Dapp

Share

Dapps are digital applications that run on a P2P network of computers rather than a single server, typically utilizing smart contracts to ensure transparency and uptime. In 2026, Dapps have achieved mass-market appeal through Account Abstraction, allowing for a "Web2-like" user experience with the security of Web3. This tag covers the entire ecosystem of decentralized software—from social media and productivity tools to governance platforms and identity management.

5021 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Robinhood (HOOD) Stock Jumps 14% on Market Rally and Analyst Upgrades

2026/02/07 20:44

Pi Network Targets Open Mainnet 2026, Millions Prepare as Utility and Migration Accelerate

2026/02/07 20:41

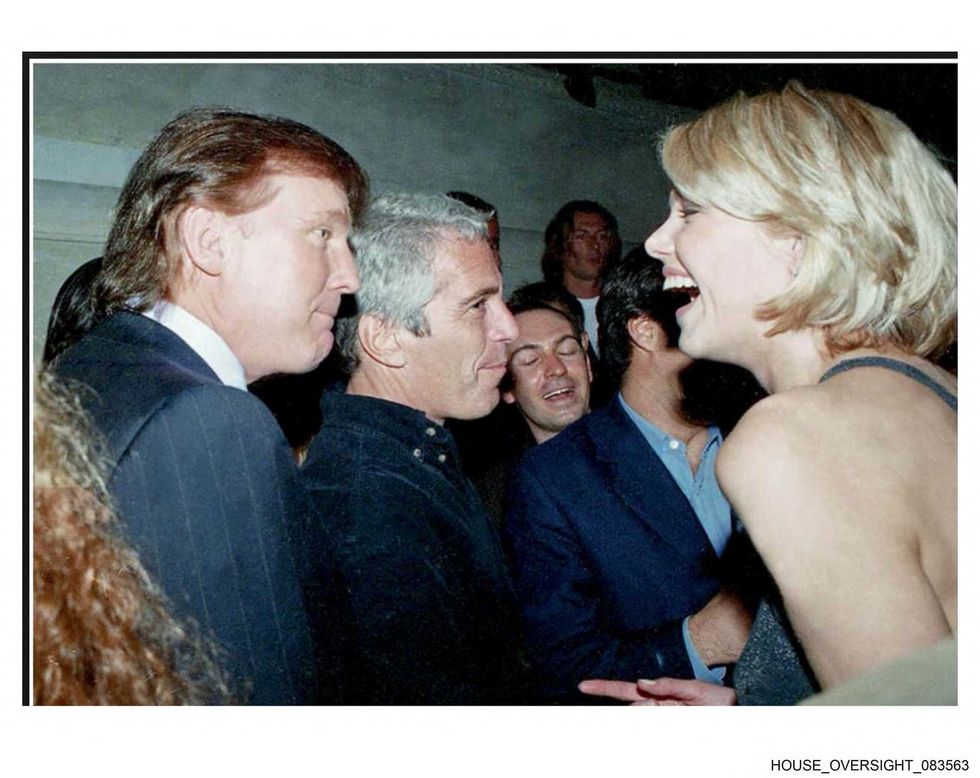

Trump named in explosive tip regarding Epstein’s death: ‘Authorized murder’

2026/02/07 20:37

Trump Administration Approves New Crypto-Friendly Bank

2026/02/07 20:37

XRP eyes $3 amid whale buying – Reversal or relief rally?

2026/02/07 20:19