Vitalik Buterin Sells Two Meme Coins, Scores $114.7K in 13,889 USDC & 28.58 ETH

Key Takeaways:

- Vitalik Buterin recently sold two memecoins he had received as gifts, converting them into 13,889 USDC + 28.58 ETH (≈ $114,700)

- This move mirrors his consistent approach of liquidating unsolicited meme tokens and often directing proceeds toward charitable or neutral uses

- These kinds of sales have the propensity to cause acute fluctuations in meme token markets and affect the sentiment speculation

Ethereum co-founder Vitalik Buterin made a lightning-fast trade to liquidate two memecoins he had received as a gift and convert them into stablecoin and ETH. This gesture again illustrates how high-profile wallets interact with speculative crypto assets and shakes out ripple effects across niche token markets.

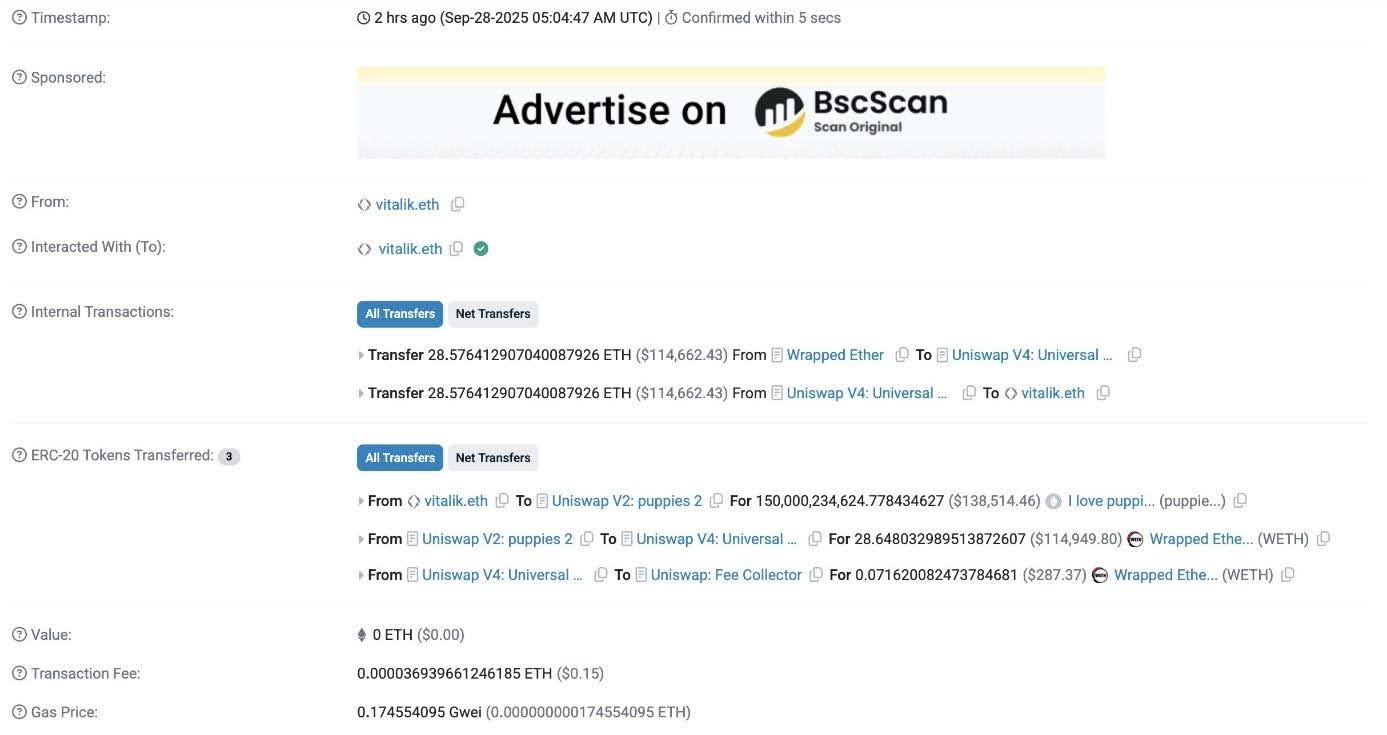

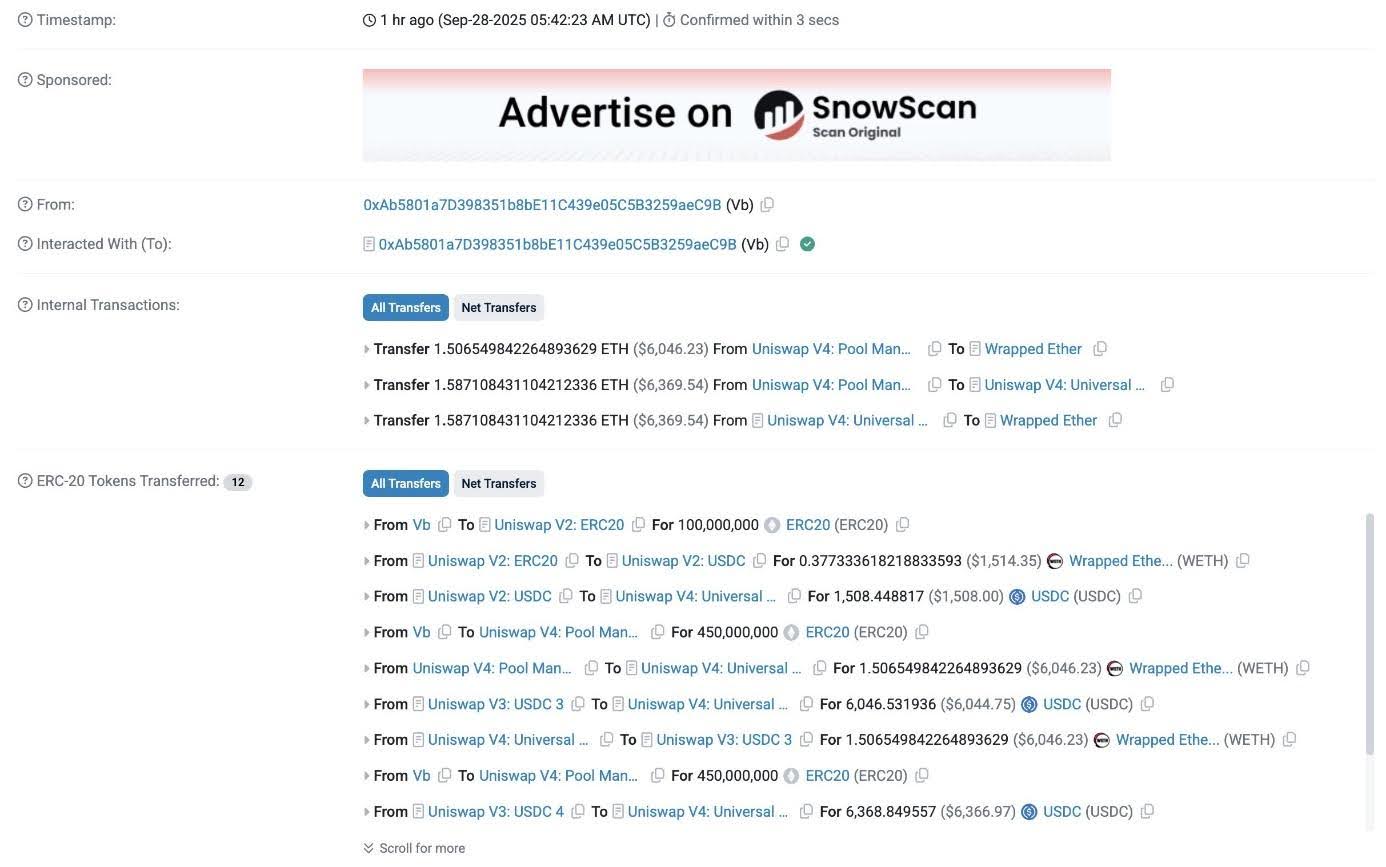

On-Chain Sale Breakdown

What Was Sold and the Returns

Blockchain monitoring through Lookonchain reports that Vitalik sold two memecoins he had received within a two-hour window, netting 13,889 USDC and 28.58 ETH. The total value of the transaction is estimated at $114,700 (based on market rates).

These tokens were not purchased by him; they were unsolicited transfers that ended up in his wallet. His decision: convert them quickly rather than hold speculative assets.

Read More: Vitalik Buterin Warns: Ethereum Risks Becoming Just Another Corporate Protocol

Pattern & Philosophical Consistency

This is not the first act like this that Vitalik has performed. A long-standing policy of his has been that any memecoins received at his address without prior notice will be sold or given away.

Such sales have traditionally been donated to charity or research funded projects. In most situations, he has preferred to channel them through his philanthropic or biotech-oriented organization, Kanro.

Read More: GameSquare Greenlights $100M Ethereum Strategy, Eyes Up to 14% Yield via DeFi Alliance

The post Vitalik Buterin Sells Two Meme Coins, Scores $114.7K in 13,889 USDC & 28.58 ETH appeared first on CryptoNinjas.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?