2026-03-10 Tuesday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

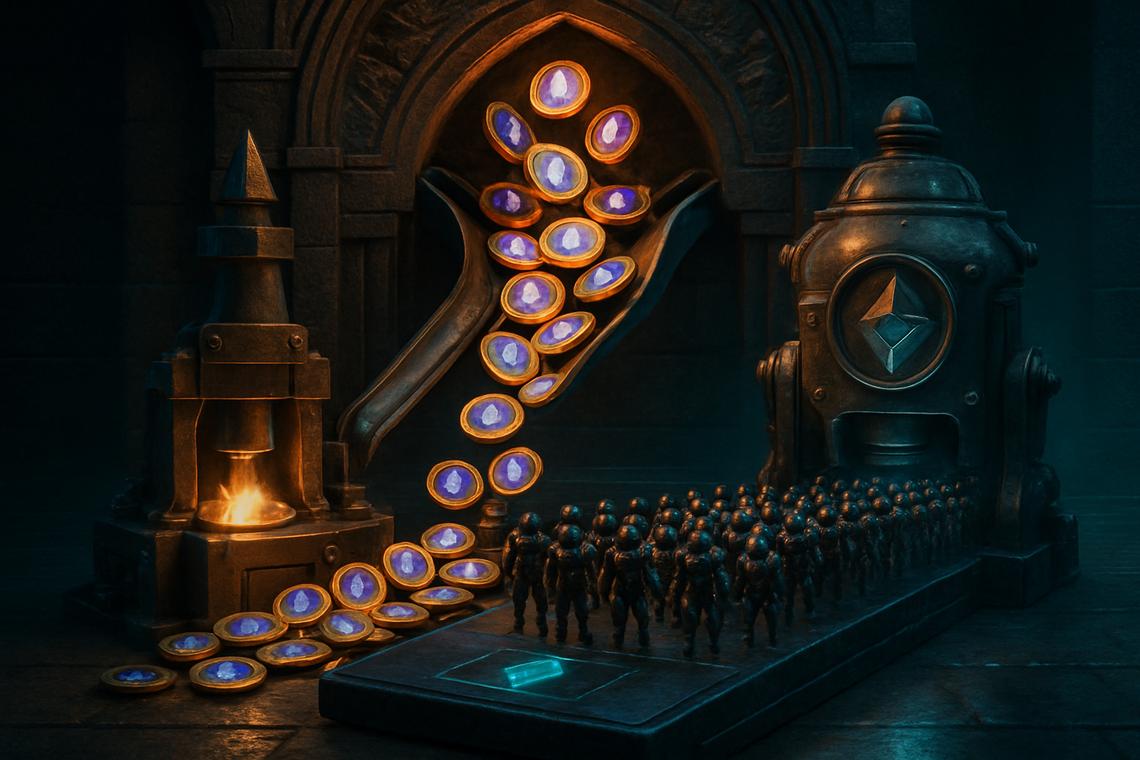

Ethereum Foundation Taps Bitwise Infrastructure for Treasury Staking Targeting 70000 ETH

Ethereum Foundation Embarks on Major Treasury Staking Initiative with Bitwise Infrastructure

In a significant and strategic move that could shape the future of

Share

Author: Hokanews2026/03/10 02:30

Ethereum Foundation to stake 70K ETH as network staking nears one-third of supply

The post Ethereum Foundation to stake 70K ETH as network staking nears one-third of supply appeared on BitcoinEthereumNews.com. The Ethereum Foundation has begun

Share

Author: BitcoinEthereumNews2026/03/10 02:27

Bitmine adds 61K ETH as prices hit $2K, Tom Lee says mini crypto winter may be ending

The post Bitmine adds 61K ETH as prices hit $2K, Tom Lee says mini crypto winter may be ending appeared on BitcoinEthereumNews.com. Bitmine Immersion Technologies

Share

Author: BitcoinEthereumNews2026/03/10 02:16

Bitmine (BMNR) buys 61,000 ether (ETH) as Tom Lee sees end in sight for bear market

The post Bitmine (BMNR) buys 61,000 ether (ETH) as Tom Lee sees end in sight for bear market appeared on BitcoinEthereumNews.com. BitMine Immersion Technologies

Share

Author: BitcoinEthereumNews2026/03/10 02:09

Bitmine Now Controls 3.76% of All Ethereum in Existence and It Is Still Buying

A publicly listed company has accumulated 4.53 million ETH worth approximately $9 billion, making it the largest single Ethereum staker in the world while targeting

Share

Author: Ethnews2026/03/10 01:24

Bitmine ETH holdings surge as treasury accelerates purchases

The post Bitmine ETH holdings surge as treasury accelerates purchases appeared on BitcoinEthereumNews.com. Investor attention is turning to large on-chain treasuries

Share

Author: BitcoinEthereumNews2026/03/10 01:13

Ethereum Price Prediction: Harvard Rotates $86.8M Into ETH as Glamsterdam Approaches and Pepeto Is Selling Out Fast

Ethereum Price Prediction: Harvard Rotates $86.8M Into ETH as Glamsterdam Approaches and Pepeto Is Selling Out Fast Harvard just moved $86.8 million into the iShares

Share

Author: Blockchainreporter2026/03/10 00:45

Ethereum staking plans by Ethereum Foundation adopt Bitwise tools for $140M treasury move

In a notable treasury move, the Ethereum Foundation has begun a new phase of ethereum staking as it seeks to earn on-chain rewards from existing reserves. Ethereum

Share

Author: The Cryptonomist2026/03/10 00:44

Ethereum Foundation Staking Strategy: A Bold 70,000 ETH Move with Bitwise to Fortify Network Security

BitcoinWorld Ethereum Foundation Staking Strategy: A Bold 70,000 ETH Move with Bitwise to Fortify Network Security In a significant development for blockchain

Share

Author: bitcoinworld2026/03/10 00:25

DOGE Eyes 10x Breakout & ETH Faces $2,050 Test; BlockDAG’s 24 Hour Aftersale Offers Rare 140x Entry Reset!

The post DOGE Eyes 10x Breakout & ETH Faces $2,050 Test; BlockDAG’s 24 Hour Aftersale Offers Rare 140x Entry Reset! appeared on BitcoinEthereumNews.com. Crypto

Share

Author: BitcoinEthereumNews2026/03/10 00:05