Coinbase Predicts ‘Full-Scale’ Altcoin Season As Bitcoin Dominance Falls Below 60%

Coinbase says the crypto market may be on the verge of a ‘’full-scale’’ altcoin season as Bitcoin dominance dips below 60%, signaling early rotation into altcoins.

Rising expectations that the Federal Reserve will cut interest rates next month would be the main driver, it said in its monthly outlook.

Flatter headline inflation last month and falling energy prices boosted expectations for a September rate cut to 92%, according to futures data

Lower interest rates often drive capital into riskier assets, and Coinbase notes that a portion of the $7 trillion parked in US money market funds could flow into cryptocurrencies.

Coinbase defines an altcoin season as when at least 75% of the top 50 altcoins outperform Bitcoin over the past 90 days.

On-chain data and market indicators suggest conditions are aligning for a broader altcoin breakout. Coinbase’s Altcoin Season Index currently sits in the low 40s, up from below 25 in July, signaling early momentum.

CoinMarketCap’s Altcoin Season Index is now 44, up from below 25 in July. Blockchain Center’s index sits at 53, and CryptoRank’s is at 50.

Coinbase Institutional’s research head, David Duong, said momentum is being driven by institutional interest in Ethereum, digital asset treasuries, and stablecoin trends.

While these metrics have yet to reach the 75 threshold that marks a full altseason, analysts say the trajectory points to a potential incoming surge.

Altcoin Market Roars Back Above $1 Trillion

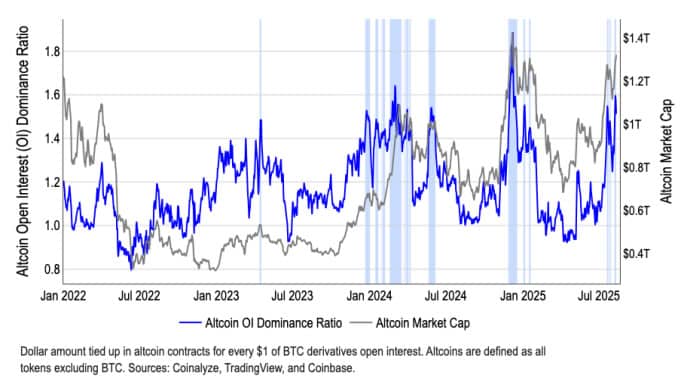

Altcoins are seeing a big comeback in 2025, with both trading activity and prices rising sharply. Data from Coinalyze, TradingView, and Coinbase shows that the Altcoin Open Interest (OI) Dominance Ratio, which tracks how much money is in altcoin derivatives compared to Bitcoin, has jumped this year.

This means more traders are betting on altcoins instead of just BTC. Altcoin market value, which dropped below $0.6 trillion in late 2024, has bounced back strongly, and is now above $1 trillion.

The rise comes as the crypto market enjoys better liquidity and renewed investor confidence, pushing more speculative trading into non-Bitcoin assets. Past spikes in the OI Dominance Ratio, like in 2022 and 2024, often brought both big rallies and sharp pullbacks.

While the current surge could mean another altcoin season is getting underway, it also carries the risk of higher volatility. With global economic uncertainty and regulatory changes still in play, traders are watching closely to see if this rally can last.

Bitcoin Dominance Drops Below 60%

Crypto trader Ito Shimotsuma noted that Bitcoin just had its first monthly bearish cross since January 2021. Back then, altcoins rose for four months, and he believes a similar pattern now could drive prices up through December 2025.

He added that the rising altcoin market cap and early positive signals from the Altcoin Season Index suggest conditions could favor a bigger altcoin rotation in September.

Bitcoin dominance has fallen to 59.48%, its lowest in more than four months. In mid-June, Bitcoin dominance was above 65%, but it has been dropping steadily as altcoins gain more attention.

The fall shows that traders are moving money into other cryptocurrencies like Ethereum, Solana, and other top altcoins. This shift often happens during “altseason,” a period when altcoins rise faster than Bitcoin.

The chart shows Bitcoin dominance hit strong resistance near 65% before turning downward. The current 59% level is seen as an important support point; if it breaks, altcoins could take even more market share.

Trading volumes have also grown during this drop, meaning more investors are active in the market. Bitcoin is still the largest cryptocurrency, but its share is shrinking, and competition from other coins is increasing.

Right now, the market is still waiting for a strong signal that can attract new capital and trigger a full altseason. Institutional interest is particularly strong in Ethereum (ETH), driven by digital asset treasuries and stablecoin or real-world asset narratives.

Tokens with higher beta to ETH, like LDO, ARB, ENA, and OP, show varying gains, with LDO benefiting from both ETH’s rally and recent SEC guidance clarifying that liquid staking tokens may not constitute securities under certain conditions.

Related Articles:

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise