appropriately timed, too, as Algorand also partnered with Allbridge for cross-chain stablecoin functionalities.

Utilities have been at the heart of DeFi altcoin projects, even as they struggle to balance volumes in trading. VET and ALGO might rank among the best altcoins to buy, but Remittix presents a far stronger potential for gains.

Here’s more on RTX.

Remittix: Benefit From Utilities, Earn From The Hype

The RTX project has its sights set on revolutionizing the PayFi sector in cryptocurrency. With Remittix, users will be able to deposit crypto tokens directly into their fiat bank accounts, anywhere in the world.

That utility comes with added perks, mainly because Remittix is built on the Ethereum blockchain. There is increased security on transactions, faster, more seamless transaction processing, and reduced gas fees to boot.

And the hype? Remittix’s presale is going strong, with over $27 million realized in about nine months. The Remittix Web3 wallet is expected to launch in December; what more could any trader be waiting for, especially when Remittix has a 25x potential for gains?

Remittix Coins Go For $0.113!

The hype on RTX tokens is more now that there’s a referral program to earn from. Share your link and earn 15% of your referral’s purchase, in USDT!

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post VeChain, Algroand & Remittix Are Tipped As The Best Altcoins To Buy Now In October appeared first on Live Bitcoin News.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?