SEC Drops 4-Year Aave Investigation Following ‘Significant’ Defense Battle: Report

The U.S. Securities and Exchange Commission has formally concluded its multi-year investigation into the Aave Protocol without recommending any enforcement action.

The action ends nearly four years of regulatory uncertainty surrounding one of decentralized finance’s most widely used lending platforms.

Aave founder and chief executive Stani Kulechov disclosed the outcome in a public post on August 12.

Aave Survived the SEC’s DeFi Crackdown — Here’s What Happened Behind the Scenes

The probe into Aave began around late 2021 or early 2022, during a period of heightened regulatory scrutiny of decentralized finance platforms.

At the time, the SEC was expanding its enforcement focus beyond centralized exchanges to include protocols offering lending, borrowing, and liquidity services without traditional intermediaries.

While the SEC did not publicly outline the scope of its concerns, industry observers have long assumed that the inquiry centered on whether the AAVE token or aspects of the protocol’s operations fell under U.S. securities laws and whether any registration obligations applied.

Throughout the investigation, Aave cooperated with regulators, engaging with SEC staff over several years.

In June 2025, Aave representatives met with members of the SEC’s Crypto Task Force to discuss regulatory approaches, though the agency has not indicated whether those discussions were connected to the closure decision.

Kulechov said the process required significant effort and resources from both the company and him personally, describing the investigation as a prolonged period of regulatory pressure not only for Aave but for decentralized finance more broadly.

As is typical in cases that end without enforcement, the SEC did not publish findings or allegations tied to the probe.

The letter stated that, as of that date, staff did not intend to recommend an enforcement action to the Commission in connection with the investigation identified internally as “HO-14386.”

The notice followed standard SEC practice and included a disclaimer that the decision should not be interpreted as an exoneration and does not prevent the agency from reopening the matter in the future.

The SEC has consistently maintained flexibility to act quickly when investor protection concerns arise, avoiding rigid procedural rules that could delay enforcement.

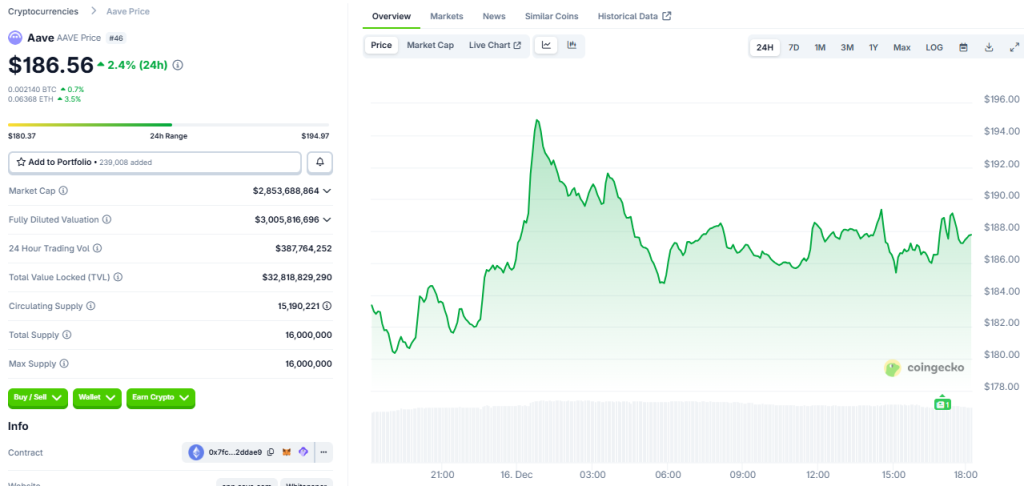

Notably, earlier today, the Aave (AAVE) token reached a high of $194 before dipping to a low of $184. The token has since stabilized at $187.67, marking a 2.4% gain over the past 24 hours.

Source: CoinGecko

Source: CoinGecko

For Aave users, it means the protocol can continue operating without the immediate risk of U.S. enforcement action tied to the long-running SEC investigation.

It also reduces regulatory uncertainty around Aave’s core products, offering users more confidence that the platform will remain accessible and stable in the near term.

Is the SEC Done Fighting Crypto? Major Cases Close Without Charges

Aave’s case is the latest in a growing list of high-profile crypto investigations closed without charges in 2025.

In December, Ondo Finance disclosed that the SEC had ended its own multi-year probe into the firm’s tokenized real-world asset products and its ONDO token.

The broader enforcement landscape has shifted notably since early 2025, as the SEC has dropped or dismissed cases and investigations involving Coinbase, Kraken, Robinhood, OpenSea, Uniswap Labs, Consensys, Crypto.com, and several other firms.

Many of those actions were withdrawn with prejudice, preventing the agency from bringing the same claims again.

The change followed a leadership transition at the SEC and a stated move away from regulation through litigation toward developing clearer policy guidance.

A review published by The New York Times earlier today found that the SEC initiated no new crypto-related federal court cases.

Of the crypto cases inherited from prior administrations, the agency pulled back from more than half, either dismissing them, staying proceedings, or conceding key issues.

Ayrıca Şunları da Beğenebilirsiniz

MoneyGram launches stablecoin-powered app in Colombia

WIF Price Prediction: Targeting $0.48 Recovery Within 2 Weeks as MACD Shows Bullish Divergence