Bitcoin Falls to $86K as Senate Delays Crypto Market Structure Bill

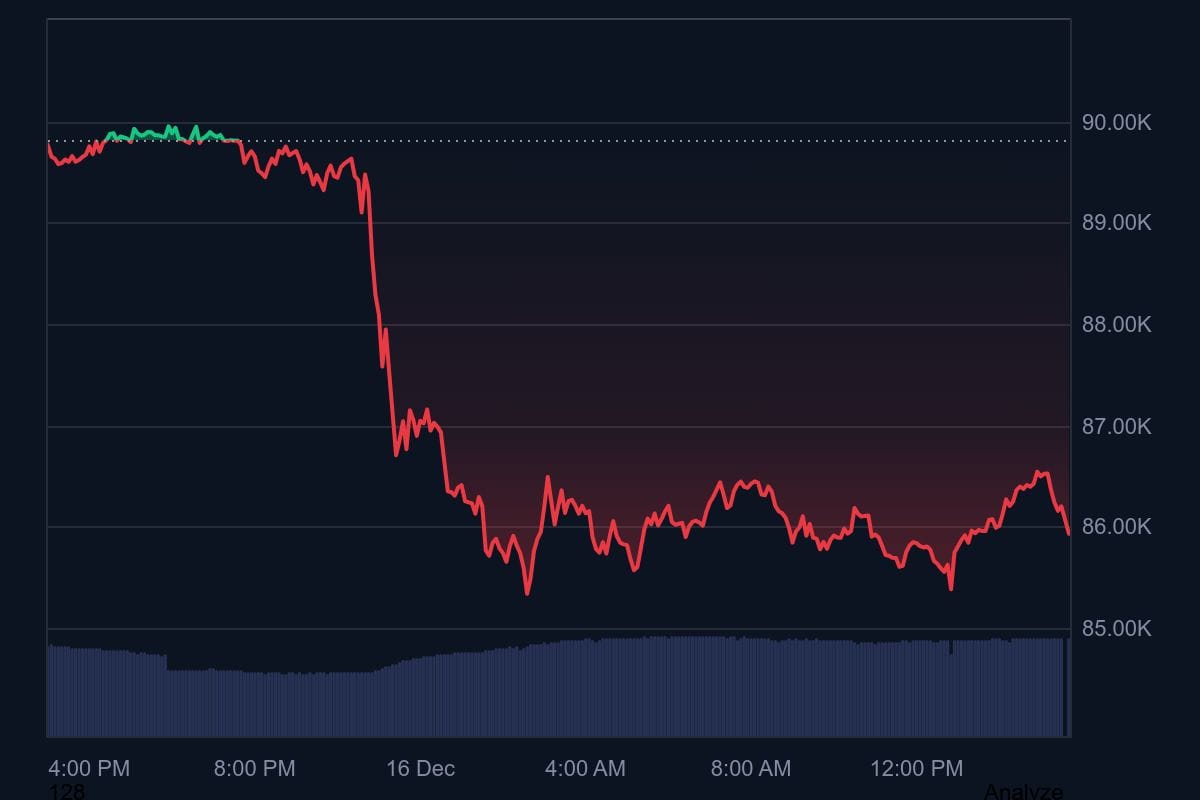

Bitcoin dropped over 4% in the past 24 hours after the U.S. Senate Banking Committee confirmed on Monday that it would delay markup of long-awaited crypto market structure legislation until early 2026, extending regulatory uncertainty that has weighed on institutional sentiment.

The benchmark cryptocurrency briefly touched $84,000 before stabilizing near $85,800 in Asian trading hours, while Ethereum declined over 6% to $2,900. Total cryptocurrency market capitalization fell below $3 trillion to $2.93 trillion as the sell-off rippled across major tokens.

The Senate Banking Committee said it ran out of time to advance the bill before Congress adjourns for the holiday recess, despite nearly two months of active bipartisan negotiations. Chairman Tim Scott's office said discussions would continue, with a markup now targeted for early 2026.

"Chairman Scott and the Senate Banking Committee have made strong progress with Democratic counterparts on bipartisan digital asset market structure legislation," the committee's GOP statement read, adding that Scott "has consistently and patiently engaged in good-faith discussions to produce a strong bipartisan product."

The postponement leaves unresolved how the SEC and CFTC will divide oversight of spot markets and digital asset securities, a jurisdictional question that has created compliance challenges for U.S.-based crypto firms.

Exchange-traded fund flows reflected the defensive shift in positioning. Bitcoin spot ETFs recorded $358 million in outflows, while Ethereum ETFs shed $225 million, according to market data. Combined outflows totaled $582 million across the two largest crypto assets.

In contrast, Solana and XRP ETFs remained positive with inflows of $35 million and $11 million respectively, suggesting selective appetite for specific tokens rather than wholesale risk-off behavior.

The Senate Agriculture Committee, which has jurisdiction over CFTC-related crypto legislation, has not scheduled its own markup, further reducing the likelihood of comprehensive digital asset rules being finalized before mid-2026.

The delay reintroduces policy uncertainty at a time when institutional crypto adoption has accelerated ahead of regulatory clarity. For asset allocators, the gap between market development and legislative frameworks creates friction that translates into higher risk premiums and faster de-risking when sentiment deteriorates.

Ayrıca Şunları da Beğenebilirsiniz

Xsolla Expands MTN Mobile Money Support to Congo-Brazzaville and Zambia, Enhancing Access in Fast-Growing Markets

iGMS Introduces AI-Driven Pro+ Plan, Cutting Host Workloads by Up to 85%